Your Paypal cash app zelle images are available in this site. Paypal cash app zelle are a topic that is being searched for and liked by netizens today. You can Download the Paypal cash app zelle files here. Get all free photos.

If you’re looking for paypal cash app zelle pictures information connected with to the paypal cash app zelle keyword, you have visit the ideal blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Paypal Cash App Zelle. Zelle® is already in lots of banking apps, so look for it in yours today. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the. Zelle® is a great way to send money to friends and family, even if they bank somewhere different than you do. The cash app does not allow you to transfer money from zelle to your cash app account.

The 6 Best Payment Apps of 2020 From thebalance.com

The 6 Best Payment Apps of 2020 From thebalance.com

1 that means it’s super easy to pitch in or get paid back for all sorts of things like the neighborhood block party or getting paid back for covering the cost of a vacation rental for a group of friends. Paypal, which owns venmo, is offering similar guidance for users of its app, a company spokesperson said. Let�s see in what ways paypal, venmo, and zelle differ from each other establishment Venmo, zelle, paypal, cash app, and google pay compared: If you exceed 600 dollars it will be income instead of a simple reimbursement for dinner, drinks, or taxi, or what ever. On january 1, a provision of the american rescue.

Apps like venmo, paypal, zelle, and cash app all let you send and receive money from your phone or computer.

Can you zelle to cash app? Paypal and zelle are accepted by a variety of banks. And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. Cash app alternatives in the u.s. If you exceed 600 dollars it will be income instead of a simple reimbursement for dinner, drinks, or taxi, or what ever. Zelle, vimeo, cash app, and paypal.

Source: youtube.com

Source: youtube.com

Like venmo, cash app has expanded its service offerings in recent times to include early paychecks, cryptocurrency trading, and a debit card. 1 that means it’s super easy to pitch in or get paid back for all sorts of things like the neighborhood block party or getting paid back for covering the cost of a vacation rental for a group of friends. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. Zelle, vimeo, cash app, and paypal. And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere.

Source: androidstandard.com

Source: androidstandard.com

The new reporting requirement only applies to sellers of goods and. By zach laidlaw updated jul 29, 2020. And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. Paypal can be instant for paypal to paypal transfers but if it requires your bank or card for extra processes, it can take a few days. Like venmo, cash app has expanded its service offerings in recent times to include early paychecks, cryptocurrency trading, and a debit card.

Source: thebalance.com

Source: thebalance.com

New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. Zelle, vimeo, cash app, and paypal. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the. New year, new tax laws. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules.

Source: whatismyipaddress.com

Source: whatismyipaddress.com

There’s also cash app, google pay, apple pay and even facebook messenger. The cash app does not allow you to transfer money from zelle to your cash app account. Which is the best money transfer service? Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the. Include paypal, venmo, and zelle.

Source: medium.com

Source: medium.com

And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. It was inevitable we’d end up exchanging money using our phones. Square�s cash app includes a partially updated page for users with cash app for business. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. By zach laidlaw updated jul 29, 2020.

Source: recode.net

Source: recode.net

Paypal, which owns venmo, is offering similar guidance for users of its app, a company spokesperson said. The cash app does not allow you to transfer money from zelle to your cash app account. It’s been a long time coming and will be effective on january 1, 2022. Is the cash app available Paypal also has more/higher fees.

Source: unbrick.id

Source: unbrick.id

And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. Is the cash app available Zelle, vimeo, cash app, and paypal. Cash app alternatives in the u.s. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the.

Source: usatoday.com

Source: usatoday.com

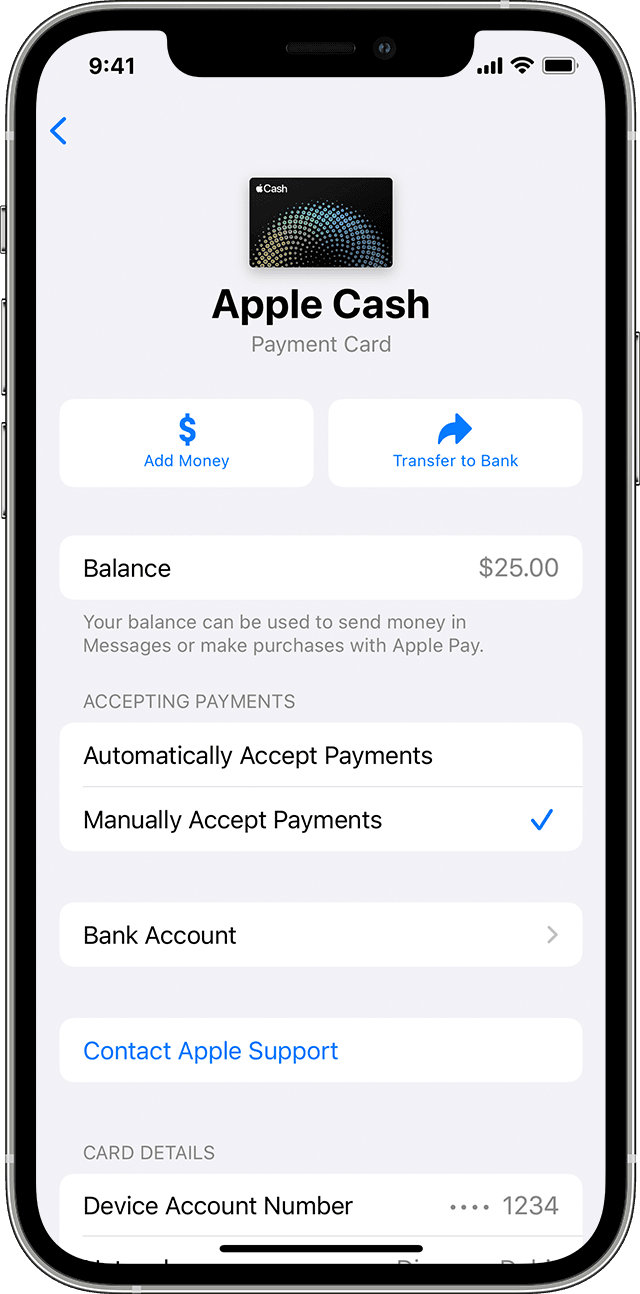

Don’t go out with friends and exchange money over these apps. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. Zelle, vimeo, cash app, and paypal. Cash app users must link their bank accounts to add money to their accounts. On january 1, a provision of the american rescue.

Source: whatismyipaddress.com

Source: whatismyipaddress.com

Let�s see in what ways paypal, venmo, and zelle differ from each other establishment Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. By thechasbowie jan 8, 2022. Don’t go out with friends and exchange money over these apps.

Source: theverge.com

Source: theverge.com

Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. Cash app alternatives in the u.s. Let�s see in what ways paypal, venmo, and zelle differ from each other establishment 1 that means it’s super easy to pitch in or get paid back for all sorts of things like the neighborhood block party or getting paid back for covering the cost of a vacation rental for a group of friends. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules.

Source:

Source:

Paypal and zelle are accepted by a variety of banks. Cash app users must link their bank accounts to add money to their accounts. Paypal can be instant for paypal to paypal transfers but if it requires your bank or card for extra processes, it can take a few days. Can you zelle to cash app? It was inevitable we’d end up exchanging money using our phones.

Source: clark.com

Source: clark.com

If you exceed 600 dollars it will be income instead of a simple reimbursement for dinner, drinks, or taxi, or what ever. There’s also cash app, google pay, apple pay and even facebook messenger. Paypal can be instant for paypal to paypal transfers but if it requires your bank or card for extra processes, it can take a few days. New year, new tax laws. Let�s see in what ways paypal, venmo, and zelle differ from each other establishment

Source: businessinsider.com

Source: businessinsider.com

Venmo, zelle, paypal, cash app, and google pay compared: By thechasbowie jan 8, 2022. Zelle® is a great way to send money to friends and family, even if they bank somewhere different than you do. There’s also cash app, google pay, apple pay and even facebook messenger. Cash app users must link their bank accounts to add money to their accounts.

Source: youtube.com

Source: youtube.com

The new reporting requirement only applies to sellers of goods and. Paypal also has more/higher fees. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers. Payment apps like venmo, zelle, cash app, and paypal would fall under that category. On january 1, a provision of the american rescue.

Source: clark.com

Source: clark.com

1 that means it’s super easy to pitch in or get paid back for all sorts of things like the neighborhood block party or getting paid back for covering the cost of a vacation rental for a group of friends. Which is the best money transfer service? Can you zelle to cash app? The new reporting requirement only applies to sellers of goods and. Paypal can be instant for paypal to paypal transfers but if it requires your bank or card for extra processes, it can take a few days.

Source: whatismyipaddress.com

Source: whatismyipaddress.com

Venmo, zelle, paypal, cash app, and google pay compared: And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. New venmo, paypal, cash app, and zelle tax rules �absolutely� mean more audits, cpa says. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers.

Source: policygenius.com

Source: policygenius.com

Venmo, zelle, paypal, cash app, and google pay compared: Can you zelle to cash app? Include paypal, venmo, and zelle. This was passed way back in march of last year. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs.

Source: whatismyipaddress.com

Source: whatismyipaddress.com

The money you receive from a zelle account will be deposited into your linked bank account if it is. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. On january 1, a provision of the american rescue. Although p2p payment apps can have similarities, they do differ in the services they offer, the fee structures, transfer limits, or the access of money. No such tax rule exists, only a reporting adjustment for business transactions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title paypal cash app zelle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.