Your How much does cash app charge to cash out 150 images are available. How much does cash app charge to cash out 150 are a topic that is being searched for and liked by netizens now. You can Download the How much does cash app charge to cash out 150 files here. Download all free vectors.

If you’re looking for how much does cash app charge to cash out 150 pictures information connected with to the how much does cash app charge to cash out 150 keyword, you have come to the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

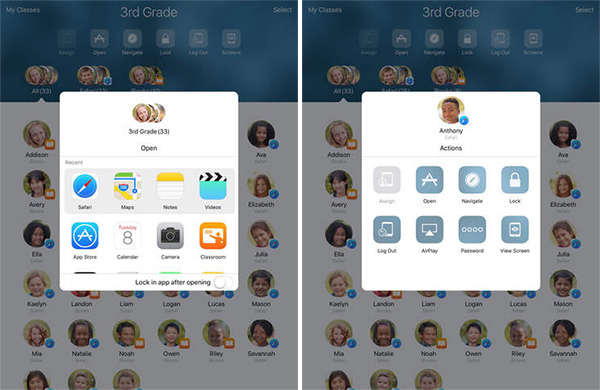

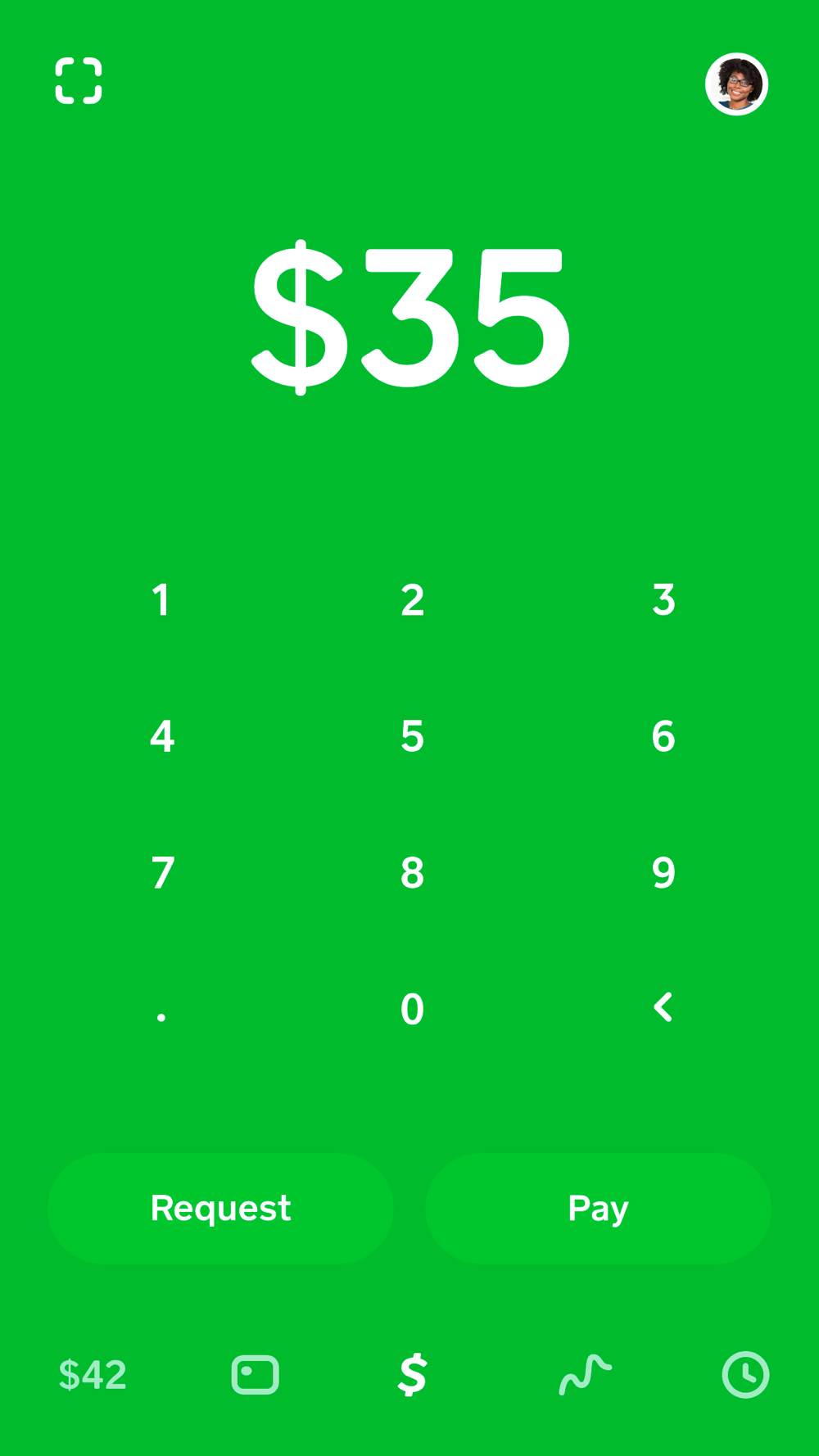

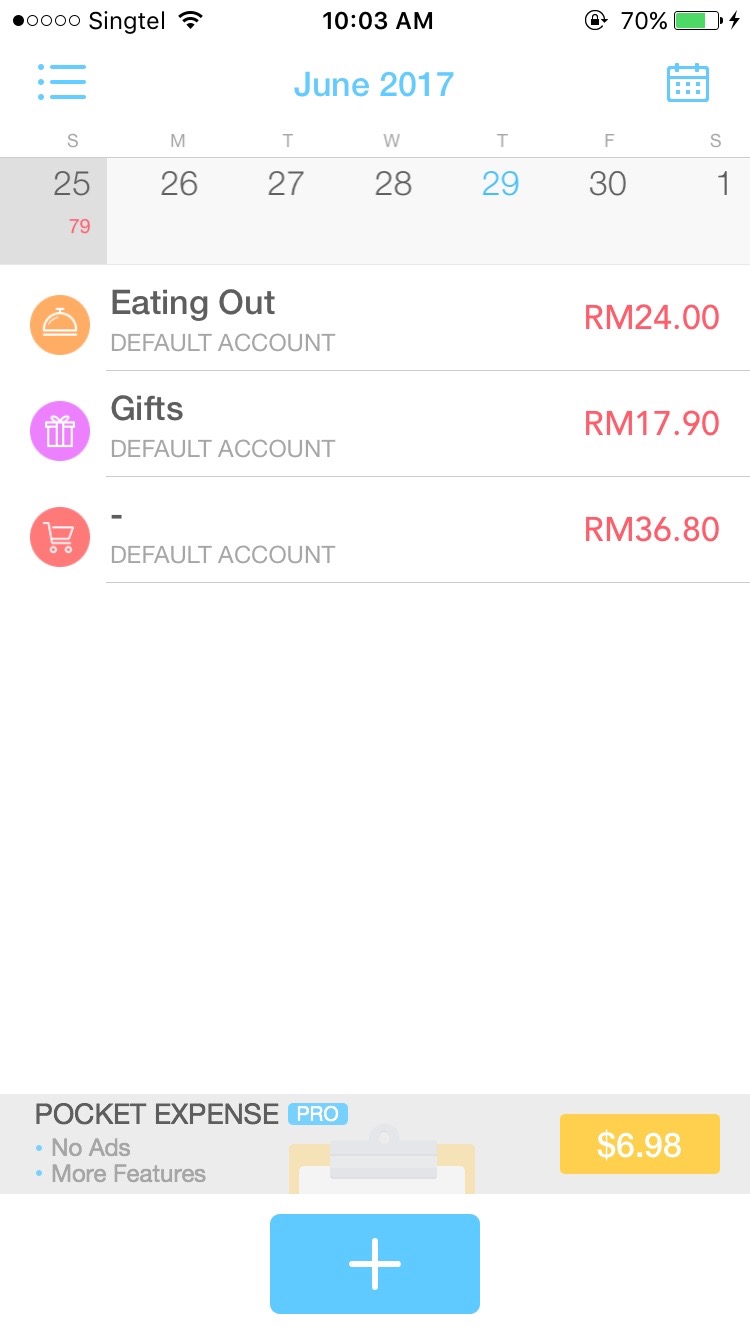

How Much Does Cash App Charge To Cash Out 150. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Cards created with a template; Click the banking tab on the cash app home screen. Cash app also functions similarly to a bank account, giving users a debit card called a “cash card”.

For business payments, the customer is charged 2.75%. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. If cash app can’t verify your id, it might require additional information. The app charges $2 and banks charge anywhere between $1.50 to $3.50 on average per transaction. Confirm with your pin or touch id If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total.

Cash in from linked bank account in gcash app (e.g.

If cash app can’t verify your id, it might require additional information. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. The process is sleek and straightforward. The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Cash app makes direct deposits available as soon as they are received, up to two days earlier than many banks. Upload your own art (takes 15 business days to produce;

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Does cash app have customer service phone support? Check out other alternatives for sending money online. The process is sleek and straightforward. Cards created with a template;

Source: flickrstudioapp.com

Source: flickrstudioapp.com

Now you have more insight on the fees. Top cash advance app pockbox.com. Cash in from bank via online or mobile banking. For business payments, the customer is charged 2.75%. The cash app instant transfer fee is 1.5%, with a minimum of $0.25.

Source: webcashapp.net

Source: webcashapp.net

If you are sending money via a credit card linked to your cash app, a 3% fee will be added to the total. Pretending to be a cash app representative, the fraudster reaches out to a user by email, social media, phone or text to collect personal or financial information. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. The app charges $2 and banks charge anywhere between $1.50 to $3.50 on average per transaction. Upload your own art (takes 15 business days to produce;

Source: payamno.com

Source: payamno.com

Check out other alternatives for sending money online. $10 to $80 per hour. The cash app doesn�t charge a fee to send, request or receive personal payments from a debit card or a bank account, or for a standard deposit. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Meanwhile, if you’re cashing out through bank transfer (to a bank using the instapay network), a php 15 fee per transaction will be charged.

Source: inustec2020.com

Source: inustec2020.com

The app also allows users to invest their money in stocks and buy and sell bitcoin. That means to get $1,000 out of your own account, you could pay between $14. Confirm the transaction either by using your touch id or pin⁴. It allows users to make purchases using the funds in their cash app account. It earned good marks for data security, customer support and.

Source: cangguguide.com

Source: cangguguide.com

For business payments, the customer is charged 2.75%. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. $0.95/each, minimum 75 card pack. They can also use the optional linked debit card to shop or hit an atm. Upload your own art (takes 15 business days to produce;

Source: skycumbres.com

Source: skycumbres.com

$10 to $80 per hour. Instant deposits are subject to a 1.5% fee (with a minimum fee of $0.25) but arrive to your debit card instantly. Choose an amount and press cash out; The best way to contact cash app support is through your app. For more ways to reach out including cash app support�s verified phone number, check out contact cash app support here.

Source: adw.boopsie2.com

Source: adw.boopsie2.com

Cash in from remittance partner in gcash app (e.g. How to use cash app. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. If cash app can’t verify your id, it might require additional information.

Source: togiajans.com

Source: togiajans.com

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. But the downside is that you can only send money within the us and to the uk when using cash app. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. The app charges $2 and banks charge anywhere between $1.50 to $3.50 on average per transaction. For more ways to reach out including cash app support�s verified phone number, check out contact cash app support here.

Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Select an amount to add. 2.9% + $0.30 transaction rate on a customer’s purchase of the card. $10 to $80 per hour. If cash app can’t verify your id, it might require additional information.

Source: reni.bigdatatales.com

Source: reni.bigdatatales.com

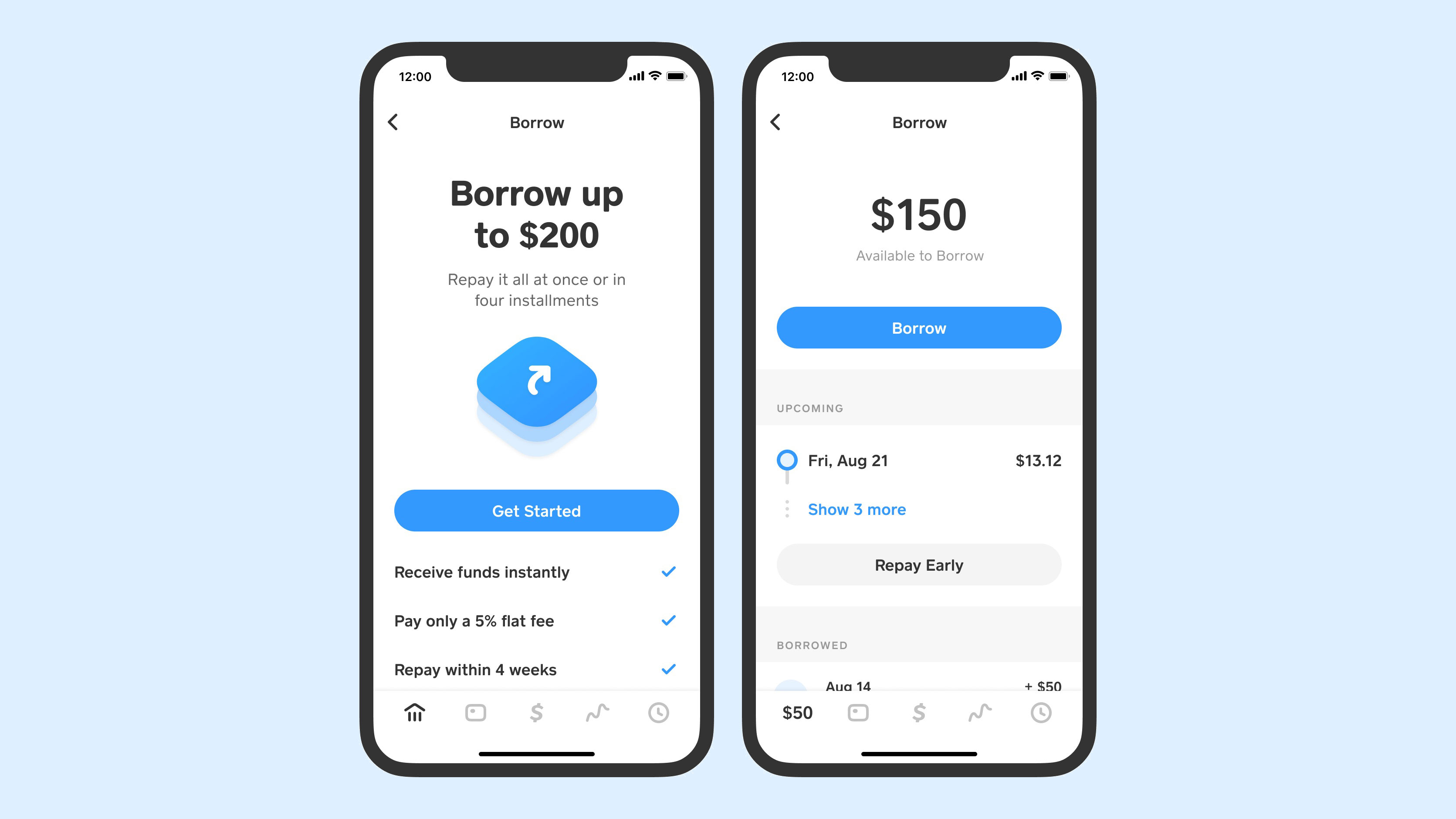

Robinhood withdrawal fee, terms and how to transfer funds out of brokerage account 2022 robinhood app withdrawal fee, transfer funds to bank options, terms for moving cash, getting money out of brokerage account by ach, wire transfer, debit card, atm, or check. A cash advance app can be the perfect solution. Robinhood withdrawal fee, terms and how to transfer funds out of brokerage account 2022 robinhood app withdrawal fee, transfer funds to bank options, terms for moving cash, getting money out of brokerage account by ach, wire transfer, debit card, atm, or check. For more ways to reach out including cash app support�s verified phone number, check out contact cash app support here. Let’s dive into your cash advance options.

Source: cangguguide.com

Source: cangguguide.com

Does cash app have customer service phone support? To cash out funds from your cash app to your bank account: Upload your own art (takes 15 business days to produce; The process is sleek and straightforward. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month.

Source: dentistryforlife2020.org

Source: dentistryforlife2020.org

Cash app also functions similarly to a bank account, giving users a debit card called a “cash card”. Another cash app similar to dave that you can use to get cash advances whenever you have unplanned expenses that need sorting out is moneylion. Confirm the transaction either by using your touch id or pin⁴. Cash in from bank via online or mobile banking. How to use cash app.

Source: inustec2020.com

Source: inustec2020.com

Select an amount to add. It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. Start by downloading cash app on your smartphone. Cash app offers standard deposits to your bank account and instant deposits to your linked debit card. Pockbox is the perfect app to get cash advances of up to $2,500 in minutes.

Source: dangaopx.com

Source: dangaopx.com

To cash out funds from your cash app to your bank account: Cash in from bank via online or mobile banking. Tap the profile icon on your cash app home screen, select support, and navigate to the issue. To cash out funds from your cash app to your bank account: A cash advance app can be the perfect solution.

Source: sprzatanie-lublin.com

Source: sprzatanie-lublin.com

The service grants you instant loans of up to $250 per pay cycle depending on how much income you regularly earn and deposit into your checking account. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements. $10 to $80 per hour. It allows users to make purchases using the funds in their cash app account. The best way to contact cash app support is through your app.

Source: neveazzurra.org

Source: neveazzurra.org

It charges the sender a 3% fee to send a payment using a credit card and 1.5% for an instant deposit to a bank account. The service grants you instant loans of up to $250 per pay cycle depending on how much income you regularly earn and deposit into your checking account. Select an amount to add. Confirm with your pin or touch id For more ways to reach out including cash app support�s verified phone number, check out contact cash app support here.

Source: santaclaritatreeservice.org

Source: santaclaritatreeservice.org

Confirm the transaction either by using your touch id or pin⁴. Confirm the transaction either by using your touch id or pin⁴. But the downside is that you can only send money within the us and to the uk when using cash app. Once you’ve topped up your cash app balance, you’ll be able to send directly from it to your friends, as long as you have a verified account.³. To cash out funds from your cash app to your bank account:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how much does cash app charge to cash out 150 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.