Your What is the instant fee for cash app images are available in this site. What is the instant fee for cash app are a topic that is being searched for and liked by netizens today. You can Get the What is the instant fee for cash app files here. Download all royalty-free photos and vectors.

If you’re searching for what is the instant fee for cash app images information linked to the what is the instant fee for cash app interest, you have come to the right site. Our website frequently gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

What Is The Instant Fee For Cash App. The fee users pay for an instant ‘cash out� of $350 from cash app is $5.25. The first mobile banking experience of its kind. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total.

Instant Cash Loan & Salary Loan App QuickCredit From thepopularapps.com

Instant Cash Loan & Salary Loan App QuickCredit From thepopularapps.com

So sending someone $100 will actually cost. You can avail loan up to amount rs.5 lakh using this app. With a cash app instant transfer, your money will be transferred instantly to your linked card.¹. But the downside is that you can only send money within the us and to the uk when using cash app. Manage money better with a paycheck advance from b9. The cash app instant transfer fee is 1.5%, with a minimum of $0.25.

The first mobile banking experience of its kind.

1 cash app is a financial platform, not a bank. Set up direct deposit with albert cash and get your paycheck up to 2 days early. Cash app to cash app payments are instant and usually can’t be canceled. Don’t use p2p services like cash app to buy things from strangers. Banking services provided and debit cards issued by. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total.

Source: angelika-metamorfozy.blogspot.com

Source: angelika-metamorfozy.blogspot.com

Here�s when your cash app will charge you a fee. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Usually, the fees apply when you make an instant withdrawal. This app offers loan to salaried people up. Speed up your direct deposits.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

With a cash app account, you can receive paychecks up to 2 days early. ( iphone or android) 2. That’s a perk that matters. Usually, the fees apply when you make an instant withdrawal. Some people refer to this as the “cash app referral code hack.”.

Source: cashappdesk.com

Source: cashappdesk.com

Then have them send that $5 back. If you qualify, the app will deduct your loan amount from your bank account when your next paycheck arrives. Download to see if you qualify for albert instant. Albert is not a bank. No credit check, no fee & interest salary advances of up to 100% of your wages.

Source: bingdroid.com

Source: bingdroid.com

With a cash app instant transfer, your money will be transferred. So sending someone $100 will actually cost. No credit check, no fee & interest salary advances of up to 100% of your wages. You can avail loan up to amount rs.5 lakh using this app. That’s a perk that matters.

Source: arabandalucia.com

Source: arabandalucia.com

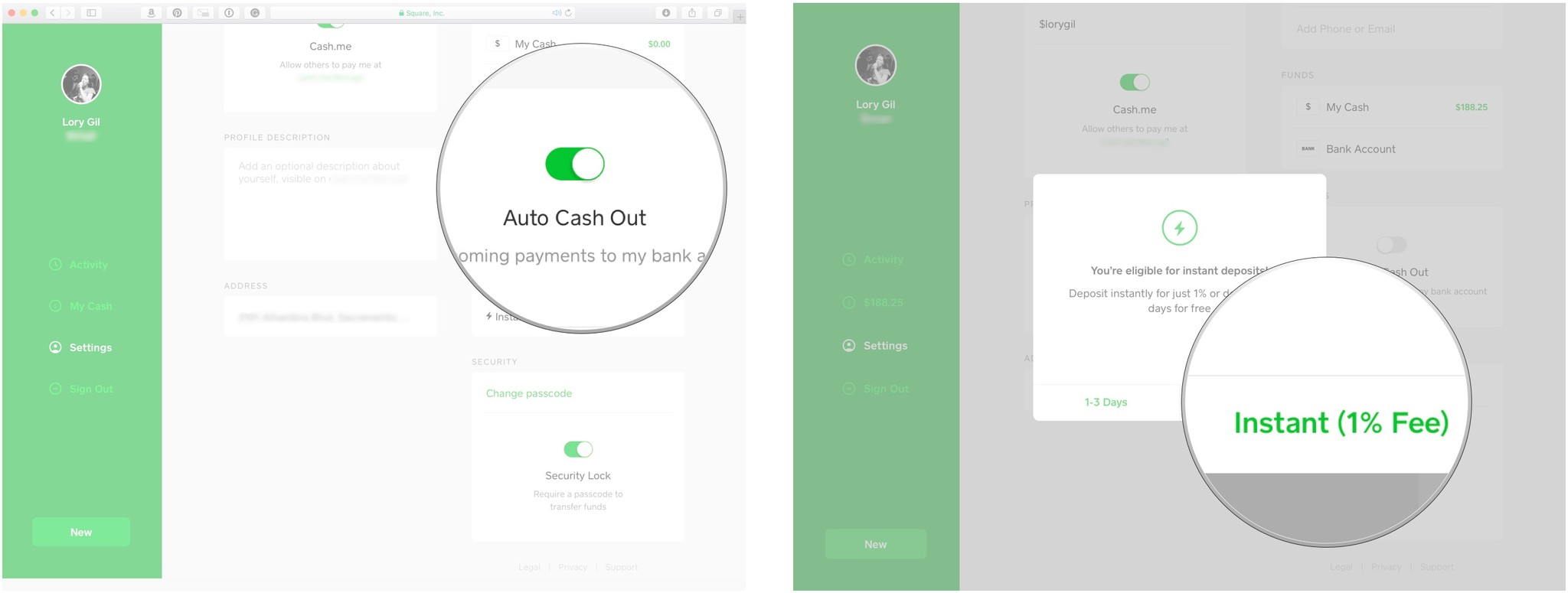

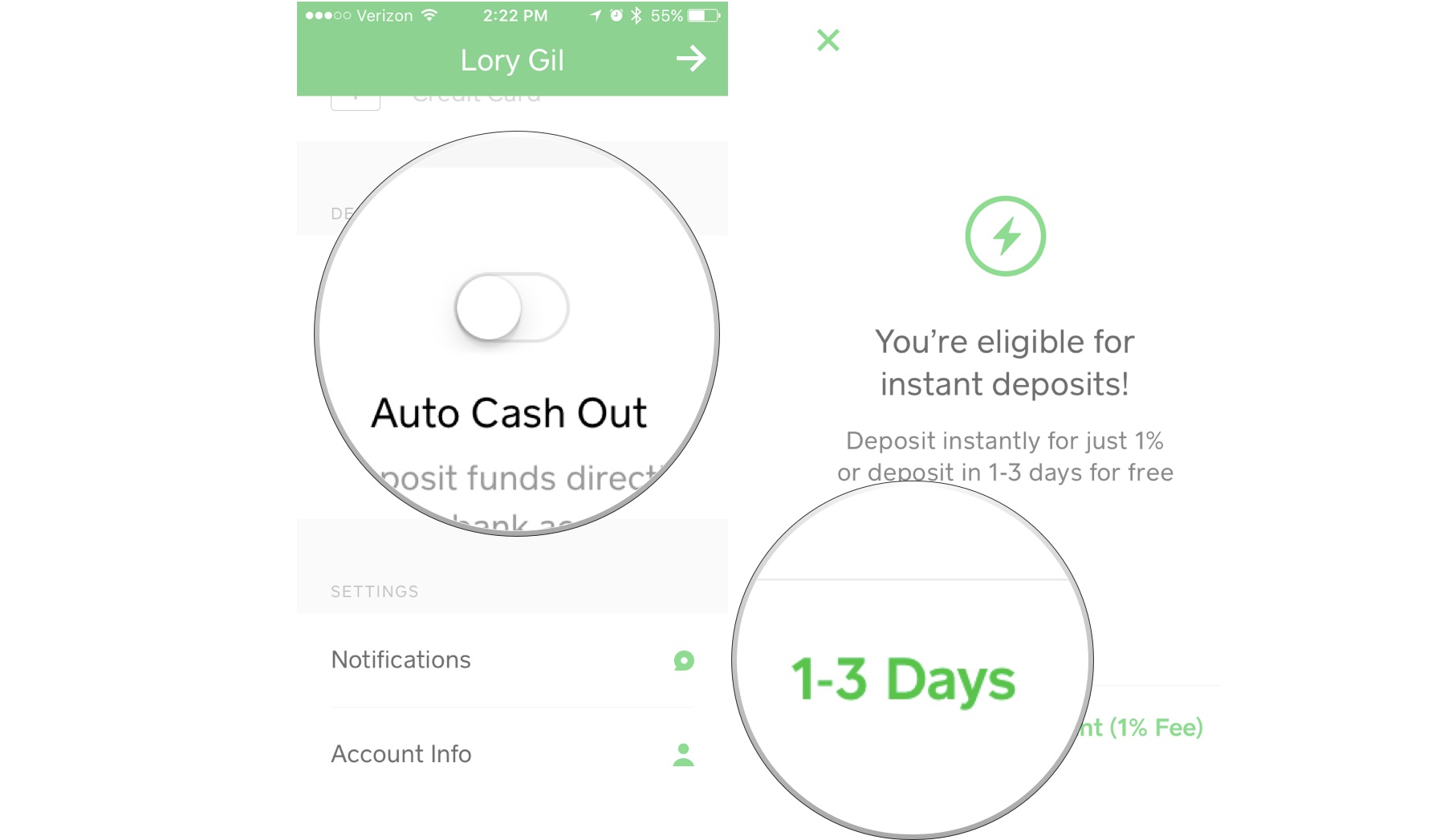

Lastly, when it comes to the business account, cash app has a fee of 2.75% on each transaction⁹. *availability for this funding provider may be limited to specific regions, please select the purple text under the ‘deposit method’ column to view the support article for the provider and find out more details. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Cash app to cash app payments are instant and usually can’t be canceled. Cash app instant deposit fee calculator inspire ideas 2022 from fortuite.org.

Source: apkdwq.blogspot.com

Source: apkdwq.blogspot.com

Download to see if you qualify for albert instant. Now you have more insight on the fees. With a cash app account, you can receive paychecks up to 2 days early. Cash app may apply some fees for withdrawals, but it depends on each situation. Don’t use p2p services like cash app to buy things from strangers.

Source: fortuite.org

Source: fortuite.org

The fee users pay for an instant ‘cash out� of $350 from cash app is $5.25. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. Lastly, when it comes to the business account, cash app has a fee of 2.75% on each transaction⁹. Then save and invest right in the app. Set up direct deposit with albert cash and get your paycheck up to 2 days early.

Source: fortuite.org

Source: fortuite.org

With a cash app instant transfer, your money will be transferred. Cash app instant deposit fee calculator inspire ideas 2022 from fortuite.org. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Here�s when your cash app will charge you a fee. Use it everywhere to earn instant discounts on everyday spending.

Source: youtube.com

Source: youtube.com

But the downside is that you can only send money within the us and to the uk when using cash app. Never give your cash app pin or card number to anyone. With a cash app instant transfer, your money will be transferred. With a cash app account, you can receive paychecks up to 2 days early. Cash app to cash app payments are instant and usually can’t be canceled.

Source: imore.com

Source: imore.com

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. These are displayed before a trade confirmation⁸. The fee users pay for an instant ‘cash out� of $350 from cash app is $5.25. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Send $5 to any cash app user to get the $5 bonus from cash app.

Source:

Source:

So sending someone $100 will actually cost. Some people refer to this as the “cash app referral code hack.”. *availability for this funding provider may be limited to specific regions, please select the purple text under the ‘deposit method’ column to view the support article for the provider and find out more details. Always have the product in your hands before you transfer money. These are displayed before a trade confirmation⁸.

Source: thepopularapps.com

Source: thepopularapps.com

Cash app charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. Now you have more insight on the fees. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. The first mobile banking experience of its kind. *availability for this funding provider may be limited to specific regions, please select the purple text under the ‘deposit method’ column to view the support article for the provider and find out more details.

Source: ade.pathwaystocharacter.org

Source: ade.pathwaystocharacter.org

With a cash app account, you can receive paychecks up to 2 days early. Lastly, when it comes to the business account, cash app has a fee of 2.75% on each transaction⁹. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Some fees, like atm charges, will be reimbursed — up to 3 times per month and up to $7 per withdrawal — if you receive at least $300 in. Usually, the fees apply when you make an instant withdrawal.

Source: bnt.imbo-project.org

Source: bnt.imbo-project.org

1 cash app is a financial platform, not a bank. Speed up your direct deposits. This app offers loan to salaried people up. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. Download to see if you qualify for albert instant.

Source: msa-tcd.blogspot.com

Source: msa-tcd.blogspot.com

The lodefast app by lodestar financial allows you to cash checks online to deposit into your linked bank account, debit card, any prepaid debit card, or akimbo card. And spend money with your cash debit card or withdraw funds from over 55,000 free atms. Always have the product in your hands before you transfer money. Download to see if you qualify for albert instant. Cash app charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account.

Source: recode.net

Source: recode.net

This app offers loan to salaried people up. Then have them send that $5 back. (click/tap to copy) pro tip invite a friend to cash app with this code & send them $5. Here�s when your cash app will charge you a fee. The fee users pay for an instant ‘cash out� of $350 from cash app is $5.25.

Source: fortuite.org

Source: fortuite.org

(click/tap to copy) pro tip invite a friend to cash app with this code & send them $5. And spend money with your cash debit card or withdraw funds from over 55,000 free atms. Instant direct deposits, on the other hand, are instant however cash app does charge a small fee of 1.5% for this particular service. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Additionally, cash app doesn’t charge any fees per trade but there might be some charged by the securities and exchange commission (sec).

Source: youtube.com

Source: youtube.com

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Always have the product in your hands before you transfer money. Speed up your direct deposits. Pro tip invite a friend to cash app with this code & send them $5. With a cash app account, you can receive paychecks up to 2 days early.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the instant fee for cash app by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.