Your Empower retirement app keeps closing images are ready in this website. Empower retirement app keeps closing are a topic that is being searched for and liked by netizens today. You can Download the Empower retirement app keeps closing files here. Download all free images.

If you’re searching for empower retirement app keeps closing pictures information linked to the empower retirement app keeps closing keyword, you have come to the right site. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Empower Retirement App Keeps Closing. We�ve updated and refined our features to make it easier than ever to invest from your mobile device. The pay is not as competitive as they make it out to be. After multiple supports tickets being opened and being on the phone sofi essentially said it’s not possible to have multiple bill pays with one bank. [author] has entered into an agreement with personal capital corporation (personal capital), through which author will be paid up to $200 for each person who uses webpage to register with personal capital and links at least $100,000 in investable assets to.

How To Close Stash Retirement Account inspire ideas 2022 From car2.mitsubishi-oto.com

How To Close Stash Retirement Account inspire ideas 2022 From car2.mitsubishi-oto.com

Meet the new vanguard app. Online access is like going to war with the app or website. In the first in a series of perspectives from people who have seen the south african investment management industry develop over the past 25 years or more, we speak to former electus head neil brown. Enroll in a plan and/or change your contribution percentage any day of the month, and your changes will be effective on the 1st of the following month. Get started with as little as $500. Sigfig offers low management fees, free financial counseling and free management of the first $10,000 invested, but its $2,000 account minimum.

(company) is not an investment client of pcac.

(company) is not an investment client of pcac. Get started with as little as $500. I�m in desperate need of whatever money i�m entitled too at this moment. I watch my wife�s empower account go up while my fidelity account keeps going down wtf! I lost my job last month. Now, the first 30 days are free, and the app costs $6 a month to access all of its features after the introductory period.

Source: seariderdivecenter.com

Source: seariderdivecenter.com

The maximum quarterly account fee for empower retirement is $22.00. [author] has entered into an agreement with personal capital corporation (personal capital), through which author will be paid up to $200 for each person who uses webpage to register with personal capital and links at least $100,000 in investable assets to. Empower goes above and beyond, automating your savings. Enroll in a plan and/or change your contribution percentage any day of the month, and your changes will be effective on the 1st of the following month. The 10% early distribution penalty does.

Source: miro.com

Source: miro.com

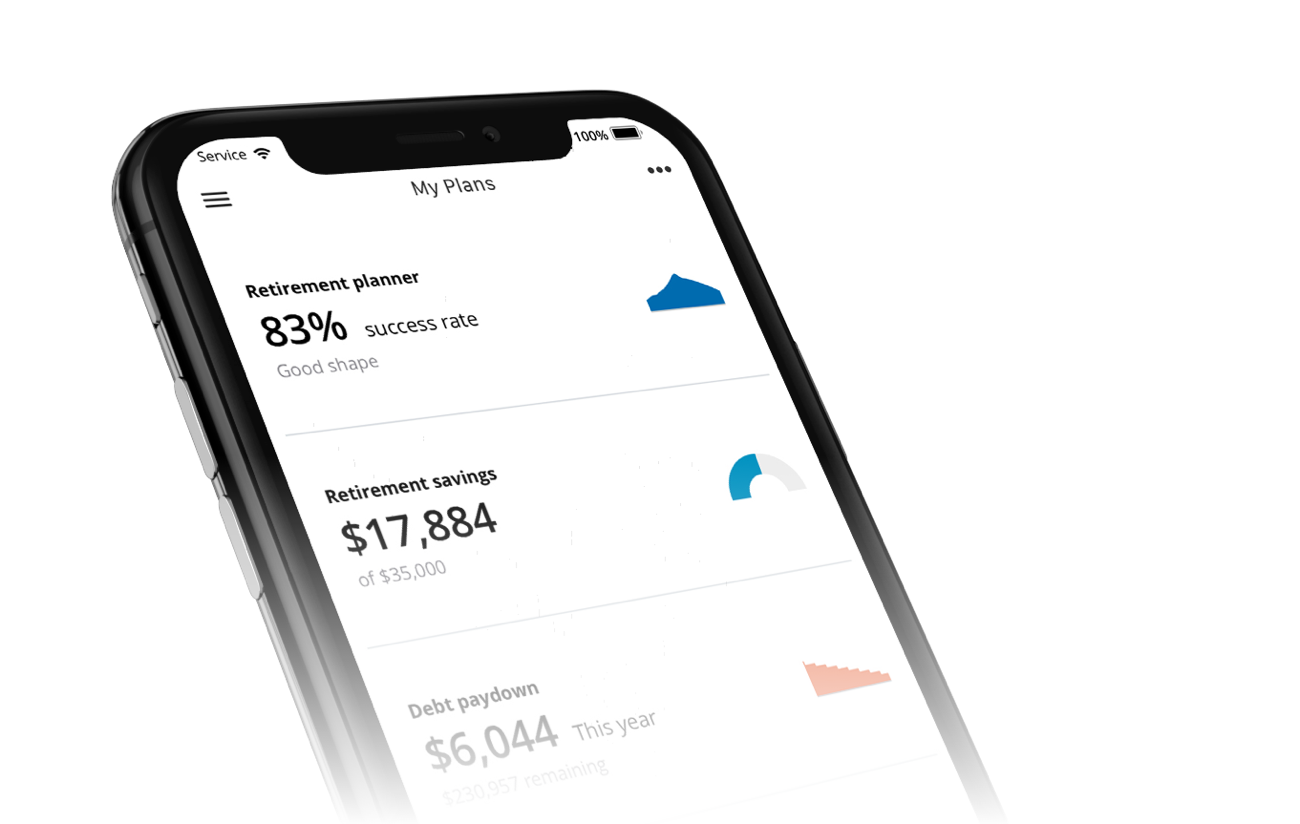

Automated saving is a major feature of empower. Empower goes above and beyond, automating your savings. Meet the new vanguard app. With features like budgeting, financial coaches, and cash advances, they make it simple to make smarter financial decisions. Redesigned mobile app featuring improved experience for submitting claims, tracking claims status, managing your aflac benefits and much more!

Source: supresor.co

Source: supresor.co

When do you want your retirement. In the first in a series of perspectives from people who have seen the south african investment management industry develop over the past 25 years or more, we speak to former electus head neil brown. There gaining and i�m loosing! Enroll in a plan and/or change your contribution percentage any day of the month, and your changes will be effective on the 1st of the following month. Meet the new vanguard app.

Source:

Source:

Now, the first 30 days are free, and the app costs $6 a month to access all of its features after the introductory period. Founded in 2009 and acquired in june 2020 by empower retirement, personal capital shows you all your financial accounts in one place — your spending money, your savings, your debts and your investments. Now, the first 30 days are free, and the app costs $6 a month to access all of its features after the introductory period. The 457 (b) plan has an administrative fee per participant associated with the plan. Pros, cons and how it compares.

Source: afrikanallianceofsocialdemocrats.org

Source: afrikanallianceofsocialdemocrats.org

Online access is like going to war with the app or website. Jan 14, 2022 / 08:47 pm est. Get started with as little as $500. It’s a shame sofi doesn’t support multiple bill pay accounts for the same bank. Redesigned mobile app featuring improved experience for submitting claims, tracking claims status, managing your aflac benefits and much more!

Source: proyek1.gmwq.org

Source: proyek1.gmwq.org

Personal capital advisors corporation (pcac) compensates (company) for new leads. Remember, you�ll have to pay that borrowed money back, plus interest, within 5 years of taking your. The pay is not as competitive as they make it out to be. Meet the new vanguard app. Empower goes above and beyond, automating your savings.

Source: home10.mons-ac.org

Source: home10.mons-ac.org

Meet the new vanguard app. The 10% early distribution penalty does. Enroll in a plan and/or change your contribution percentage any day of the month, and your changes will be effective on the 1st of the following month. The 457 (b) plan has an administrative fee per participant associated with the plan. Automated saving is a major feature of empower.

Source: reddit.com

Source: reddit.com

Empower is severely lacking the manpower to handle this many customers and plans. The 10% early distribution penalty does. Founded in 2009 and acquired in june 2020 by empower retirement, personal capital shows you all your financial accounts in one place — your spending money, your savings, your debts and your investments. In the first in a series of perspectives from people who have seen the south african investment management industry develop over the past 25 years or more, we speak to former electus head neil brown. I watch my wife�s empower account go up while my fidelity account keeps going down wtf!

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

Get started with as little as $500. I�m in desperate need of whatever money i�m entitled too at this moment. Get started with as little as $500. Redesigned mobile app featuring improved experience for submitting claims, tracking claims status, managing your aflac benefits and much more! For example i have 2 credit cards with another bank that id like to pay off with my sofi.

Source: proyek1.gmwq.org

Source: proyek1.gmwq.org

Pros, cons and how it compares. Meet the new vanguard app. In the first in a series of perspectives from people who have seen the south african investment management industry develop over the past 25 years or more, we speak to former electus head neil brown. Now, the first 30 days are free, and the app costs $6 a month to access all of its features after the introductory period. After multiple supports tickets being opened and being on the phone sofi essentially said it’s not possible to have multiple bill pays with one bank.

Source: jos2.apoteknorge.com

Source: jos2.apoteknorge.com

I signed up on vanguard website after receiving a letter saying i had paid into their 401k retirement plan. There gaining and i�m loosing! We�ve updated and refined our features to make it easier than ever to invest from your mobile device. Online access is like going to war with the app or website. Your highest total loan balance within the last 12 months is deducted from the amount eligible for a loan to determine the actual available amount.

Source: car2.mitsubishi-oto.com

Source: car2.mitsubishi-oto.com

Sigfig offers low management fees, free financial counseling and free management of the first $10,000 invested, but its $2,000 account minimum. The 457 (b) plan has an administrative fee per participant associated with the plan. Personal capital is a wealth management app — with an emphasis on investing. With a 401 (k) loan, you borrow money from your retirement savings account. Founded in 2009 and acquired in june 2020 by empower retirement, personal capital shows you all your financial accounts in one place — your spending money, your savings, your debts and your investments.

![]() Source: apps.apple.com

Source: apps.apple.com

Meet the new vanguard app. I signed up on vanguard website after receiving a letter saying i had paid into their 401k retirement plan. When do you want your retirement. The 457 (b) plan has an administrative fee per participant associated with the plan. Sigfig offers low management fees, free financial counseling and free management of the first $10,000 invested, but its $2,000 account minimum.

Source: start.embassyinriyadh.com

Source: start.embassyinriyadh.com

Founded in 2009 and acquired in june 2020 by empower retirement, personal capital shows you all your financial accounts in one place — your spending money, your savings, your debts and your investments. Automated saving is a major feature of empower. I lost my job last month. Pros, cons and how it compares. Remember, you�ll have to pay that borrowed money back, plus interest, within 5 years of taking your.

Source: time.com

Source: time.com

(company) is not an investment client of pcac. Sigfig offers low management fees, free financial counseling and free management of the first $10,000 invested, but its $2,000 account minimum. Social security�s online retirement benefit application process is a safe way to file for your retirement benefit because it asks you this very important question. With features like budgeting, financial coaches, and cash advances, they make it simple to make smarter financial decisions. (company) is not an investment client of pcac.

Source: ispot.tv

Source: ispot.tv

Personal capital is a wealth management app — with an emphasis on investing. Online access is like going to war with the app or website. After multiple supports tickets being opened and being on the phone sofi essentially said it’s not possible to have multiple bill pays with one bank. I�m in desperate need of whatever money i�m entitled too at this moment. Empower is severely lacking the manpower to handle this many customers and plans.

Source: jos2.apoteknorge.com

Source: jos2.apoteknorge.com

Remember, you�ll have to pay that borrowed money back, plus interest, within 5 years of taking your. It’s a shame sofi doesn’t support multiple bill pay accounts for the same bank. Pros, cons and how it compares. Note that when i originally downloaded empower, it was a free app. With a 401 (k) loan, you borrow money from your retirement savings account.

Source: generals.tedxdarwin.com

Source: generals.tedxdarwin.com

We�ve updated and refined our features to make it easier than ever to invest from your mobile device. The 10% early distribution penalty does. Remember, you�ll have to pay that borrowed money back, plus interest, within 5 years of taking your. [author] has entered into an agreement with personal capital corporation (personal capital), through which author will be paid up to $200 for each person who uses webpage to register with personal capital and links at least $100,000 in investable assets to. The pay is not as competitive as they make it out to be.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title empower retirement app keeps closing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.