Your What percentage of your money does cash app take images are ready in this website. What percentage of your money does cash app take are a topic that is being searched for and liked by netizens now. You can Get the What percentage of your money does cash app take files here. Get all royalty-free images.

If you’re looking for what percentage of your money does cash app take images information linked to the what percentage of your money does cash app take interest, you have visit the ideal site. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

What Percentage Of Your Money Does Cash App Take. But the downside is that you can only send money within the us and to the uk when using cash app. Likewise, you can make payments (such as utilities) from cash app. When you finally do remember, it might be at a time when you really need the money, but don�t necessarily want to pay the instant transfer fee. In fy 2020, cash app generated $1.2 billion in gross profit, up 167.8% from the previous year.

Screenshot_20200926060538_Cash App » RiRiWills�s Cover Photos From faceadventure.com

Screenshot_20200926060538_Cash App » RiRiWills�s Cover Photos From faceadventure.com

P2p payment apps like square’s cash app as well as. Rakuten then earns a percentage of what you spend, keeps part of it as a commission, and passes the rest along to you. If you don�t regularly use square cash, you might forget that you have money, hundreds of dollars even, that you need to transfer. When you finally do remember, it might be at a time when you really need the money, but don�t necessarily want to pay the instant transfer fee. The development of p2p payment apps serves a growing preference among young people toward using and digital payments rather than cash. Defensive assets such as bonds usually have the same access time when held in funds.

In visual form, which you can save via pinterest, you get:

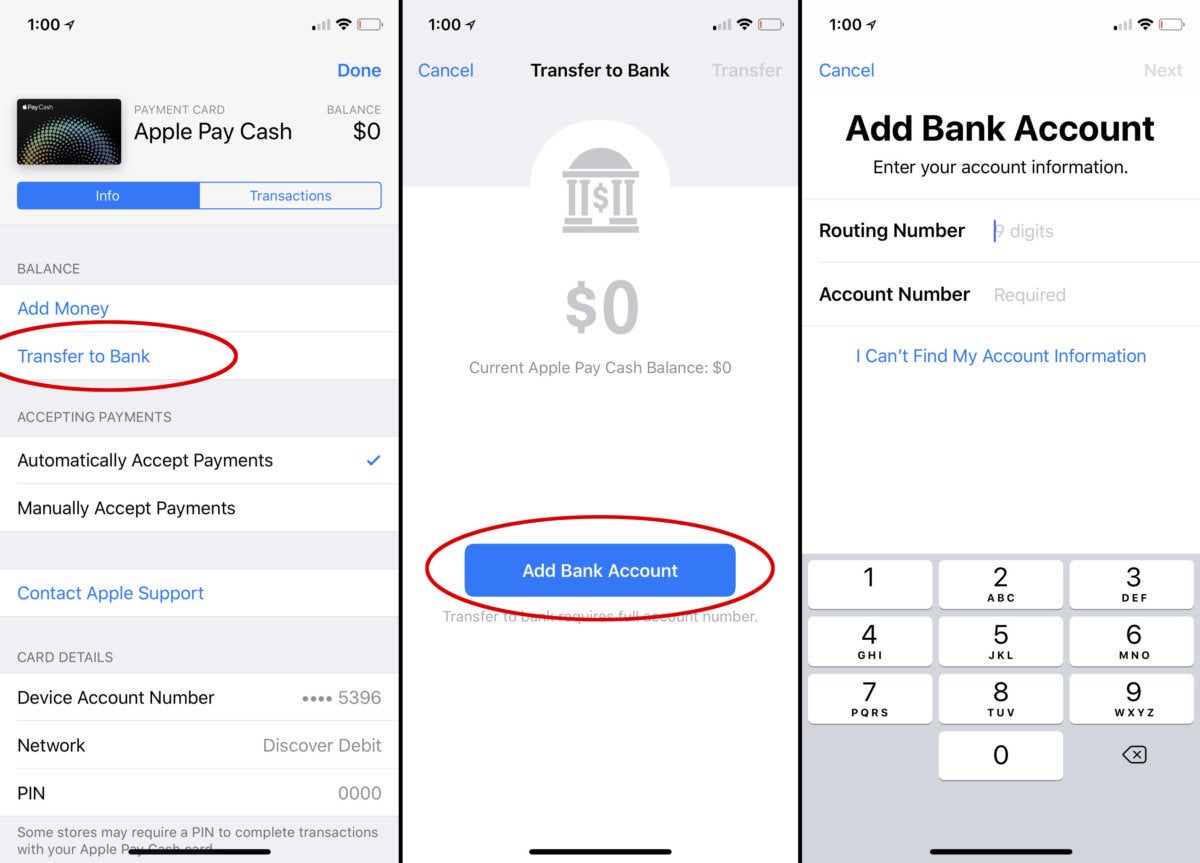

It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal. When you finally do remember, it might be at a time when you really need the money, but don�t necessarily want to pay the instant transfer fee. You can both make payments and withdraw money from the cash app wallet to your bank account. Tap on your cash app balance located at the lower left corner. Defensive assets such as bonds usually have the same access time when held in funds. In 2016, 36% of millennials (age 20 to 35 at the time) reported that they didn�t usually carry cash at all.

Source: skycumbres.com

Source: skycumbres.com

Cash app atm withdrawals would cost you $2 fee unless you make $300 deposit in your account every month. Empower’s cash advance of up to $250 is available for a $8 per month subscription fee. So sending someone $100 will actually cost you $103. Cash app atm withdrawals would cost you $2 fee unless you make $300 deposit in your account every month. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card.

Source: gobankingrates.com

Source: gobankingrates.com

The development of p2p payment apps serves a growing preference among young people toward using and digital payments rather than cash. Buried in the settings section of the square cash app is the ability to set up automatic cash outs, so all of your peer. Here’s a breakdown of each category, based on dave ramsey’s advice: Cash boost is the cash program that gets you discounts (either a percentage or fixed dollar amount) whenever you pay at an eligible merchant using your cash card. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card.

Source: afrikanallianceofsocialdemocrats.org

Source: afrikanallianceofsocialdemocrats.org

Cash app will tell you how much you’ll be able to borrow. Moreover, the limit for the cash out is set at $1000 per dayand $310 per transaction in one day. It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal. The service allows users to send and receive money instantly. In 2016, 36% of millennials (age 20 to 35 at the time) reported that they didn�t usually carry cash at all.

Source: landofepin.com

Source: landofepin.com

While it is possible to use cash app without ever giving up your identity, there are many perks to do so. In 2018, only a third of adults under 30 reported using mostly cash to make holiday purchases. Verify your cash app account. While it is possible to use cash app without ever giving up your identity, there are many perks to do so. Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000.

Source: cleangrillsofhonolulu.com

Source: cleangrillsofhonolulu.com

Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. If you see “borrow” you can take out a cash app loan. Check for the word “borrow.”. The cash app doesn�t charge a fee to send, request or receive personal payments from a debit card or a bank account, or for a standard deposit. Empower also allows users to get their paycheck up to two days faster than traditional accounts.

Source: partner-affiliate.com

Source: partner-affiliate.com

If you don�t regularly use square cash, you might forget that you have money, hundreds of dollars even, that you need to transfer. Insurance — 10% to 25%. At honey, you need to earn the equivalent of $10 to. Cash app does not provide tax advice. At rakuten, for instance, rewards are issued in $5 increments.

Source:

Source:

Check for the word “borrow.”. Cash app makes money by charging businesses to use their application and by charging individual users transaction fees to access additional services. Moreover, the limit for the cash out is set at $1000 per dayand $310 per transaction in one day. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. If you see “borrow” you can take out a cash app loan.

Source: landofepin.com

Source: landofepin.com

Empower’s cash advance of up to $250 is available for a $8 per month subscription fee. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. In 2018, only a third of adults under 30 reported using mostly cash to make holiday purchases. Insurance — 10% to 25%. The development of p2p payment apps serves a growing preference among young people toward using and digital payments rather than cash.

Source: landofepin.com

Source: landofepin.com

With a cash app instant transfer, your money will be transferred instantly to your linked card.¹. This is a rather standard fee with. But the downside is that you can only send money within the us and to the uk when using cash app. Recreation — 5% to 10%. And, there is no longer a transaction minimum.

Source: faceadventure.com

Source: faceadventure.com

The cash app doesn�t charge a fee to send, request or receive personal payments from a debit card or a bank account, or for a standard deposit. Once verified, you can receive an unlimited amount and send up to $7500 per week and activate your cash app card. Here’s a breakdown of each category, based on dave ramsey’s advice: Cash app gives you a routing and account number to enable direct deposits, so your paycheck can be sent directly to cash app. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app.

Source: axelliance-conseil.com

Source: axelliance-conseil.com

When you finally do remember, it might be at a time when you really need the money, but don�t necessarily want to pay the instant transfer fee. Insurance — 10% to 25%. Once verified, you can receive an unlimited amount and send up to $7500 per week and activate your cash app card. Personal spending — 5% to 10%. Paypal also charges a 1% fee for instant withdrawals to your bank account or card.

Source: ibc-mission.org

Source: ibc-mission.org

At honey, you need to earn the equivalent of $10 to. In fy 2020, cash app generated $1.2 billion in gross profit, up 167.8% from the previous year. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. Once verified, you can receive an unlimited amount and send up to $7500 per week and activate your cash app card. The development of p2p payment apps serves a growing preference among young people toward using and digital payments rather than cash.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

Recreation — 5% to 10%. One advantage is that paypal allows the largest transactions of the bunch, tied with apple pay cash and google. If you don�t regularly use square cash, you might forget that you have money, hundreds of dollars even, that you need to transfer. Buried in the settings section of the square cash app is the ability to set up automatic cash outs, so all of your peer. Note that stock mutual funds usually sell at the end of the business day and take 1 to 3 days to get your money.

Source: tricksgum.com

Source: tricksgum.com

Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. The cash app doesn�t charge a fee to send, request or receive personal payments from a debit card or a bank account, or for a standard deposit. With a cash app instant transfer, your money will be transferred instantly to your linked card.¹. Now you have more insight on the fees. Empower’s cash advance of up to $250 is available for a $8 per month subscription fee.

Source: landofepin.com

Source: landofepin.com

Insurance — 10% to 25%. You need to activate cash boost but doing so is simple. Miscellaneous — 5% to 10%. Bear in mind that you can only verify a cash app account if you are 18 years old and above. Accept a cash app borrow loan.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

Here’s a breakdown of each category, based on dave ramsey’s advice: But the downside is that you can only send money within the us and to the uk when using cash app. Here’s a breakdown of each category, based on dave ramsey’s advice: New cash app reporting rules. At honey, you need to earn the equivalent of $10 to.

Source: pol.wpallinfo.com

Source: pol.wpallinfo.com

New cash app reporting rules. Likewise, you can make payments (such as utilities) from cash app. Accept a cash app borrow loan. Cash app gives you a routing and account number to enable direct deposits, so your paycheck can be sent directly to cash app. Empower is a fintech app with a visa debit card that earns cash back—and can give you access to up to $250 in cash advances.

Source: itnews.com

Source: itnews.com

But the downside is that you can only send money within the us and to the uk when using cash app. P2p payment apps like square’s cash app as well as. In 2016, 36% of millennials (age 20 to 35 at the time) reported that they didn�t usually carry cash at all. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Cash app does not provide tax advice.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what percentage of your money does cash app take by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.