Your How much does cash app charge to cash out 20 images are available. How much does cash app charge to cash out 20 are a topic that is being searched for and liked by netizens today. You can Find and Download the How much does cash app charge to cash out 20 files here. Get all royalty-free images.

If you’re looking for how much does cash app charge to cash out 20 pictures information related to the how much does cash app charge to cash out 20 keyword, you have come to the ideal site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

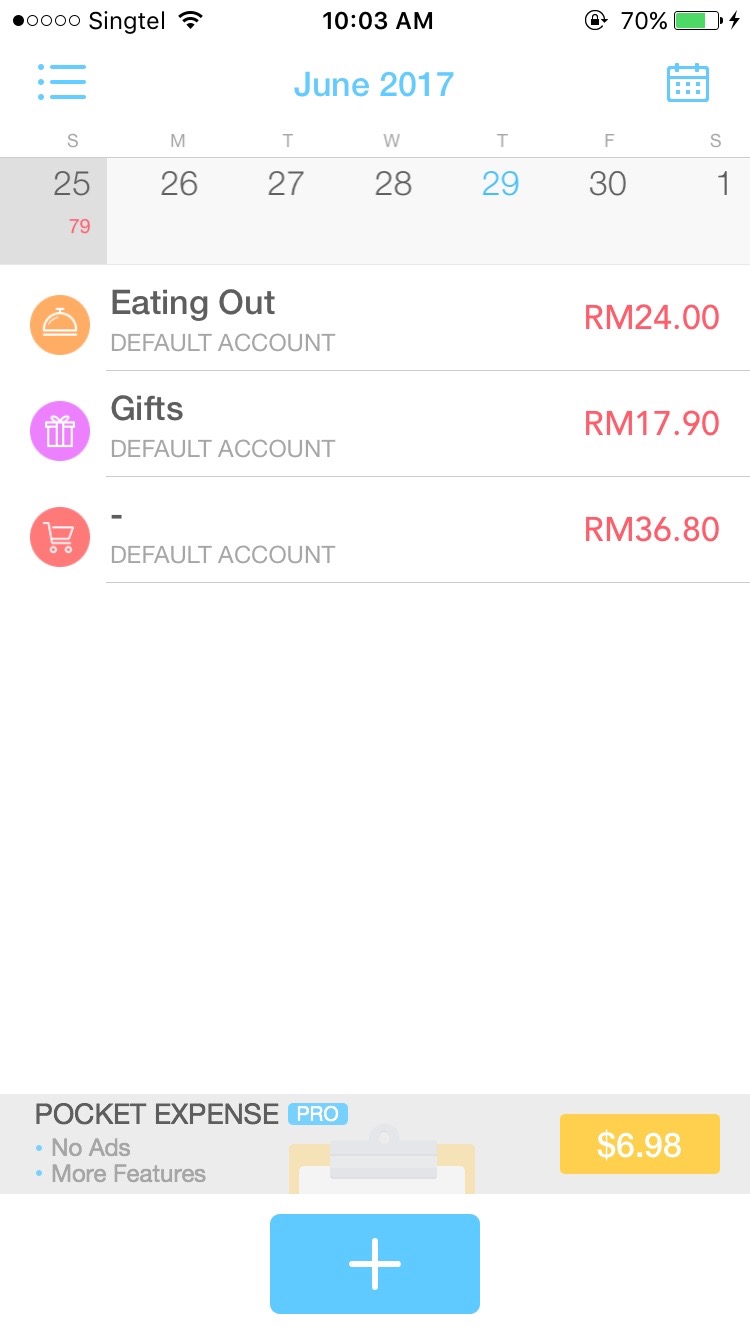

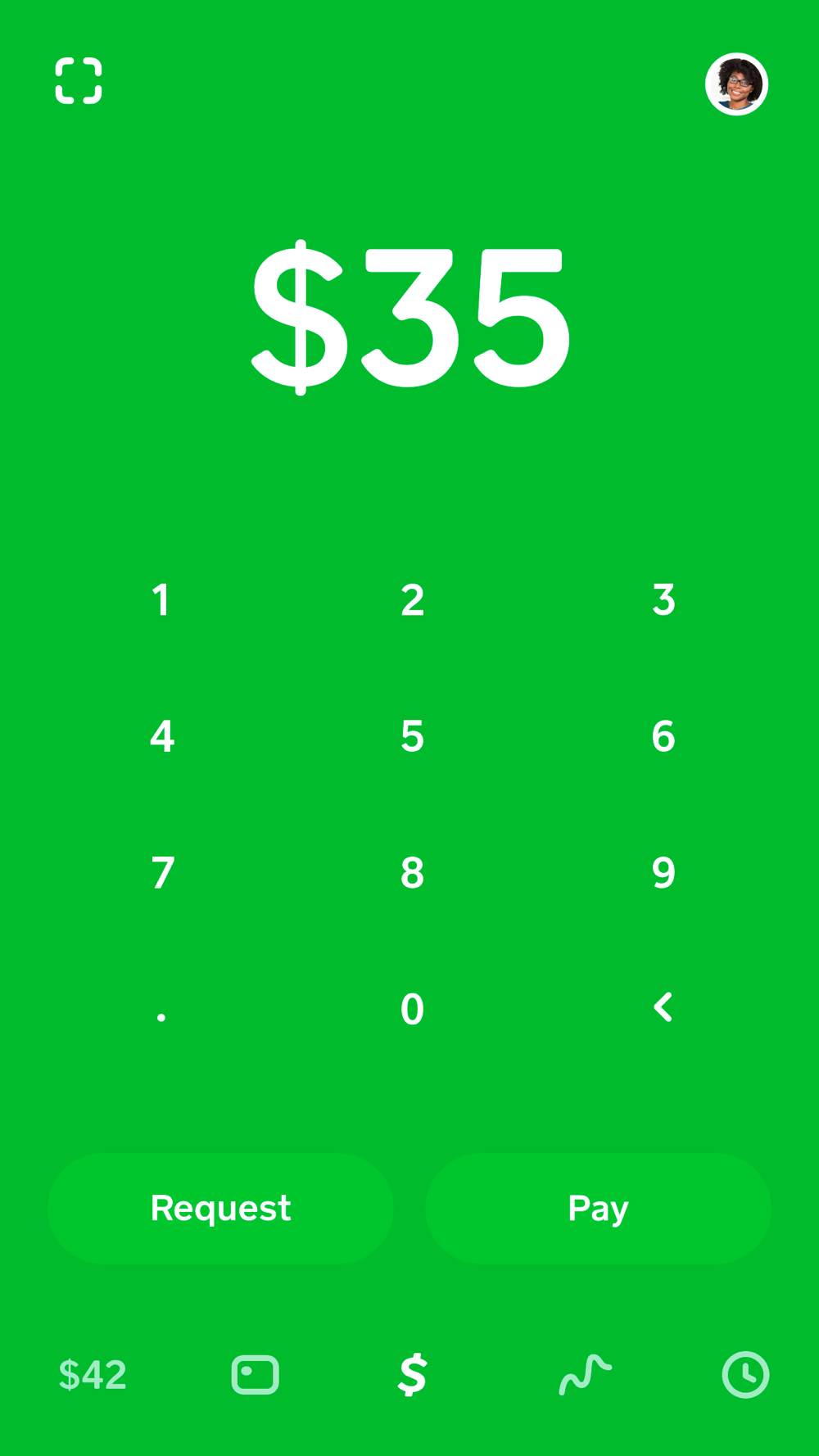

How Much Does Cash App Charge To Cash Out 20. You don’t pay interest with dave, but there is a $1/month fee to get access to dave loans. Get a free $20 cash app payment by asking for it. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Go to the “banking” header.

How Much Does It Cost To Relocate A Pool Table Thinkervine From payamno.com

How Much Does It Cost To Relocate A Pool Table Thinkervine From payamno.com

To cash out, at least $25 needs to be from spin wheel and paid offers, and you cannot have more than $25 from paid emails. Proceed here to check out all the steps involved in claiming your free money. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Cash app is the latest and greatest in mobile payment apps. Send $5 to any cash app user to get the $5 bonus from cash app. Cash app does have a few advantages over venmo:

Cash app does have a few advantages over venmo:

Accept a cash app borrow loan. Then have them send that $5 back. Pretending to be a cash app representative, the fraudster reaches out to a user by email, social media, phone or text to collect personal or financial information. Here, we’ve outlined the range of transactions that may be classified as cash advances and attract the cash advance rate and fees. Other current rewards app reviews. The online store uses paypal payments pro ($30/month) to process payments and uses recurring billing ($10/month).

Source: inustec2020.com

Source: inustec2020.com

Since 2020, cash app has been testing out a feature that allows users to borrow $20 to $200 with a 5% fee and paid back within four weeks. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Currently this feature is being offered by 1,000 users. To avoid missing out on your cash app signup bonus, make sure you link your debit card or bank account to your cash app, send $5 within 14 days of entering the referral code. Check for the word “borrow.”.

Source: iammrfoster.com

Source: iammrfoster.com

Cash app will tell you how much you’ll be able to borrow. Cash app is the latest and greatest in mobile payment apps. Tap on your cash app balance located at the lower left corner. Pro tip invite a friend to cash app with this code & send them $5. That means to get $1,000 out of your own account, you could pay between $14 and $22 in fees.

Source: dentistryforlife2020.org

Source: dentistryforlife2020.org

$0.80, minimum 75 card pack. New varo users and people who can’t qualify for. Cash app does charge a $2 atm fee per withdrawal, in addition to the fee the atm provider charges. However, these loans haven�t been rolled out to all users and there have been no announcements regarding plans to expand the feature�s availability. Go to the “banking” header.

Source: landofepin.com

Source: landofepin.com

Cash app does have a few advantages over venmo: Accept a cash app borrow loan. It does not have fees listed on its website, so you’ll have to call a local store to get information on how much it will charge to cash your check. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Tap the profile icon in the top right.

Source: santaclaritatreeservice.org

Source: santaclaritatreeservice.org

Atm withdrawals and cash out. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Currently this feature is being offered by 1,000 users. Empower is a fintech app with a visa debit card that earns cash back—and can give you access to up to $250 in cash advances. Cash app does charge a $2 atm fee per withdrawal, in addition to the fee the atm provider charges.

Source: forgotten-kjetil.blogspot.com

Source: forgotten-kjetil.blogspot.com

If cash app can’t verify your id, it might require additional information. The dave app is easy to download and install, just pop into google play or the app store. You don’t pay interest with dave, but there is a $1/month fee to get access to dave loans. Here�s when your cash app will charge you a fee. Inboxpays only offers paypal, but this does mean that you can earn cash, rather than gift cards or prizes.

![]() Source: dentistryforlife2020.org

Source: dentistryforlife2020.org

Empower is a fintech app with a visa debit card that earns cash back—and can give you access to up to $250 in cash advances. Since 2020, cash app has been testing out a feature that allows users to borrow $20 to $200 with a 5% fee and paid back within four weeks. However, there is a high minimum payout of $50, and there are some terms. If you see “borrow” you can take out a cash app loan. If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total.

Send $5 to any cash app user to get the $5 bonus from cash app. So sending someone $100 will actually cost. Cash app does charge a $2 atm fee per withdrawal, in addition to the fee the atm provider charges. To cash out, at least $25 needs to be from spin wheel and paid offers, and you cannot have more than $25 from paid emails. Cash app warns about impersonators conducting phishing scams.

Source: romola-garai.com

Source: romola-garai.com

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Accept a cash app borrow loan. Using your credit card to withdraw money from an atm or at the checkout is a cash advance. Get a free $20 cash app payment by asking for it. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Source: santorinichicago.com

Source: santorinichicago.com

If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. The dave app is easy to download and install, just pop into google play or the app store. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Pro tip invite a friend to cash app with this code & send them $5.

Source: ca.santaclaritatreeservice.org

Source: ca.santaclaritatreeservice.org

( iphone or android) 2. Here, we’ve outlined the range of transactions that may be classified as cash advances and attract the cash advance rate and fees. Upload your own art (takes 15 business days to produce; Since 2020, cash app has been testing out a feature that allows users to borrow $20 to $200 with a 5% fee and paid back within four weeks. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers.

Final thoughts on cash app vs venmo. So sending someone $100 will actually cost. Cash app charges a flat fee of $0.25 for transactions under $20, which is waived if you do more than 20 cash app transactions per day. Atm withdrawals and cash out. Tap on your cash app balance located at the lower left corner.

Source: epernot.com

Source: epernot.com

Since 2020, cash app has been testing out a feature that allows users to borrow $20 to $200 with a 5% fee and paid back within four weeks. So sending someone $100 will actually cost. It does not have fees listed on its website, so you’ll have to call a local store to get information on how much it will charge to cash your check. However, there is a high minimum payout of $50, and there are some terms. Cash app warns about impersonators conducting phishing scams.

Source: landofepin.com

Source: landofepin.com

$0.80, minimum 75 card pack. Currently this feature is being offered by 1,000 users. Square’s cash app is beta testing a new feature where users can borrow $20 to $200, the loan length is four weeks and cash app is charging a flat fee of 5% (multiplied by 52 weeks is 60% or almost 80% with compounding interest). $0.95/each, minimum 75 card pack. Cash app has a higher percentage of use among males, with 24% more active users than venmo.

Source: outload.bidenharrismerch.us

Source: outload.bidenharrismerch.us

To cash out, at least $25 needs to be from spin wheel and paid offers, and you cannot have more than $25 from paid emails. Cash app is the latest and greatest in mobile payment apps. To cash out, at least $25 needs to be from spin wheel and paid offers, and you cannot have more than $25 from paid emails. Get a free $20 cash app payment by asking for it. Square’s cash app is beta testing a new feature where users can borrow $20 to $200, the loan length is four weeks and cash app is charging a flat fee of 5% (multiplied by 52 weeks is 60% or almost 80% with compounding interest).

Source: payamno.com

Source: payamno.com

Here, we’ve outlined the range of transactions that may be classified as cash advances and attract the cash advance rate and fees. Accept a cash app borrow loan. New varo users and people who can’t qualify for. It would take four separate swipes to get $1,000 out of your cash app account. Then have them send that $5 back.

Source: inustec2020.com

Source: inustec2020.com

Check out other alternatives for sending money online. To cash out, at least $25 needs to be from spin wheel and paid offers, and you cannot have more than $25 from paid emails. Atm withdrawals and cash out. You can have those fees waived if you receive a direct deposit of $300 or more into your cash app account each month. Cash app has a higher percentage of use among males, with 24% more active users than venmo.

Source: skycumbres.com

Source: skycumbres.com

Accept a cash app borrow loan. Currently this feature is being offered by 1,000 users. However, there is a high minimum payout of $50, and there are some terms. However, these loans haven�t been rolled out to all users and there have been no announcements regarding plans to expand the feature�s availability. Final thoughts on cash app vs venmo.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much does cash app charge to cash out 20 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.