Your Does irs track cash app images are ready in this website. Does irs track cash app are a topic that is being searched for and liked by netizens today. You can Download the Does irs track cash app files here. Download all royalty-free vectors.

If you’re searching for does irs track cash app pictures information related to the does irs track cash app keyword, you have come to the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

Does Irs Track Cash App. And, there is no longer a transaction minimum. Venmo, paypal and cash app to report payments of $600 or more to irs this year: Paypal and cash app could be subject to a new tax law that just took effect in january. … but, when it comes to investigating a case related to scam, unauthorized access, or money.

Irs Cash App Deposit Limit generatles From therenaissancepavilion.com

Irs Cash App Deposit Limit generatles From therenaissancepavilion.com

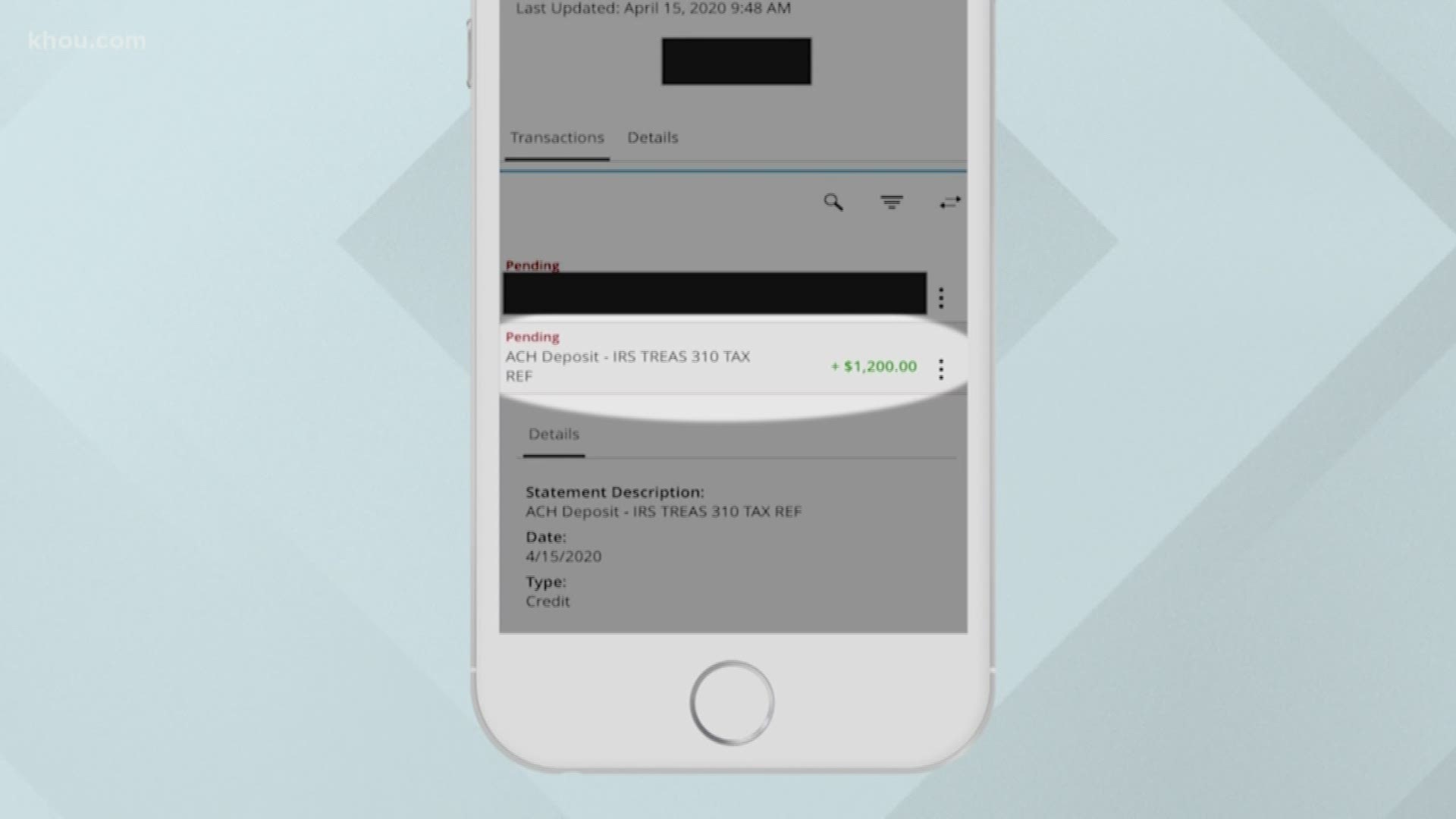

In 2023, those who receive more than $600 in income on venmo and other cash apps will receive a 1099k form to fill out and report their earnings. Don’t have cash on you to make a purchase? New irs rules for cash app transactions take effect in 2022 starting january 1, 2022, cash app business transactions of more than $600 will need to be reported to the irs. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. Venmo, paypal and cash app to report payments of $600 or more to irs this year: Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year.

The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions.

The treasury proposal calls for financial institutions, including cash apps, to track total deposits and withdrawals to find major tax reporting discrepancies. They prefer transactions where there is an audit trail such as credit cards, ch. Certain cash app accounts will receive tax forms for the 2018 tax year. Some social media users have criticized the biden administration, internal revenue service and the u.s. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. Does irs track cash app.

Source: countryask.com

Source: countryask.com

Certain cash app accounts will receive tax forms for the 2018 tax year. A business transaction is defined as payment. In 2023, those who receive more than $600 in income on venmo and other cash apps will receive a 1099k form to fill out and report their earnings. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Can police track cash app transaction history?

Source: therenaissancepavilion.com

Source: therenaissancepavilion.com

… but, when it comes to investigating a case related to scam, unauthorized access, or money. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Click to see full answer. Similarly, you may ask, does cashapp report to irs? They prefer transactions where there is an audit trail such as credit cards, ch.

Source: payamno.com

Source: payamno.com

However, now the apps like cashapp will report to the irs for the businesses receiving transactions amounting to above $600 on aggregate per annum. An answer to this question is both yes and no. Some social media users have criticized the biden administration, internal revenue service and the u.s. It’s fast, convenient, and the payment method of choice for millennials and gen z. Rather, small business owners, independent contractors and those with a.

Source: cloudvo.com

Source: cloudvo.com

Maybe you saw the claims on social media that starting next year, the irs wants to know about any money you get on cash apps over $600 as part of president biden�s american rescue plan. The biden administration’s proposal the treasury proposal , which came out in may 2021 and is subject to congressional approval, is aimed at getting better information to find tax cheats. Log in to your cash app dashboard on web to download your forms. You may have heard the expression, cash is king? They prefer transactions where there is an audit trail such as credit cards, ch.

Source: cloudvo.com

Source: cloudvo.com

Does irs track cash app. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. And, there is no longer a transaction minimum. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs.

![]() Source: indierockblog.com

Source: indierockblog.com

… but, when it comes to investigating a case related to scam, unauthorized access, or money. New irs rules for cash app transactions take effect in 2022 starting january 1, 2022, cash app business transactions of more than $600 will need to be reported to the irs. The biden administration’s proposal the treasury proposal , which came out in may 2021 and is subject to congressional approval, is aimed at getting better information to find tax cheats. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. The treasury proposal calls for financial institutions, including cash apps, to track total deposits and withdrawals to find major tax reporting discrepancies.

Source: cangguguide.com

Source: cangguguide.com

One of the reasons is that the irs cannot track cash transactions between people, and that is why they do not like it and would love to eliminate cash. Does irs track cash app. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000.

Source: knockdebtout.com

Source: knockdebtout.com

Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. Then, does cashapp report to irs? Venmo only tracks payments through a tab on the app. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. Venmo, paypal and cash app to report payments of $600 or more to irs this year:

Source: partner-affiliate.com

Source: partner-affiliate.com

But as these apps are generally used for transferring small amounts of money, they can skirt the reporting thresholds and result in income that’s not reported to the irs. Then, does cashapp report to irs? But as these apps are generally used for transferring small amounts of money, they can skirt the reporting thresholds and result in income that’s not reported to the irs. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year.

Source: therenaissancepavilion.com

Source: therenaissancepavilion.com

Cash app does not provide tax advice. Similar to cash payments, app payments are hard to track, which allows easy tax evasion by businesses. Does cash app report to irs? Certain cash app accounts will receive tax forms for the 2018 tax year. You may have heard the expression, cash is king?

Source: payamno.com

Source: payamno.com

Some social media users have criticized the biden administration, internal revenue service and the u.s. It’s fast, convenient, and the payment method of choice for millennials and gen z. You may have heard the expression, cash is king? For any additional tax information, please reach out to a tax professional or visit the irs website. Then, does cashapp report to irs?

Source: stimuq.blogspot.com

Source: stimuq.blogspot.com

A business transaction is defined as payment. Does irs track cash app. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. One of the reasons is that the irs cannot track cash transactions between people, and that is why they do not like it and would love to eliminate cash. Rather, small business owners, independent contractors and those with a.

Source:

Source:

Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. The treasury proposal calls for financial institutions, including cash apps, to track total deposits and withdrawals to find major tax reporting discrepancies. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Maybe you saw the claims on social media that starting next year, the irs wants to know about any money you get on cash apps over $600 as part of president biden�s american rescue plan. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs.

Source: cangguguide.com

Source: cangguguide.com

No more running to the atm. Tax experts say the best advice is to keep track. The treasury proposal calls for financial institutions, including cash apps, to track total deposits and withdrawals to find major tax reporting discrepancies. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. Log in to your cash app dashboard on web to download your forms.

Source: cangguguide.com

Source: cangguguide.com

— cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. The irs is not requiring individuals to report or pay taxes on individual venmo, cash app or paypal transactions over $600. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Maybe you saw the claims on social media that starting next year, the irs wants to know about any money you get on cash apps over $600 as part of president biden�s american rescue plan. The treasury proposal calls for financial institutions, including cash apps, to track total deposits and withdrawals to find major tax reporting discrepancies.

Source: partner-affiliate.com

Source: partner-affiliate.com

Certain cash app accounts will receive tax forms for the 2018 tax year. Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000. And, there is no longer a transaction minimum. A business transaction is defined as payment. Similarly, you may ask, does cashapp report to irs?

Source: hookedonscents.com

Source: hookedonscents.com

You may have heard the expression, cash is king? An answer to this question is both yes and no. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. New cash app reporting rules.

Source: payamno.com

Source: payamno.com

Can police track cash app? Can police track cash app? 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. They prefer transactions where there is an audit trail such as credit cards, ch. A business transaction is defined as payment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does irs track cash app by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.