Your Square cash app fee calculator images are available. Square cash app fee calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Square cash app fee calculator files here. Get all royalty-free vectors.

If you’re looking for square cash app fee calculator images information related to the square cash app fee calculator keyword, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

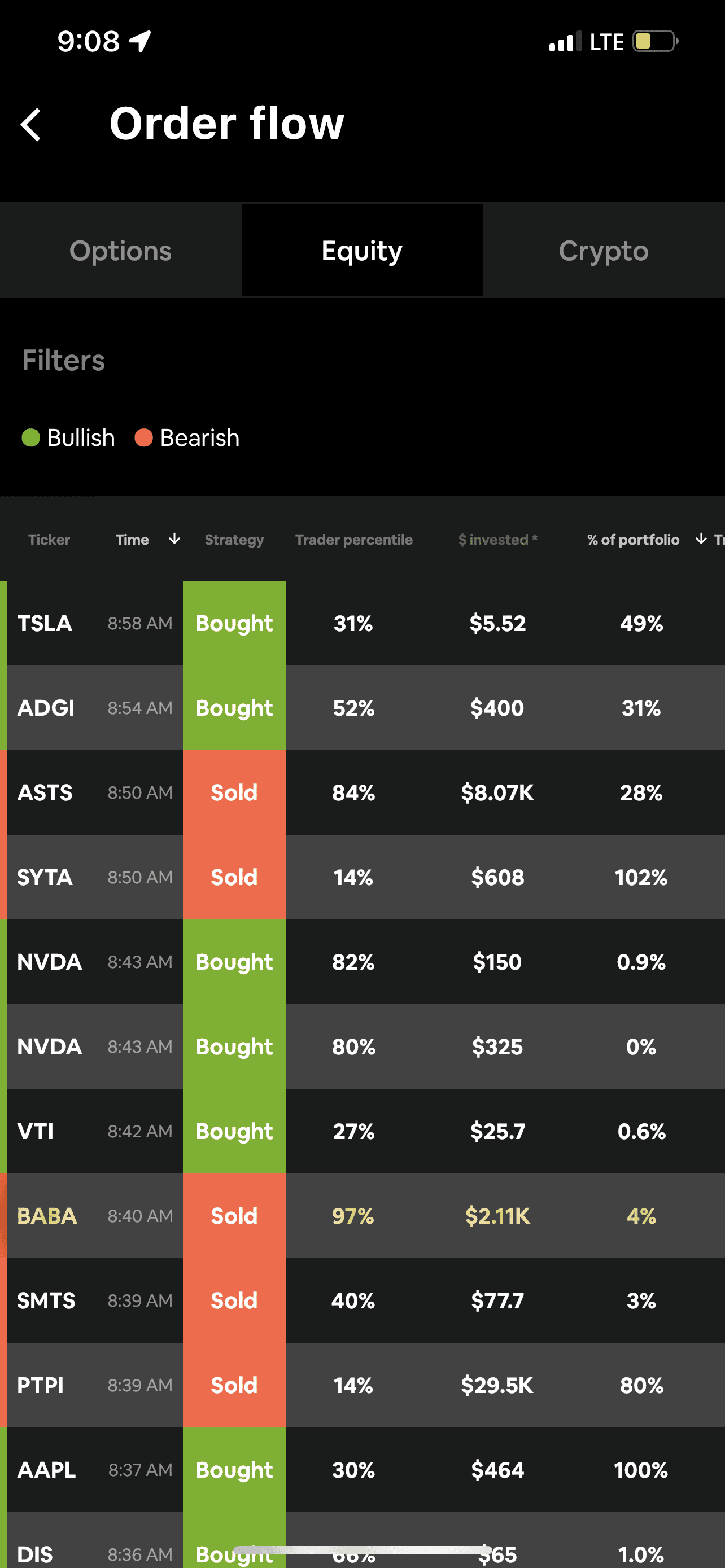

Square Cash App Fee Calculator. Square reader cost & fee score: Plus, get free services included. When you make a payment using a credit card on cash app, square adds a 3% fee to the transaction. 1 cash app is a financial platform, not a bank.

Whats Cash App Fee Calculator All information about start From flickrstudioapp.com

Whats Cash App Fee Calculator All information about start From flickrstudioapp.com

Miles calculator true airfare cost calculator. If you have a paycheck direct deposit of at least $300 per month, then cash app. Which small businesses should use square cash? $ your square fees would be: You can pay employees instantly if you use square payroll and your employees use square’s cash app. Plus, get free services included.

If you are an online merchant and use square�s merchant services, you can use our square fees calculator to calculate the exact amount that square charges for each transaction.

Cash app investing has high ratings on both app stores. Square’s cash app tests new feature allowing users to borrow up to $200. You can pay employees instantly if you use square payroll and your employees use square’s cash app. Cash app investing has high ratings on both app stores. $ your square fees would be: Cash app investing, as the name would suggest, is easily accessible through the cash app apple or android mobile app.

Source: landofepin.com

Source: landofepin.com

But the downside is that you can only send money within the us and to the uk when using cash app. As of 2022, square charges 2.9% + 0.3 for each transaction. You can pay employees instantly if you use square payroll and your employees use square’s cash app. In this case, the transaction incurs a fee of 3.5% + $0.15. Check out other alternatives for sending money online.

Source: flickrstudioapp.com

Source: flickrstudioapp.com

If cash app can’t verify your id, it might require additional information. $ your square fees would be: In this case, the transaction incurs a fee of 3.5% + $0.15. The cost to receive payments through a business account is 2.75%. Bitcoin trading is offered by cash app.

Source: crypto-economy.com

Source: crypto-economy.com

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. If a person sends you: If cash app can’t verify your id, it might require additional information. Square for restaurants with square reader for magstripe. Initially, there are two pricing options:

Source: dentistryforlife2020.org

Source: dentistryforlife2020.org

1 cash app is a financial platform, not a bank. Cash app investing does not trade bitcoin and cash app is not a member of finra or sipc. For instance, invoices come with a fee of around 2.5% per payment, like online checkout link recurring costs, pos app card on file payments, and virtual terminal card payments. Paypal is complex and depends on which services you need. Standard transfers on the app to your bank account take two to three days and are free, while.

Source: flickrstudioapp.com

Source: flickrstudioapp.com

Square ecommerce api has a 1.9 to 2.9% fee, and inserted chip cards start at 1.75%. Bitcoin trading is offered by cash app. That’s for every tapped (mobile payments), dipped (chip cards), and swiped (magstripe cards) payment. In this case, the transaction incurs a fee of 3.5% + $0.15. Which small businesses should use square cash?

Source: landofepin.com

Source: landofepin.com

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. If a person sends you: For instance, invoices come with a fee of around 2.5% per payment, like online checkout link recurring costs, pos app card on file payments, and virtual terminal card payments. Select below if you are swiping or manually entering the credit card number, or if you

Source: pis.flickrstudioapp.com

Source: pis.flickrstudioapp.com

With no monthly fee, cash app may be a good fit for those who want to send money conveniently, and perhaps dip their toes into. Which small businesses should use square cash? When you make a payment using a credit card on cash app, square adds a 3% fee to the transaction. Square reader cost & fee score: For instance, invoices come with a fee of around 2.5% per payment, like online checkout link recurring costs, pos app card on file payments, and virtual terminal card payments.

Source: fortuite.org

Source: fortuite.org

Plus, get free services included. Miles calculator true airfare cost calculator. It’s important to note, however, that this lower rate only applies to the square for retail app. But the downside is that you can only send money within the us and to the uk when using cash app. Pay hidden or additional fees.

Source: currencyfair.com

Source: currencyfair.com

$ your square fees would be: Now you have more insight on the fees. Which small businesses should use square cash? Square offers a free point of sale app for both android and apple devices (smartphones and tablets). Standard transfers on the app to your bank account take two to three days and are free, while.

Source: eltiemponeworleans.com

Source: eltiemponeworleans.com

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Square invoice charges 2.9% + $0.30 per online invoice sent, except when using square’s card on file system, which saves customer card information. The square payroll tool has different pricing plans are based on the type and number of employees a business has. Standard transfers on the app to your bank account take two to three days and are free, while. Which small businesses should use square cash?

Source: flickrstudioapp.com

Source: flickrstudioapp.com

$ enter your square fee rate below: Bitcoin trading is offered by cash app. In this case, the transaction incurs a fee of 3.5% + $0.15. The app, which you can also use to send and receive money from family and friends, is simple to use from an investment perspective. Select below if you are swiping or manually entering the credit card number, or if you

Source: adwuk.org

Source: adwuk.org

Banking services provided and debit cards issued by cash app�s bank partners. Standard transfers on the app to your bank account take two to three days and are free, while. If you use your debit card at an atm, cash app charges a $2 fee. Online calculators > financial calculators > square fee calculator square fee calculator. Cash app investing does not trade bitcoin and cash app is not a member of finra or sipc.

Source: ade.pathwaystocharacter.org

Source: ade.pathwaystocharacter.org

Square fee calculator 2022 to calculate square fees for merchants. If cash app can’t verify your id, it might require additional information. Business accounts can issue refunds from within the square cash app. Pay hidden or additional fees. Square fee calculator 2022 to calculate square fees for merchants.

Source: pol.wpallinfo.com

Source: pol.wpallinfo.com

Check out other alternatives for sending money online. However, cash app also facilitates direct deposits. Check out other alternatives for sending money online. Pay hidden or additional fees. If you use your debit card at an atm, cash app charges a $2 fee.

Source: marketwatch.com

Source: marketwatch.com

With no monthly fee, cash app may be a good fit for those who want to send money conveniently, and perhaps dip their toes into. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. If you use your debit card at an atm, cash app charges a $2 fee. Square fee calculator 2022 to calculate square fees for merchants. Select below if you are swiping or manually entering the credit card number, or if you

Source: marrimarrimille-russell.blogspot.com

Source: marrimarrimille-russell.blogspot.com

Paypal is complex and depends on which services you need. A fee of 2.75 percent is automatically deducted from any payment accepted with cash for business. When you make a payment using a credit card on cash app, square adds a 3% fee to the transaction. Initially, there are two pricing options: Cash app started out as square cash, a p2p service, but businesses can also now use the service using cash for business.

Source: smallbiztrends.com

Source: smallbiztrends.com

Plus, get free services included. Cash app started out as square cash, a p2p service, but businesses can also now use the service using cash for business. Cash app investing does not trade bitcoin and cash app is not a member of finra or sipc. The app, which you can also use to send and receive money from family and friends, is simple to use from an investment perspective. If so, the fee will be listed on the trade confirmation before you complete the transaction.

Source: flickrstudioapp.com

Source: flickrstudioapp.com

Banking services provided and debit cards issued by cash app�s bank partners. Which small businesses should use square cash? But the downside is that you can only send money within the us and to the uk when using cash app. Online calculators > financial calculators > square fee calculator square fee calculator. Initially, there are two pricing options:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title square cash app fee calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.