Your Does cash app report to irs bitcoin images are ready in this website. Does cash app report to irs bitcoin are a topic that is being searched for and liked by netizens now. You can Download the Does cash app report to irs bitcoin files here. Download all royalty-free images.

If you’re looking for does cash app report to irs bitcoin pictures information related to the does cash app report to irs bitcoin interest, you have visit the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

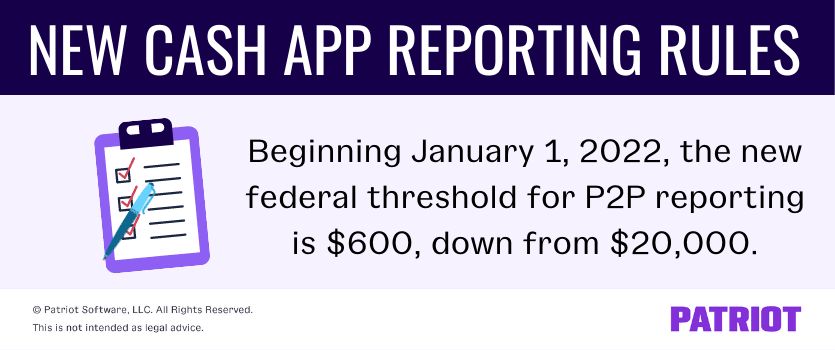

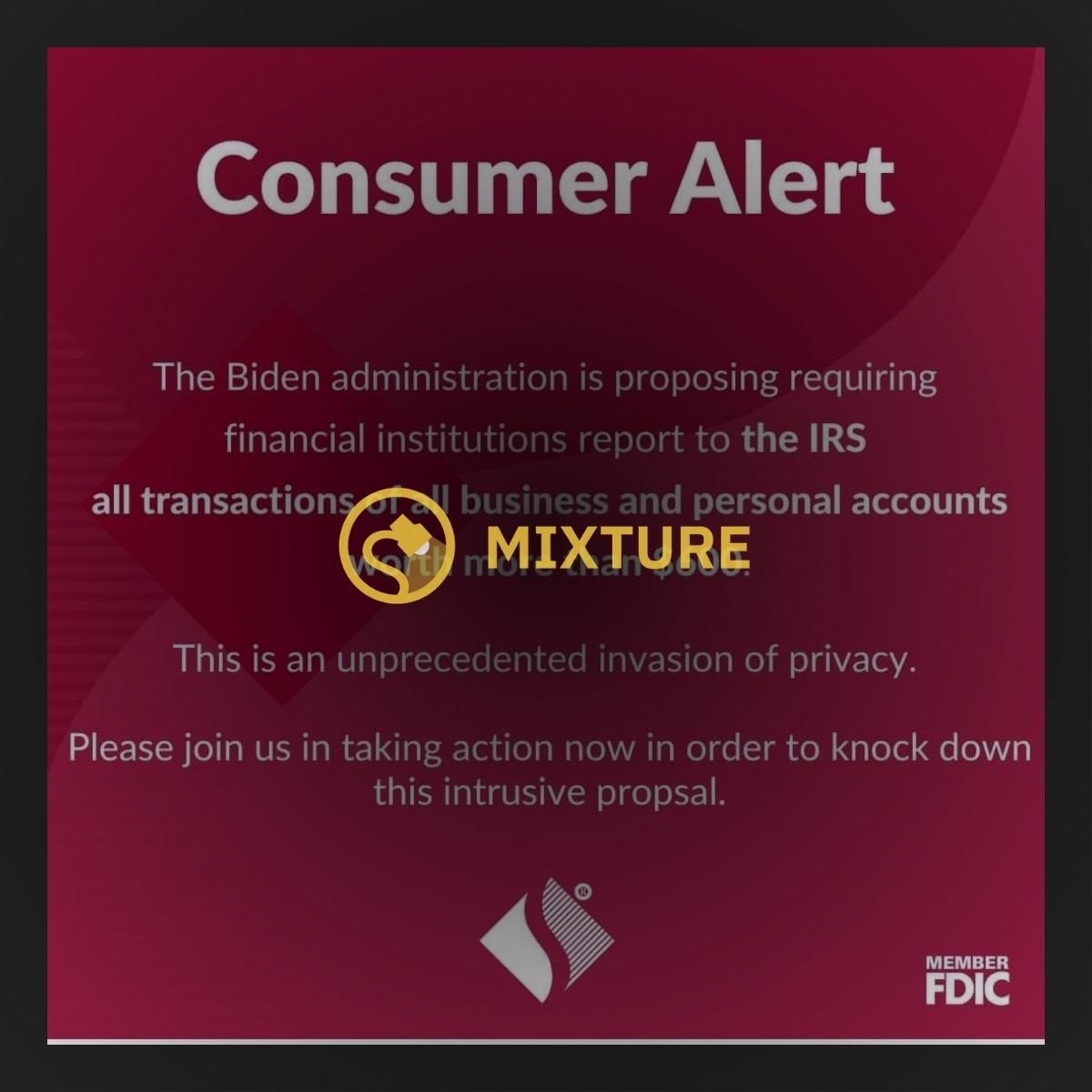

Does Cash App Report To Irs Bitcoin. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. They request your full name, date of birth, and last four digits of social security to make a bitcoin purchase. 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. Log in to your cash app dashboard on web to download your forms.

Does Personal Cash App Report To Irs Thinkervine From cangguguide.com

Does Personal Cash App Report To Irs Thinkervine From cangguguide.com

Tax reporting for cash app. Irs rules on reporting bitcoin and other crypto just got even more confusing. This verification process usually takes about 24 hours. The free app, now available for android phones and iphones, is easy to navigate. About 24 hoursafter adding a method of payment to purchase the bitcoin, cash app will ask you to verify your identity. Those who use cash apps for personal use won�t be.

It is your responsibility to determine any tax impact of your bitcoin transactions on cash app.

Irs rules on reporting bitcoin and other crypto just got even more confusing. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. Do rocks reports to the irs? If you use cash apps like venmo, zelle or paypal for business transactions, some changes are coming to what those apps report to irs. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Certain cash app accounts will receive tax forms for the 2018 tax year.

Source: knockdebtout.com

Source: knockdebtout.com

As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle. You must have a balance of at least 0.0001 bitcoin to make a withdrawal. They request your full name, date of birth, and last four digits of social security to make a bitcoin purchase. Does cash app report to irs bitcoin.if you send up to $20,000 to $30,000 per month, cash app is sure to share your details with the irs. Certain cash app accounts will receive tax forms for the 2018 tax year.

Source: knockdebtout.com

Source: knockdebtout.com

Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. Does square cash app report to irs. It is claimed by the irs that digital currencies like bitcoin are not official currencies since they are not issued by any central bank. Bitcoin / cryptocurrency tax guidelines.

Source: tablesplanner.com

Source: tablesplanner.com

This is problematic when it comes to tax reporting because cost basis information is necessary for calculating your gains and losses. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app. 1, mobile payment apps like venmo, paypal and cash app are required to report commercial transactions totaling more than $600 per year to the internal revenue service. These are some ways the irs knows that you have bitcoin and potentially owe crypto taxes. Does cash app report to the irs?

Source: hookedonscents.com

Source: hookedonscents.com

A student organization i was in used cashapp to pay for dues (50kish) and the treasurer got audited by the irs who thought it was his personal. Do rocks reports to the irs? Cash app does not provide tax advice. Coinbase app bitcoin wallet bitcoin wallet — cash apps, including paypal, venmo and zelle, will be subject to new tax rules starting jan. Cash app does not provide tax advice.

Source: seariderdivecenter.com

Source: seariderdivecenter.com

Best cash back credit cards. These are some ways the irs knows that you have bitcoin and potentially owe crypto taxes. Tax reporting for cash app. Click to see full answer then, does cashapp report to irs? Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds.

Source: partner-affiliate.com

Source: partner-affiliate.com

There may be fees for buying or selling bitcoin. The irs will ask filers on their 2020 income tax return whether. It is claimed by the irs that digital currencies like bitcoin are not official currencies since they are not issued by any central bank. There may be fees for buying or selling bitcoin. Does cashapp report to the irs.

Source: gelarbatiknusantara2019.com

Source: gelarbatiknusantara2019.com

Tax changes coming for cash app transactions. Tax reporting for cash app. The us tax system is voluntary, and it is your responsibility to report all transactions whether the irs. Coinbase app bitcoin wallet bitcoin wallet — cash apps, including paypal, venmo and zelle, will be subject to new tax rules starting jan. But if you choose to receive payment via a credit or debit card, you must report that income on a specific tax.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

How long does it take to get bitcoin verified on cash app? Starting january 1, 2022, cash app business transactions of more than. This is problematic when it comes to tax reporting because cost basis information is necessary for calculating your gains and losses. The free app, now available for android phones and iphones, is easy to navigate. It is your responsibility to determine any tax impact of your bitcoin transactions on cash app.

Source: ginzamoonshell.com

Source: ginzamoonshell.com

The irs will ask filers on their 2020 income tax return whether. A student organization i was in used cashapp to pay for dues (50kish) and the treasurer got audited by the irs who thought it was his personal. Does cash app report to irs bitcoin.if you send up to $20,000 to $30,000 per month, cash app is sure to share your details with the irs. The irs is allowed to and does publish guidance in the form of faqs and the. If you’ve decided to offload some of it or you want to purchase some, uncle sam will want to know.

Source: tablesplanner.com

Source: tablesplanner.com

Tax changes coming for cash app transactions. Cash app does not provide tax advice. This verification process usually takes about 24 hours. About 24 hoursafter adding a method of payment to purchase the bitcoin, cash app will ask you to verify your identity. Under the tax laws, the crypto definition provides insight as to how tax obligations should be handled.

Source: apoteknorge.com

Source: apoteknorge.com

There may be fees for buying or selling bitcoin. Cash app is the one. Cpa kemberley washington explains what you need to know. Cryptocurrencies like bitcoin is treated by the irs as assets. About 24 hoursafter adding a method of payment to purchase the bitcoin, cash app will ask you to verify your identity.

Source: allfruittrees.blogspot.com

Source: allfruittrees.blogspot.com

Kicking off this year�s tax filing season, the u.s. Does cash app report personal accounts to irs new 2022 tax rules. The irs is allowed to and does publish guidance in the form of faqs and the. A new rule will go into effect on jan. Under the tax laws, the crypto definition provides insight as to how tax obligations should be handled.

Source: chefsandwines.com

Source: chefsandwines.com

This is problematic when it comes to tax reporting because cost basis information is necessary for calculating your gains and losses. Those who use cash apps for personal use won�t be. Does cash app report to the irs? Do rocks reports to the irs? Tax reporting for cash app.

Source: togiajans.com

Source: togiajans.com

Tax reporting for cash app. Does cash app report to the irs? Does square cash app report to irs. The irs plans to take a closer look at cash app business transactions of more than $600. Does cash app report personal accounts to irs new 2022 tax rules.

Source: payamno.com

Source: payamno.com

Tax reporting for cash app. Log in to your cash app dashboard on web to download your forms. The us tax system is voluntary, and it is your responsibility to report all transactions whether the irs. Do rocks reports to the irs? Click to see full answer then, does cashapp report to irs?

Source: hookedonscents.com

Source: hookedonscents.com

The irs will ask filers on their 2020 income tax return whether. Starting january 1, 2022, cash app business transactions of more than. Does cashapp report to the irs. Those who use cash apps for personal use won�t be. Click to see full answer then, does cashapp report to irs?

Source: cangguguide.com

Source: cangguguide.com

They request your full name, date of birth, and last four digits of social security to make a bitcoin purchase. Tax reporting for cash app. Starting january 1, 2022, cash app business transactions of more than. The irs plans to take a closer look at cash app business transactions of more than $600. Does cash app report to the irs?

Source: media-link.org

Source: media-link.org

Starting january 1, 2022, cash app business transactions of more than. Does cash app report to irs for personal use. They request your full name, date of birth, and last four digits of social security to make a bitcoin purchase. Does cash app report to the irs? As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does cash app report to irs bitcoin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.