Your Venmo cash app market share images are ready in this website. Venmo cash app market share are a topic that is being searched for and liked by netizens today. You can Download the Venmo cash app market share files here. Download all royalty-free images.

If you’re looking for venmo cash app market share images information related to the venmo cash app market share keyword, you have come to the right site. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

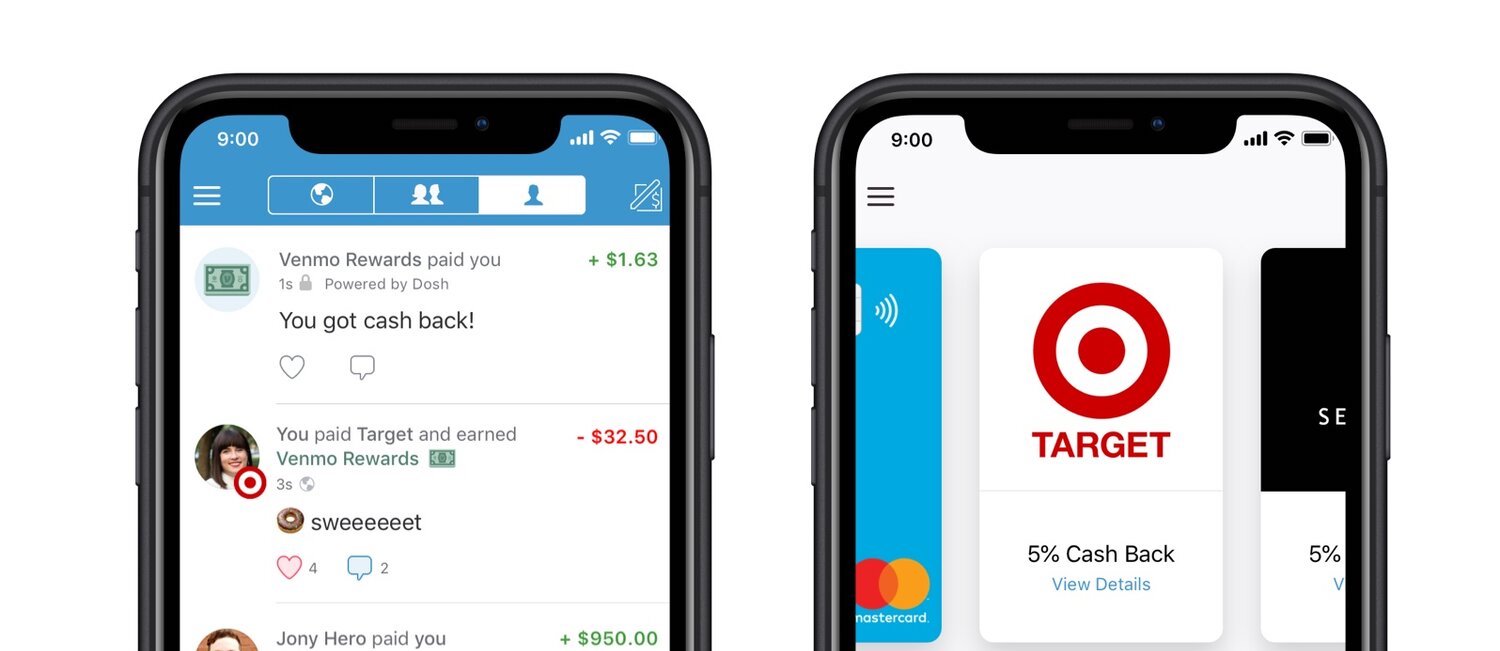

Venmo Cash App Market Share. Venmo rolled a checkbox out a couple months ago to let people paying for things mark it as a good or service payment. They both also charge a small fee for instant transfers to your bank, but no fee for standard transfers, which take one to three business days. On january 1, a provision of the american rescue plan act went into effect that requires payment services to report any transactions collectively worth $600 or more in a year to the tax agency. While sms functionality died with the app launch in late 2010, the social element of venmo remains one of the app’s core.

Cash App vs. Venmo How They Compare GOBankingRates From gobankingrates.com

Cash App vs. Venmo How They Compare GOBankingRates From gobankingrates.com

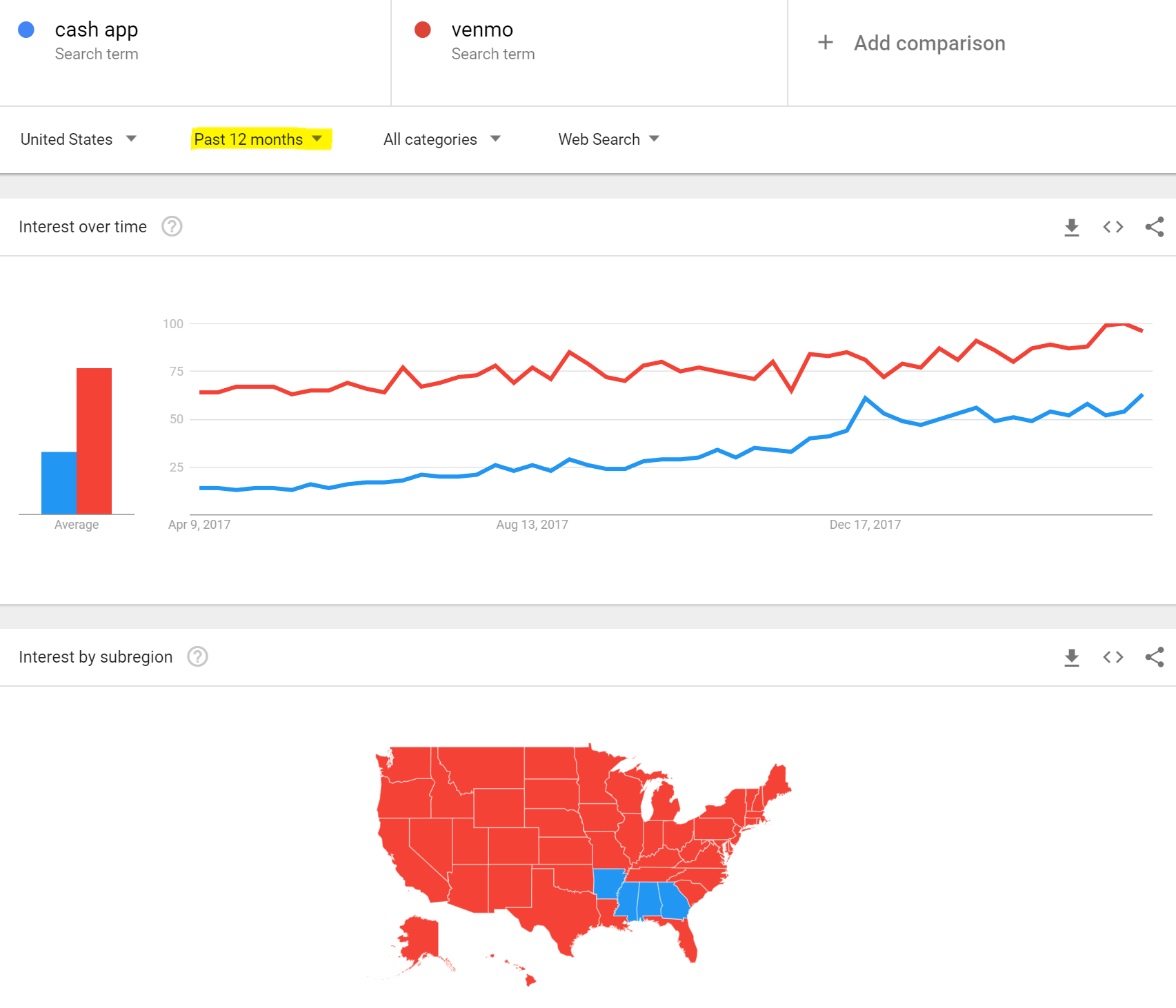

Venmo’s app is available from the app store and google play. The irs is cracking down on the apps to make sure everyone is paying their fair share of taxes. A look inside the most popular consumer finance products in the us by maximilian friedrich, analyst october 22, 2019 5 min read we believe that after adding more than 8 million annual active users during the six months ended september 30, 2019, venmo is on track to surpass 50 million annual active users by the end of october. Both have been competing for their market share in the us, and cash app also launched uk services in 2018. Cash app and venmo are us domestic payment apps that are seemingly similar. The first prototype worked over sms, andrew and iqram would send notes alongside the cash to keep track of payments.

The irs is cracking down on the apps to make sure everyone is paying their fair share of taxes.

Reporting requirement will ensure that small businesses that receive payments through those apps are paying their fair share in taxes on them;. Unfortunately, minimal barriers to entry also make cash app attractive to cons and fraudsters. Looking at square�s services, including cash app, vs venmo and zelle by total payment volume. Cash app has a higher percentage of use among males, with 24% more. In the next 5 minutes, you will see how cash app and venmo stack up in 8 key criteria. Cash app vs venmo market share compared.

Source: cashappreferral.com

Source: cashappreferral.com

Cash app has a higher percentage of use among males, with 24% more. Venmo rolled a checkbox out a couple months ago to let people paying for things mark it as a good or service payment. A look inside the most popular consumer finance products in the us by maximilian friedrich, analyst october 22, 2019 5 min read we believe that after adding more than 8 million annual active users during the six months ended september 30, 2019, venmo is on track to surpass 50 million annual active users by the end of october. They’re holding it down in the united kingdom and canada with almost 90% of the market share for those countries. So should you be concerned that big brother is watching …

Source: caretaker.com

Source: caretaker.com

If you’re interested in using these apps to make transfers or purchases on your brex card in the future, please share your ideas in the early access tab of your brex dashboard. A look inside the most popular consumer finance products in the us by maximilian friedrich, analyst october 22, 2019 5 min read we believe that after adding more than 8 million annual active users during the six months ended september 30, 2019, venmo is on track to surpass 50 million annual active users by the end of october. The more regulation in the market the worse it is for consumers. The irs is cracking down on the apps to make sure everyone is paying their fair share of taxes. Cash app vs venmo market share compared.

However, we were shocked to see that they’re actually different in several key ways. On january 1, a provision of the american rescue plan act went into effect that requires payment services to report any transactions collectively worth $600 or more in a year to the tax agency. They’re holding it down in the united kingdom and canada with almost 90% of the market share for those countries. They both also charge a small fee for instant transfers to your bank, but no fee for standard transfers, which take one to three business days. New year, new tax laws.

Source: ascend.org

Source: ascend.org

Venmo’s app is available from the app store and google play. It�s a bullshit clickbait title and the article itself is barely a paragraph long. Both have been competing for their market share in the us, and cash app also launched uk services in 2018. Cash app vs venmo active users difference. They’re holding it down in the united kingdom and canada with almost 90% of the market share for those countries.

Source: recode.net

Source: recode.net

They’re holding it down in the united kingdom and canada with almost 90% of the market share for those countries. The first prototype worked over sms, andrew and iqram would send notes alongside the cash to keep track of payments. Venmo’s app is available from the app store and google play. In 2024, we expect more than 220 million digital wallet users in the us which, if valued like bank customers at maturity today, could represent an $800 billion opportunity in the us equity market. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs.

Source: seekingalpha.com

Source: seekingalpha.com

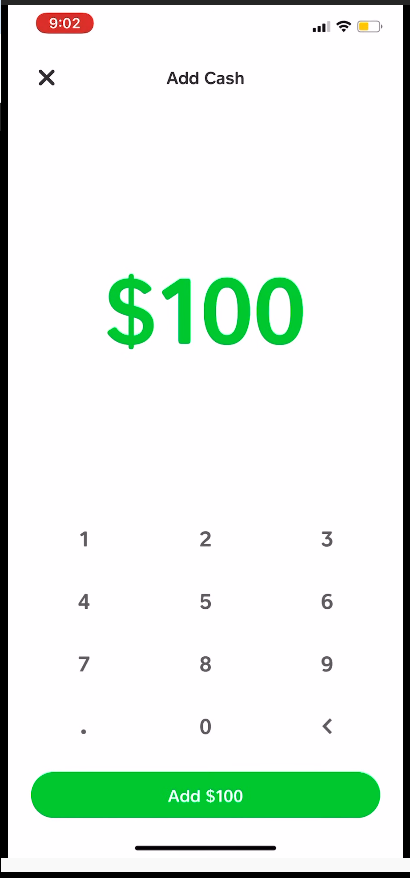

A collaborative effort by the major us banks to curtail venmo and cash app’s growth samsung pay Cash app, paypal and venmo must now report transactions totaling $600 to the irs our current president joe biden may not be the average man or small business owner’s friend many believed he could have been in the last presidential election (or that he promised he would be). The user scans a qr code or enters a username to find another cash app user and send payment from the linked account or the cash app balance. Neither charge a fee to send money, unless you are doing so with a credit card. Venmo rolled a checkbox out a couple months ago to let people paying for things mark it as a good or service payment.

Source: cleveland.com

Source: cleveland.com

Cash app and zelle aren’t yet supported for brex card transactions or as connected funding sources. It�s a bullshit clickbait title and the article itself is barely a paragraph long. Check out over here in. Venmo’s app is available from the app store and google play. Neither charge a fee to send money, unless you are doing so with a credit card.

Source: engagecpas.com

Source: engagecpas.com

Cash app has a higher percentage of use among males, with 24% more. (wcmh) — many people who use zelle, venmo, and cash app were stunned to learn that the irs now wants to know about large transactions. News venmo, paypal and cash app will now have to report transactions totaling more than $600 to the irs as. While sms functionality died with the app launch in late 2010, the social element of venmo remains one of the app’s core. A collaborative effort by the major us banks to curtail venmo and cash app’s growth samsung pay

Source: money.com

Source: money.com

In this comparison we will weigh up the strengths and weaknesses of each company, as we identify which one offers the best. In 2020, $148.80 billion transacted via venmo in the us, and we expect this figure to reach $304.52 billion by the end of 2023. (wcmh) — many people who use zelle, venmo, and cash app were stunned to learn that the irs now wants to know about large transactions. The first prototype worked over sms, andrew and iqram would send notes alongside the cash to keep track of payments. Cash app and zelle aren’t yet supported for brex card transactions or as connected funding sources.

Source: almvest.com

Source: almvest.com

The irs is cracking down on the apps to make sure everyone is paying their fair share of taxes. So should you be concerned that big brother is watching … Cash app vs venmo market share compared. In this comparison we will weigh up the strengths and weaknesses of each company, as we identify which one offers the best. It�s a bullshit clickbait title and the article itself is barely a paragraph long.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Owned by paypal, venmo had more than 80 million users as of november 2021. Both have been competing for their market share in the us, and cash app also launched uk services in 2018. In the period between february 2017 and february 2018, facebook messenger was the most popular p2p payment app. More than 60 million people use the venmo app for fast, safe, social payments. The user scans a qr code or enters a username to find another cash app user and send payment from the linked account or the cash app balance.

Source: markets.businessinsider.com

Source: markets.businessinsider.com

A collaborative effort by the major us banks to curtail venmo and cash app’s growth samsung pay More than 60 million people use the venmo app for fast, safe, social payments. Cash app links to a user’s bank account, debit, or credit card. However, we were shocked to see that they’re actually different in several key ways. The user scans a qr code or enters a username to find another cash app user and send payment from the linked account or the cash app balance.

Source: businessinsider.com

Source: businessinsider.com

Check out over here in. Unlike zelle, venmo does charge for some services. Cash app vs venmo market share compared. Both have been competing for their market share in the us, and cash app also launched uk services in 2018. Cash app and zelle aren’t yet supported for brex card transactions or as connected funding sources.

Source: fool.com

Source: fool.com

Cash app links to a user’s bank account, debit, or credit card. They both also charge a small fee for instant transfers to your bank, but no fee for standard transfers, which take one to three business days. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Neither charge a fee to send money, unless you are doing so with a credit card. While sms functionality died with the app launch in late 2010, the social element of venmo remains one of the app’s core.

Source: youtube.com

Source: youtube.com

A collaborative effort by the major us banks to curtail venmo and cash app’s growth samsung pay Reporting requirement will ensure that small businesses that receive payments through those apps are paying their fair share in taxes on them;. The more regulation in the market the worse it is for consumers. Only transactions that are marked as paying for a good or service by the person paying are included in this. A look inside the most popular consumer finance products in the us by maximilian friedrich, analyst october 22, 2019 5 min read we believe that after adding more than 8 million annual active users during the six months ended september 30, 2019, venmo is on track to surpass 50 million annual active users by the end of october.

Source: blog.rentdrop.io

Source: blog.rentdrop.io

Cash app and venmo are us domestic payment apps that are seemingly similar. A consumer study from q2 and cornerstone advisors sheds light on the p2p payments market and. Unfortunately, minimal barriers to entry also make cash app attractive to cons and fraudsters. The more regulation in the market the worse it is for consumers. Cash app and venmo are us domestic payment apps that are seemingly similar.

Source: fox9.com

Source: fox9.com

Venmo and cash app follow a very similar fee structure. Cash app vs venmo active users difference. A collaborative effort by the major us banks to curtail venmo and cash app’s growth samsung pay Cash app has a higher percentage of use among males, with 24% more. Cash app vs venmo market share compared.

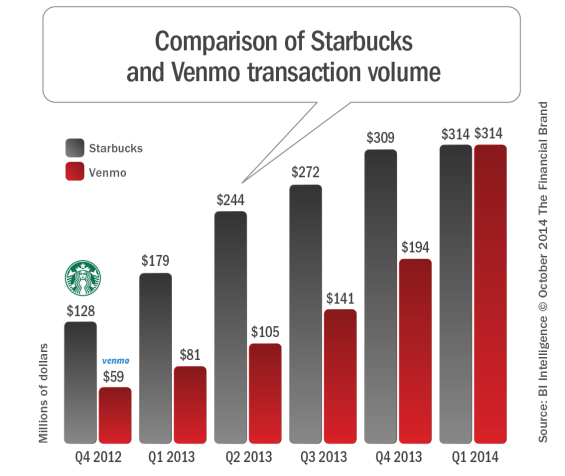

Source: thefinancialbrand.com

Source: thefinancialbrand.com

Venmo and cash app follow a very similar fee structure. About 14% of us consumers aged 18 or older used this method. Both have been competing for their market share in the us, and cash app also launched uk services in 2018. News venmo, paypal and cash app will now have to report transactions totaling more than $600 to the irs as. A look inside the most popular consumer finance products in the us by maximilian friedrich, analyst october 22, 2019 5 min read we believe that after adding more than 8 million annual active users during the six months ended september 30, 2019, venmo is on track to surpass 50 million annual active users by the end of october.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title venmo cash app market share by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.