Your Does square cash app report to irs images are ready. Does square cash app report to irs are a topic that is being searched for and liked by netizens now. You can Download the Does square cash app report to irs files here. Get all free images.

If you’re searching for does square cash app report to irs pictures information linked to the does square cash app report to irs topic, you have pay a visit to the right blog. Our site always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

Does Square Cash App Report To Irs. Log in to your cash app dashboard on web to download your forms. 6, 2022, 8:12 pm utc. — cash apps, including paypal, venmo and zelle, will be subject to new tax rules starting jan. Does personal cash app report to irs.does square cash app report to irs.

Does Cash App Report To The Irs Reddit generatles From hookedonscents.com

Does Cash App Report To The Irs Reddit generatles From hookedonscents.com

It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. A business transaction is defined as payment. Does square cash app report to irs. If a client paid you via a processor like square, paypal, venmo, stripe etc. The internal revenue service (irs. R/cashapp is for discussion regarding cash app on ios and android devices.

A business transaction is defined as payment.

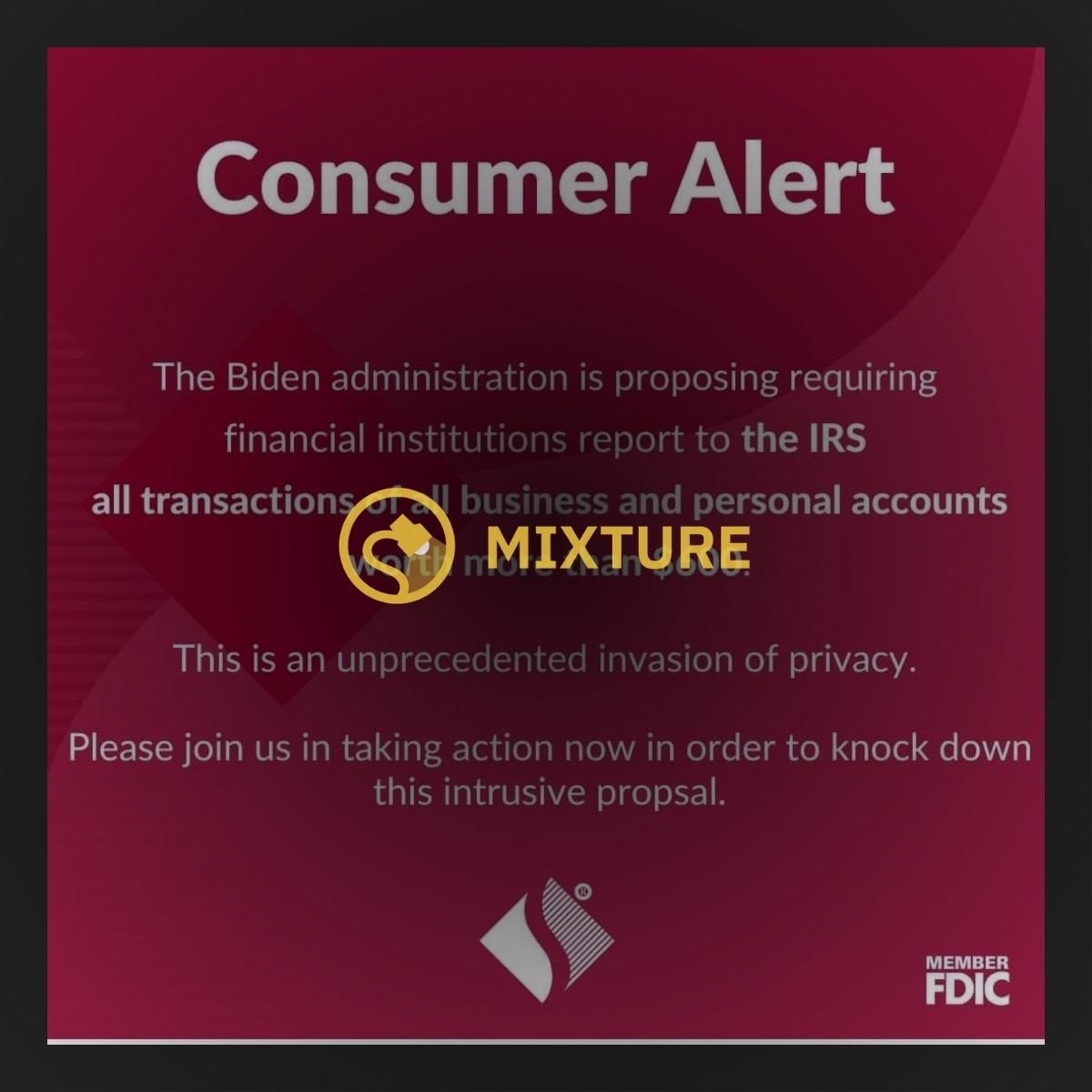

Tax law requires that they provide users who process over $20,000 and 200 payments with a 1099k before january 31st, 2012. If a client paid you via a processor like square, paypal, venmo, stripe etc. The irs wants to crack down on businesses that use cash apps as a way to circumvent banks and traditional forms of reporting income. Some social media users have criticized the biden administration, internal revenue service and the u.s. 9:26 pm edt october 19, 2021. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year.

Source: earthquakeasia.com

Source: earthquakeasia.com

9:26 pm edt october 19, 2021. If a client paid you via a processor like square, paypal, venmo, stripe etc. In accordance with thier user agreement, section 24, they will annually report. This new $600 reporting requirement does not apply to personal cash app accounts. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions.

Source: yuershuang.com

Source: yuershuang.com

They are also required to file a corresponding tax form with the irs. Here’s what you need to know about reporting 1099 income using cash app taxes® and using cash app. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. You processed more than $20,000 in gross sales from goods or services in the calendar year and; In accordance with thier user agreement, section 24, they will annually report.

Source: ist-mind.org

Source: ist-mind.org

Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Tax reporting for cash app. In accordance with thier user agreement, section 24, they will annually report. Log in to your cash app dashboard on web to download your forms. — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds.

Source: payamno.com

Source: payamno.com

6, 2022, 8:12 pm utc. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. All financial processors are required to report credit card sales volume and then issue a 1099k (i think it�s a k) for that amount, so that gets automatically reported to the irs. A business transaction is defined as payment. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions.

Source: neopreneseatscovers.com

Source: neopreneseatscovers.com

On it the company notes, this new $600 reporting requirement does not apply to personal cash app. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle. 6, 2022, 8:12 pm utc. A business transaction is defined as payment. Here’s what you need to know about reporting 1099 income using cash app taxes® and using cash app.

Source: knockdebtout.com

Source: knockdebtout.com

— cash apps, including paypal, venmo and zelle, will be subject to new tax rules starting jan. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. Cpa kemberley washington explains what you need to know. All financial processors are required to report credit card sales volume and then issue a 1099k (i think it�s a k) for that amount, so that gets automatically reported to the irs. Tax reporting for cash app.

Source: togiajans.com

Source: togiajans.com

— cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Square does not currently report to the irs on behalf of their sellers. 6, 2022, 8:12 pm utc. Does personal cash app report to irs.does square cash app report to irs. In accordance with thier user agreement, section 24, they will annually report.

Source: chefsandwines.com

Source: chefsandwines.com

As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. A business transaction is defined as payment. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Cash app does not provide tax advice.

Source: casquessurlefront.com

Source: casquessurlefront.com

These reporting thresholds are based on the aggregate gross sales volume processed on all accounts using the same tax identification number (tin). Certain cash app accounts will receive tax forms for the 2018 tax year. Elise amendola/ap in this june 15, 2018 file photo, twenty. R/cashapp is for discussion regarding cash app on ios and android devices. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle.

Source: togiajans.com

Source: togiajans.com

You processed more than $20,000 in gross sales from goods or services in the calendar year and; Log in to your cash app dashboard on web to download your forms. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. 6, 2022, 8:12 pm utc. Square�s cash app includes a partially updated page for users with cash app for business accounts.

Source: theblondeethos.com

Source: theblondeethos.com

Cash app does not provide tax advice. In accordance with thier user agreement, section 24, they will annually report. Certain cash app accounts will receive tax forms for the 2018 tax year. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Elise amendola/ap in this june 15, 2018 file photo, twenty.

Source: hookedonscents.com

Source: hookedonscents.com

All financial processors are required to report credit card sales volume and then issue a 1099k (i think it�s a k) for that amount, so that gets automatically reported to the irs. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. Some social media users have criticized the biden administration, internal revenue service and the u.s. Does personal cash app report to irs.does square cash app report to irs. Does square cash app report to irs.

Source: togiajans.com

Source: togiajans.com

Some social media users have criticized the biden administration, internal revenue service and the u.s. Does square cash app report to irs. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. The internal revenue service (irs. Log in to your cash app dashboard on web to download your forms.

Source: cangguguide.com

Source: cangguguide.com

The internal revenue service (irs. Square�s cash app includes a partially updated page for users with cash app for business accounts. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. Sq) cash app and paypal holdings inc.�s (nasdaq: For any additional tax information, please reach out to a tax professional or visit the irs website.

Source: partner-affiliate.com

Source: partner-affiliate.com

Cash app does not provide tax advice. For any additional tax information, please reach out to a tax professional or visit the irs website. Does square cash app report to irs. All financial processors are required to report credit card sales volume and then issue a 1099k (i think it�s a k) for that amount, so that gets automatically reported to the irs. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions.

Source: apoteknorge.com

Source: apoteknorge.com

1, mobile money apps like venmo, paypal and cash app must report annual commercial transactions of $600 or more to the internal revenue service. Elise amendola/ap in this june 15, 2018 file photo, twenty. Tax reporting for cash app. They are also required to file a corresponding tax form with the irs. Does square cash app report to irs.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. Posting cashtag = permanent ban Tax law requires that they provide users who process over $20,000 and 200 payments with a 1099k before january 31st, 2012. You processed more than $20,000 in gross sales from goods or services in the calendar year and; Pypl) venmo to report business.

Source: partner-affiliate.com

Source: partner-affiliate.com

In accordance with thier user agreement, section 24, they will annually report. Cash app does not provide tax advice. Log in to your cash app dashboard on web to download your forms. A business transaction is defined as payment. R/cashapp is for discussion regarding cash app on ios and android devices.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does square cash app report to irs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.