Your Cash app vs paypal vs zelle images are available. Cash app vs paypal vs zelle are a topic that is being searched for and liked by netizens today. You can Find and Download the Cash app vs paypal vs zelle files here. Find and Download all royalty-free vectors.

If you’re looking for cash app vs paypal vs zelle pictures information related to the cash app vs paypal vs zelle keyword, you have come to the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

Cash App Vs Paypal Vs Zelle. Zelle® backed by some of the biggest names in finance, zelle is another relatively recent arrival. The only downside is that apple cash is only available on a limited number of devices within the larger iphone® and ipad® ecosystem. By zach laidlaw updated jul 29, 2020. And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere.

PayPal, Cash app, Venmo, Apple Pay, Google Pay, Zelle From youtube.com

PayPal, Cash app, Venmo, Apple Pay, Google Pay, Zelle From youtube.com

Paypal is present in 203 countries and available in 26 currencies. Money can be transferred directly to a bank account or debit card: In a time when i’m trying to simplify, both digitally and physically, i’m almost embarrassed to admit that i use all three. In this section, we’ll tell you what are the key differences between the three and when you can use which. By zach laidlaw updated jul 29, 2020. A payment app owned by square, which many small merchants use to process retail purchases.

Thanks for reading our cash app vs paypal showdown!

Consumers appreciate the convenience and speed of new technologies, while tech giants and financial firms continue to improve existing solutions and develop new ones as well. Venmo, owned by paypal, was the first, and is the number one choice among. Which is the best money transfer service? In this section, we’ll tell you what are the key differences between the three and when you can use which. 2.90% + 0.30¢ for sending funds using a credit card. Can be used to send/receive money internationally:

Source: pcworld.com

Source: pcworld.com

Thanks for reading our cash app vs paypal showdown! Daniel is a 20 year old blogger from los angeles with a huge love for everything entrepreneurship, finance, and investing. A payment app owned by square, which many small merchants use to process retail purchases. If you have a favorite platform, let us know in the comments! The new reporting requirement only applies to sellers of goods and.

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Zelle® backed by some of the biggest names in finance, zelle is another relatively recent arrival. This is actually a better setup than venmo and cash app. Cash app and paypal have similar fees for sending money domestically. In 2018, square added the ability to buy and sell bitcoin on the cash app as well, which gives it a unique feature compared to other popular payment apps. Free, but when people pay you, it.

Yes, most of the time. They both charge around 3% of the transaction to send money with your linked credit card. Daniel is a 20 year old blogger from los angeles with a huge love for everything entrepreneurship, finance, and investing. And if you’re looking into international transactions, zelle isn’t an option at all, while paypal’s considerable fee schedule may encourage you to look elsewhere. Venmo, owned by paypal, was the first, and is the number one choice among.

Source: businessinsider.com

Source: businessinsider.com

While both venmo and cash app let you keep a balance in your account with them, zelle does not. But money magazine says there are big differences. Square cash vs zelle best mobile payment app in 2022 last updated on: It is a global online payment system, while venmo and zelle are to send money online within the u.s. Money can be transferred directly to a bank account or debit card:

Source: gobankingrates.com

Source: gobankingrates.com

Which is the best money transfer service? No fee if using paypal balance or a bank account. Recipient must also have an account/use the app: Unlike paypal, apple doesn’t charge fees to use its service. This is because any funds you receive from zelle are directly transferred to and from your banking account.

Source: sitahw.blogspot.com

Source: sitahw.blogspot.com

Unlike paypal, apple doesn’t charge fees to use its service. If you have a favorite platform, let us know in the comments! Zelle® backed by some of the biggest names in finance, zelle is another relatively recent arrival. Just last year, p2p transactions exceeded $120 billion. Zelle puts money in your account instantly.

Source: saberespoder.com

Source: saberespoder.com

Square cash vs zelle best mobile payment app in 2022 last updated on: Paypal vs venmo vs zelle. Venmo vs zelle vs cash app: This is actually a better setup than venmo and cash app. If i’m shopping, i send funds via paypal.

Source: excellentwebworld.com

Source: excellentwebworld.com

Just last year, p2p transactions exceeded $120 billion. The new reporting requirement only applies to sellers of goods and. While both venmo and cash app let you keep a balance in your account with them, zelle does not. No fee if using paypal balance or a bank account. Zelle® backed by some of the biggest names in finance, zelle is another relatively recent arrival.

Source: clark.com

Source: clark.com

But money magazine says there are big differences. Paypal vs venmo vs zelle. This is because any funds you receive from zelle are directly transferred to and from your banking account. Now tens of millions of people pay with venmo, zelle, or the cash app. Can be used to send/receive money internationally:

Source: gizmodo.com

Source: gizmodo.com

In 2018, square added the ability to buy and sell bitcoin on the cash app as well, which gives it a unique feature compared to other popular payment apps. Square cash vs zelle best mobile payment app in 2022 last updated on: Cash app has a wallet feature, like paypal, or the ability to send from a linked account without holding funds in your digital wallet. One advantage is that paypal allows the largest transactions of the bunch, tied with apple pay cash and google. No fee if using paypal balance or a bank account.

Source: cloudswipe.net

Source: cloudswipe.net

There’s also cash app, google pay, apple pay and even facebook messenger. 2.90% + 0.30¢ for sending funds using a credit card. They both charge around 3% of the transaction to send money with your linked credit card. Square cash vs zelle best mobile payment app in 2022 last updated on: It is a global online payment system, while venmo and zelle are to send money online within the u.s.

Source: subiness.blogspot.com

Source: subiness.blogspot.com

January 2, 2022 by finnley mobile payments apps have become insanely popular, so many companies and institutions are making. January 2, 2022 by finnley mobile payments apps have become insanely popular, so many companies and institutions are making. Money can be transferred directly to a bank account or debit card: Compare wise vs paypal, for instance, to see if there’s a cheaper way. For business payments, paypal is very convenient.

Source: cleveland.com

Source: cleveland.com

Zelle using this comparison chart. Which is the best money transfer service? Yes, most of the time. Zelle puts money in your account instantly. Thanks for reading our cash app vs paypal showdown!

Source:

Source:

Zelle® backed by some of the biggest names in finance, zelle is another relatively recent arrival. Now tens of millions of people pay with venmo, zelle, or the cash app. Cash app and paypal have similar fees for sending money domestically. 2.90% + 0.30¢ for sending funds using a credit card. By zach laidlaw updated jul 29, 2020.

Source: gobankingrates.com

Source: gobankingrates.com

By zach laidlaw updated jul 29, 2020. There’s also cash app, google pay, apple pay and even facebook messenger. Compare wise vs paypal, for instance, to see if there’s a cheaper way. Money can be picked up in person: If i’m shopping, i send funds via paypal.

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Source: t-mobile-mda-accessories-e25f50de.blogspot.com

Venmo, zelle, paypal, cash app, and google pay compared: If i’m shopping, i send funds via paypal. 2.90% + 0.30¢ for sending funds using a credit card. Which is the best money transfer service? This is because any funds you receive from zelle are directly transferred to and from your banking account.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

Venmo, owned by paypal, was the first, and is the number one choice among. Photo by linkedin sales navigator at unsplash the use of cash was on the decline before the coronavirus pandemic, with people turning to digital payments as the fintech industry touted the lack of physical cash as a safer alternative. Thanks for reading our cash app vs paypal showdown! Zelle puts money in your account instantly. Cash app and paypal have similar fees for sending money domestically.

Source: onlineslotsapp.com

Source: onlineslotsapp.com

If you have a favorite platform, let us know in the comments! This suggests zelle may operate better on the iphone. Venmo, owned by paypal, was the first, and is the number one choice among. The only downside is that apple cash is only available on a limited number of devices within the larger iphone® and ipad® ecosystem. This is actually a better setup than venmo and cash app.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

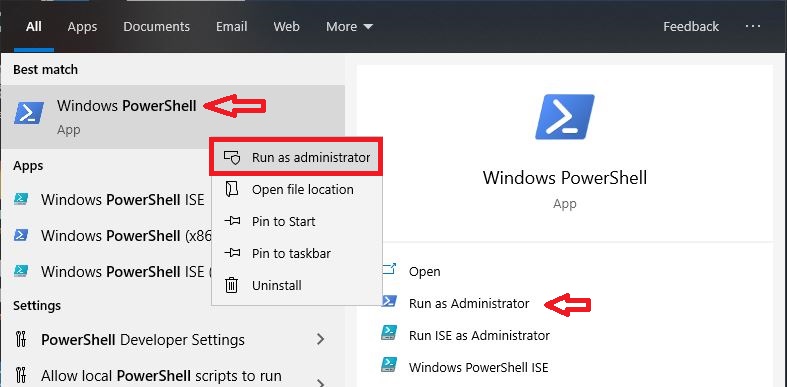

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash app vs paypal vs zelle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.