Your Cash app vs zelle fees images are available. Cash app vs zelle fees are a topic that is being searched for and liked by netizens today. You can Get the Cash app vs zelle fees files here. Find and Download all royalty-free vectors.

If you’re searching for cash app vs zelle fees images information connected with to the cash app vs zelle fees keyword, you have come to the ideal site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Cash App Vs Zelle Fees. You can send money to, or request from, anyone with a cash account, and funds are drawn from a linked bank account via debit card at no cost. Like venmo, cash app has expanded its service offerings in recent times to include early paychecks, cryptocurrency trading, and a debit card. You’ll pay a 3% fee for all credit card payments. But the downside is that you can only send money within the us and to the uk when using cash app.

How Much Money Can I Send With Zelle Keybank THAWSI From thawsi.blogspot.com

How Much Money Can I Send With Zelle Keybank THAWSI From thawsi.blogspot.com

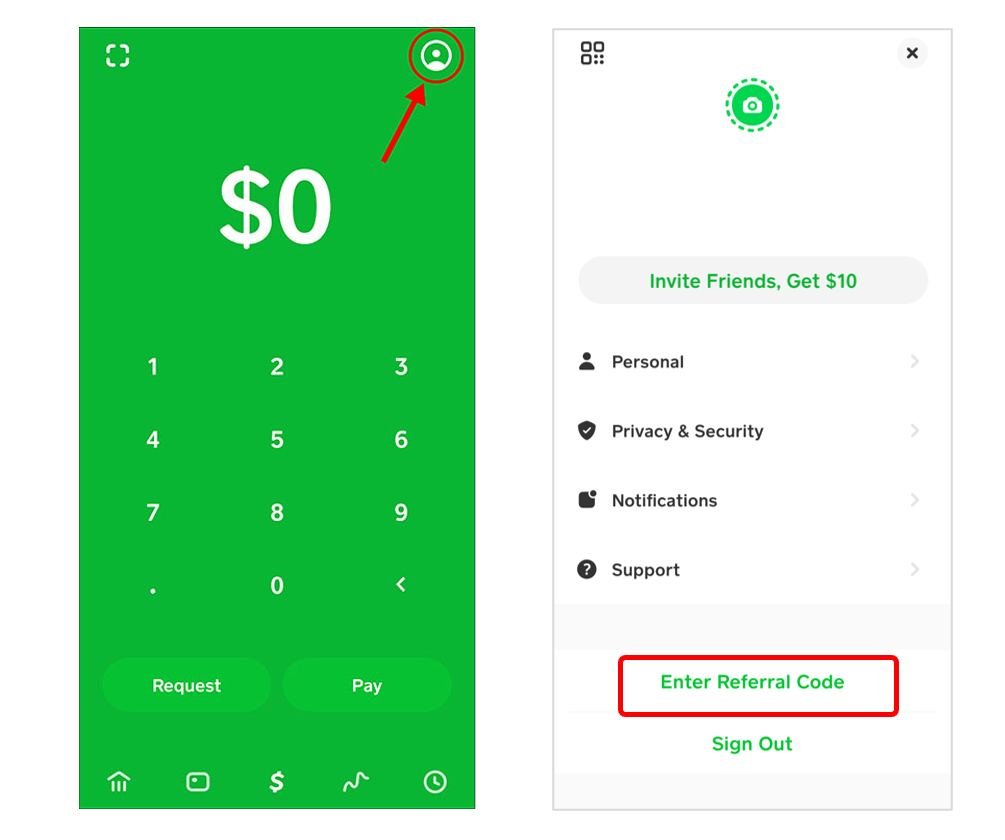

If i’m shopping, i send funds via paypal. Now you have more insight on the fees. If you want to send money through zelle, you don’t even need to download their app as zelle is probably already in your banking app. Is the cash app available Check out other alternatives for sending money online. You’ll pay a 3% fee for.

Cash app vs zelle zelle offers immediate transfers between bank accounts.

Check out other alternatives for sending money online. Cash app balances don’t earn interest, which is an important aspect of a worthwhile deposit account. Cash app vs venmo active users difference. Let’s take a look at cash app’s fees: So sending someone $100 will actually cost you $103. On the plus side, cash app charges no fees to send or receive payments in the u.s.

Source: tastyreferrals.com

Source: tastyreferrals.com

Transfers are free and fast but can only be done between domestic bank accounts. Check out other alternatives for sending money online. Square cash vs zelle best mobile payment app in 2022. Keep in mind that zelle does say that some of your own bank fees may apply, though. Cash app vs venmo active users difference.

Source: eeyore-dreamer.blogspot.com

Source: eeyore-dreamer.blogspot.com

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. If you want to send money through zelle, you don’t even need to download their app as zelle is probably already in your banking app. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Cash app charges no fees to send or receive payments in the u.s. In a time when i’m trying to simplify, both digitally and physically, i’m almost embarrassed to admit that i use all three.

Source: feqtuep.blogspot.com

Source: feqtuep.blogspot.com

Venmo and cash app charge fees if you need the money rush transferred to your bank account. Cash app does pretty much the same thing as venmo, but without the social features. In its first year, zelle saw 320 million transactions and more than $94 billion moved, leading research firm emarketer to predict in june that it would pass venmo by the end of 2018. If i’m shopping, i send funds via paypal. In other words, the cash app incentivizes users to hold a balance and invest with the app itself.

Source: excellentwebworld.com

Source: excellentwebworld.com

Cash app vs venmo active users difference. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Cash app is not a complete alternative to a real checking account, as it does not offer fdic insurance. The cash app only charges a fee to send a payment using a credit card (3%) and to make an instant deposit to a bank account (1.5%). Unlike cash app , google pay , venmo and other competitors, there is no escrow or intermediary period where the money is held by zelle.

Source: pis.flickrstudioapp.com

Source: pis.flickrstudioapp.com

Final thoughts on cash app vs venmo. Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. You’ll pay a 3% fee for. But you should always double check with your bank, as they may charge fees for certain types of transactions. No fee for transfers from your cash app balance, debit card or bank account.

Shutterstock.com cashless payments are firmly entrenched in the lives of multiple people worldwide. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. If you are sending money via a credit card linked to your cash app , a 3% fee will be added to the total. Cash app is the latest and greatest in mobile payment apps. No fee for transfers from your cash app balance, debit card or bank account.

Source: pis.flickrstudioapp.com

Source: pis.flickrstudioapp.com

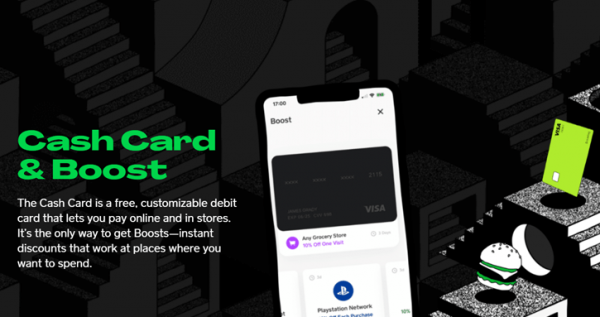

The cash card is best used for purchases only and not at atms, where you’ll get charged an extra $2 fee, detailed below. Cash app did just that in july, reaching 33.5 million cumulative downloads over venmo�s 32.9 million, according to one analyst. Unlike cash app , google pay , venmo and other competitors, there is no escrow or intermediary period where the money is held by zelle. Cash app vs venmo active users difference. Final thoughts on cash app vs venmo.

Source: pis.flickrstudioapp.com

Source: pis.flickrstudioapp.com

The cash card is best used for purchases only and not at atms, where you’ll get charged an extra $2 fee, detailed below. Cash app mobile wallet is growing in popularity because there are several legit ways to get free money on the cash app. If cash app can’t verify your id, it might require additional information. Consumers appreciate the convenience and speed of new technologies, while tech giants and financial firms continue to improve existing solutions and develop new ones as well. One of the major benefits with zelle is its lack of fees.

Source: aandrooidtutor.blogspot.com

Source: aandrooidtutor.blogspot.com

Now you have more insight on the fees. But you should always double check with your bank, as they may charge fees for certain types of transactions. Answering these questions will enable us to compare apples with apples, if they are indeed comparable apples, and which apple type is the one for you! Keep in mind that zelle does say that some of your own bank fees may apply, though. Cash app has a higher percentage of use among males, with 24% more active users than venmo.

Source: thawsi.blogspot.com

Source: thawsi.blogspot.com

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. In its first year, zelle saw 320 million transactions and more than $94 billion moved, leading research firm emarketer to predict in june that it would pass venmo by the end of 2018. And since it’s owned by square, you can be assured it’s a safe app to use for money transactions. If you are sending money via a credit card linked to your cash app , a 3% fee will be added to the total. Cash app does have a few advantages.

Source: queposcostaricaa.blogspot.com

Source: queposcostaricaa.blogspot.com

Include paypal, venmo, and zelle. Cash app mobile wallet is growing in popularity because there are several legit ways to get free money on the cash app. In addition to getting free money from daily activities, the app offers several exciting banking, investing, and debit card perks. Cash app charges no fees to send or receive payments in the u.s. Unlike cash app , google pay , venmo and other competitors, there is no escrow or intermediary period where the money is held by zelle.

Source: payamno.com

Source: payamno.com

Transfers are free and fast but can only be done between domestic bank accounts. In its first year, zelle saw 320 million transactions and more than $94 billion moved, leading research firm emarketer to predict in june that it would pass venmo by the end of 2018. Or abroad — although the current exchange rate applies for international payments. If cash app can’t verify your id, it might require additional information. Whereas other mobile payment apps like venmo and zelle cater more to the transfer of funds from one person to another.

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Cash app is the latest and greatest in mobile payment apps. If i’m shopping, i send funds via paypal. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. You can send money to, or request from, anyone with a cash account, and funds are drawn from a linked bank account via debit card at no cost. Or abroad — although the current exchange rate applies for international payments.

Source: techspot.com

Source: techspot.com

The cash app instant transfer fee is 1.5%, with a minimum of $0.25. Consumers appreciate the convenience and speed of new technologies, while tech giants and financial firms continue to improve existing solutions and develop new ones as well. Square cash vs zelle best mobile payment app in 2022. But the downside is that you can only send money within the us and to the uk when using cash app. Otherwise, the recipient uses a link provided by zelle to accept the payment to a debit card.

Source: tastyreferrals.com

Source: tastyreferrals.com

Zelle does not keep a balance because the funds you receive from the app transfer directly to your bank account. Keep in mind that zelle does say that some of your own bank fees may apply, though. Cash app is available in english and spanish languages, with users to switch between the two. Cash app balances don’t earn interest, which is an important aspect of a worthwhile deposit account. The cash card is best used for purchases only and not at atms, where you’ll get charged an extra $2 fee, detailed below.

Source: gobankingrates.com

Source: gobankingrates.com

Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. Cash app does have a few advantages. Cash app vs venmo active users difference. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in exchange for goods and services. The cash app instant transfer fee is 1.5%, with a minimum of $0.25.

Source: gobankingrates.com

Source: gobankingrates.com

One of the major benefits with zelle is its lack of fees. In a time when i’m trying to simplify, both digitally and physically, i’m almost embarrassed to admit that i use all three. Both have taken off quickly. If cash app can’t verify your id, it might require additional information. In addition to getting free money from daily activities, the app offers several exciting banking, investing, and debit card perks.

Source: queposcostaricaa.blogspot.com

Source: queposcostaricaa.blogspot.com

In its first year, zelle saw 320 million transactions and more than $94 billion moved, leading research firm emarketer to predict in june that it would pass venmo by the end of 2018. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers. It’s free to download, enroll, and also to send and receive money with. Cash app does pretty much the same thing as venmo, but without the social features. Venmo vs zelle vs cash app:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cash app vs zelle fees by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.