Your What percentage does cash app take for instant images are available. What percentage does cash app take for instant are a topic that is being searched for and liked by netizens today. You can Get the What percentage does cash app take for instant files here. Get all free images.

If you’re looking for what percentage does cash app take for instant pictures information related to the what percentage does cash app take for instant keyword, you have visit the ideal site. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

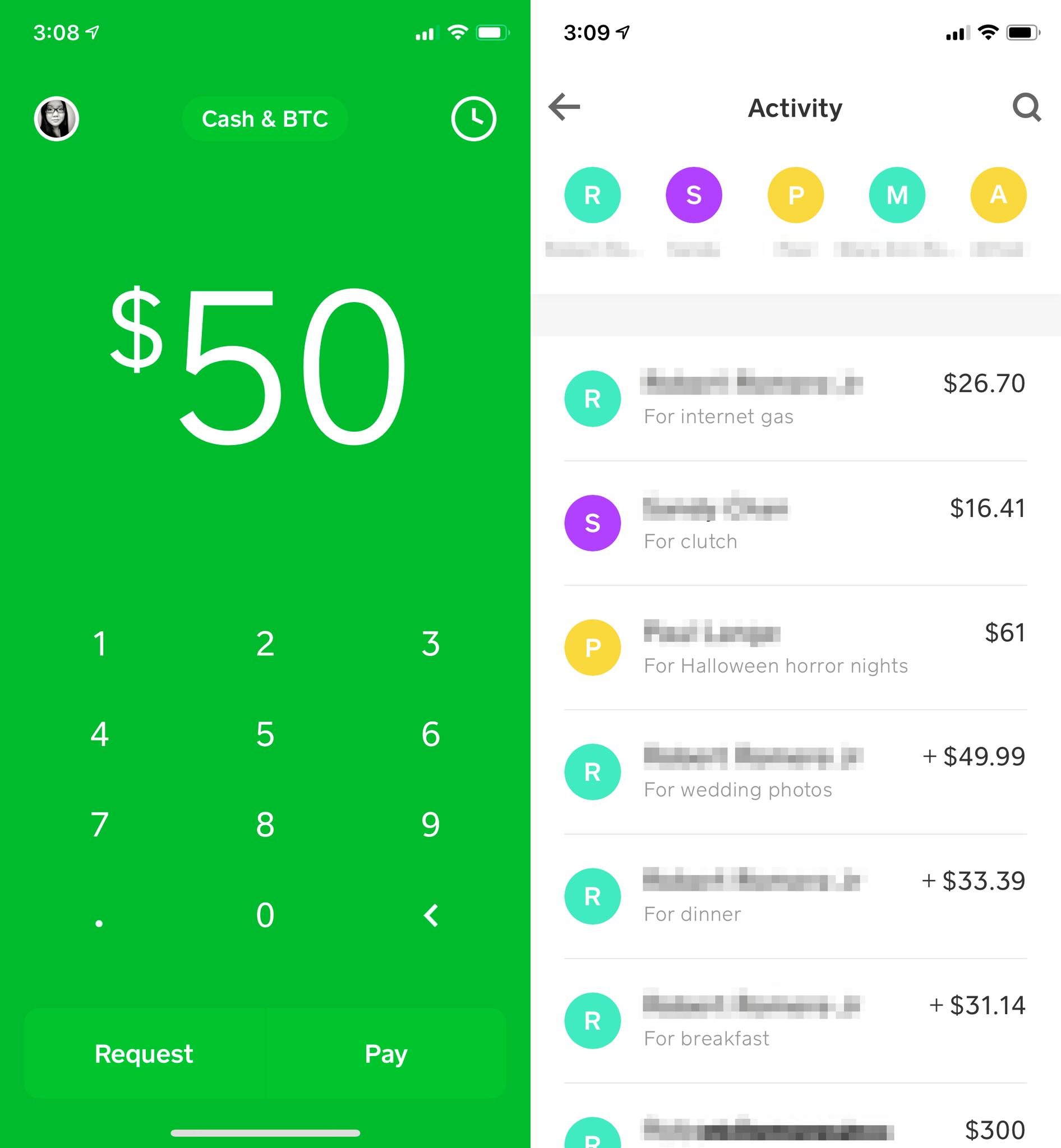

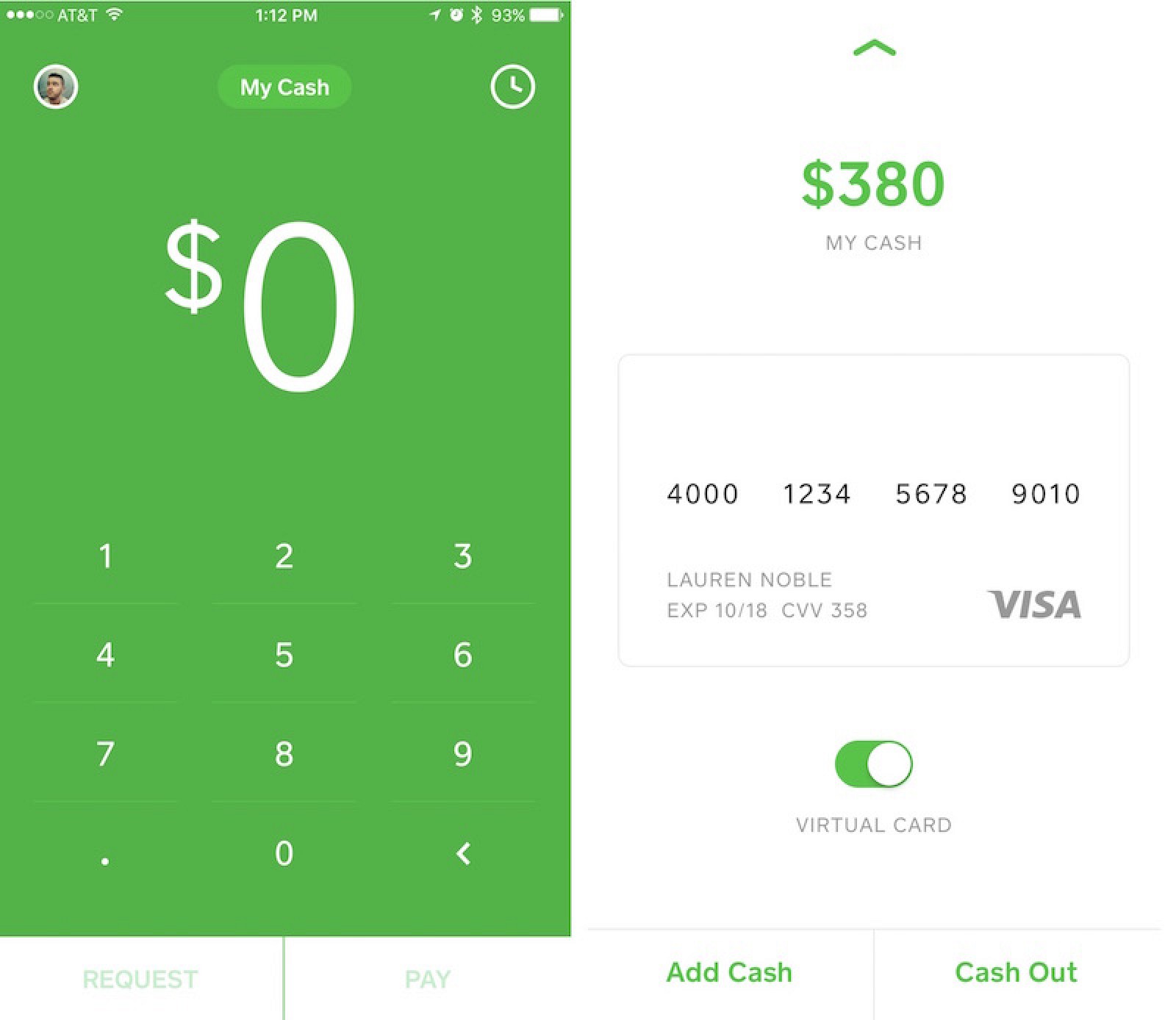

What Percentage Does Cash App Take For Instant. When you make a payment using a credit card on cash app, square adds a 3% fee to the transaction. Cash app is relatively safe to use. The instacash advance is available to anyone with a qualifying. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers.

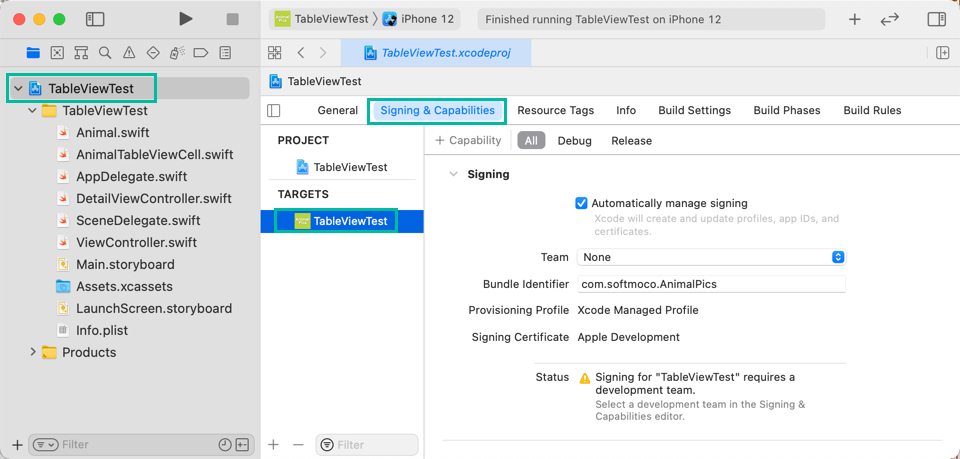

How Much Does Cash App Charge For 1 000 Instant Deposit From dentistryforlife2020.org

How Much Does Cash App Charge For 1 000 Instant Deposit From dentistryforlife2020.org

Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. One advantage is that paypal allows the largest transactions of the bunch, tied with apple pay cash and google. Cash app does not provide tax advice. The popular mobile app is available for both ios and android. Cash app does have a few advantages over venmo:

It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal.

Square cash’s existing model — charging small businesses 2.75 percent to accept payments from customers via the app — has rarely been discussed on the company’s earning calls and is not a. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Cash app does not charge an additional percentage or fixed dollar amount. Boosts may be offered for specific. Some boosts take a percentage off the entire purchase, while others take a flat dollar amount off.

Source: educacraft.com

Source: educacraft.com

Check out other alternatives for sending money online. For business payments, the customer is charged 2.75%. It earned good marks for data security, customer support and. Standard transfers on the app to your bank account take two to three days and are free, while. Empower is a fintech app with a visa debit card that earns cash back—and can give you access to up to $250 in cash advances.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

With a cash app instant transfer, your money will be transferred instantly to your linked card.¹. Empower’s cash advance of up to $250 is available for a $8 per month subscription fee. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account.

For business payments, the customer is charged 2.75%. Cash app does not charge an additional percentage or fixed dollar amount. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. With a cash app instant transfer, your money will be transferred instantly to your linked card.¹. Cash app does not provide tax advice.

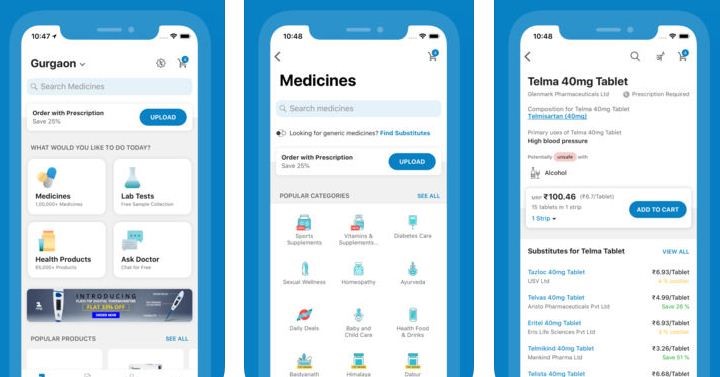

Source: lifewire.com

Source: lifewire.com

Paypal also charges a 1% fee for instant withdrawals to your bank account or card. Another cash app similar to dave that you can use to get cash advances whenever you have unplanned expenses that need sorting out is moneylion. More than 30 million individuals used the cash app for transactions in june alone, and it currently ranks first in the app store financial category. If cash app can’t verify your id, it might require additional information. It earned good marks for data security, customer support and.

Source: imore.com

Source: imore.com

You’ll need to keep at least $25 in your square account, however. They can also use the optional linked debit card to shop or hit an atm. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Some require a minimum purchase, and many have a maximum discount. Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card.

Source: ade.pathwaystocharacter.org

Source: ade.pathwaystocharacter.org

They can also use the optional linked debit card to shop or hit an atm. The cash app doesn�t charge a fee to send, request or receive personal payments from a debit card or a bank account, or for a standard deposit. These payments can be made in two ways: Cash app has a higher percentage of use among males, with 24% more active users than venmo. Boosts may be offered for specific.

Source: campingbythebay.com

Source: campingbythebay.com

It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. But the downside is that you can only send money within the us and to the uk when using cash app. The instacash advance is available to anyone with a qualifying. Some boosts take a percentage off the entire purchase, while others take a flat dollar amount off. With a cash app instant transfer, your money will be transferred instantly to your linked card.¹.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card. The popular mobile app is available for both ios and android. Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card. Cash app charges businesses that accept cash app payments 2.75% per transaction. Square cash’s existing model — charging small businesses 2.75 percent to accept payments from customers via the app — has rarely been discussed on the company’s earning calls and is not a.

Source: cangguguide.com

Source: cangguguide.com

You’ll need to keep at least $25 in your square account, however. It earned good marks for data security, customer support and. Square cash’s existing model — charging small businesses 2.75 percent to accept payments from customers via the app — has rarely been discussed on the company’s earning calls and is not a. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. Unlike the standard deposit schedule, you can complete your transaction 24 hours a day, 7 days a week.

Source: bnt.imbo-project.org

Source: bnt.imbo-project.org

These payments can be made in two ways: Cash app is relatively safe to use. Empower also allows users to get their paycheck up to two days faster than traditional accounts. Boosts may be offered for specific. Cash app is the latest and greatest in mobile payment apps.

Source:

Source:

The service grants you instant loans of up to $250 per pay cycle depending on how much income you regularly earn and deposit into your checking account. Now you have more insight on the fees. Another cash app similar to dave that you can use to get cash advances whenever you have unplanned expenses that need sorting out is moneylion. More than 30 million individuals used the cash app for transactions in june alone, and it currently ranks first in the app store financial category. Boosts may be offered for specific.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

More than 30 million individuals used the cash app for transactions in june alone, and it currently ranks first in the app store financial category. Cash app charges businesses that accept cash app payments 2.75% per transaction. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal. Empower also allows users to get their paycheck up to two days faster than traditional accounts.

Source: youtube.com

Source: youtube.com

Now you have more insight on the fees. The apps analyze your banking information to offer you a small cash advance loan until your next check arrives. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Most payment apps are free to use and don’t charge interest, making them an affordable option for a quick loan. Standard transfers on the app to your bank account take two to three days and are free, while.

Source: lifewire.com

Source: lifewire.com

The apps analyze your banking information to offer you a small cash advance loan until your next check arrives. The instacash advance is available to anyone with a qualifying. Some boosts take a percentage off the entire purchase, while others take a flat dollar amount off. Check out other alternatives for sending money online. If cash app can’t verify your id, it might require additional information.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

When you make a payment using a credit card on cash app, square adds a 3% fee to the transaction. The instacash advance is available to anyone with a qualifying. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. The popular mobile app is available for both ios and android. If cash app can’t verify your id, it might require additional information.

Source: macrumors.com

Source: macrumors.com

Some boosts take a percentage off the entire purchase, while others take a flat dollar amount off. More than 30 million individuals used the cash app for transactions in june alone, and it currently ranks first in the app store financial category. Some boosts take a percentage off the entire purchase, while others take a flat dollar amount off. Transfers to bank accounts usually happen within minutes, or up to half an hour for a transfer to a linked card. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Source: educacraft.com

Source: educacraft.com

The apps analyze your banking information to offer you a small cash advance loan until your next check arrives. Cash app does not provide tax advice. Empower also allows users to get their paycheck up to two days faster than traditional accounts. The service grants you instant loans of up to $250 per pay cycle depending on how much income you regularly earn and deposit into your checking account. Paypal also charges a 1% fee for instant withdrawals to your bank account or card.

Source: fortuite.org

Source: fortuite.org

Unlike the standard deposit schedule, you can complete your transaction 24 hours a day, 7 days a week. It earned good marks for data security, customer support and. It will take one to two days for the transaction to reflect in your account unless you opt for the instant deposit option which will levy an extra charge of 1.5% for immediate withdrawal. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Square cash’s existing model — charging small businesses 2.75 percent to accept payments from customers via the app — has rarely been discussed on the company’s earning calls and is not a.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what percentage does cash app take for instant by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.