Your Cash app irs personal account images are available. Cash app irs personal account are a topic that is being searched for and liked by netizens today. You can Find and Download the Cash app irs personal account files here. Find and Download all free images.

If you’re looking for cash app irs personal account images information linked to the cash app irs personal account topic, you have come to the right site. Our site always gives you suggestions for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Cash App Irs Personal Account. Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000. For any additional tax information, please reach out to a tax professional or visit the irs website. Sign in to cash app. Declares irs will monitor transactions of all u.s.

Does Cash App Report To Irs For Personal Use inspire From apoteknorge.com

Does Cash App Report To Irs For Personal Use inspire From apoteknorge.com

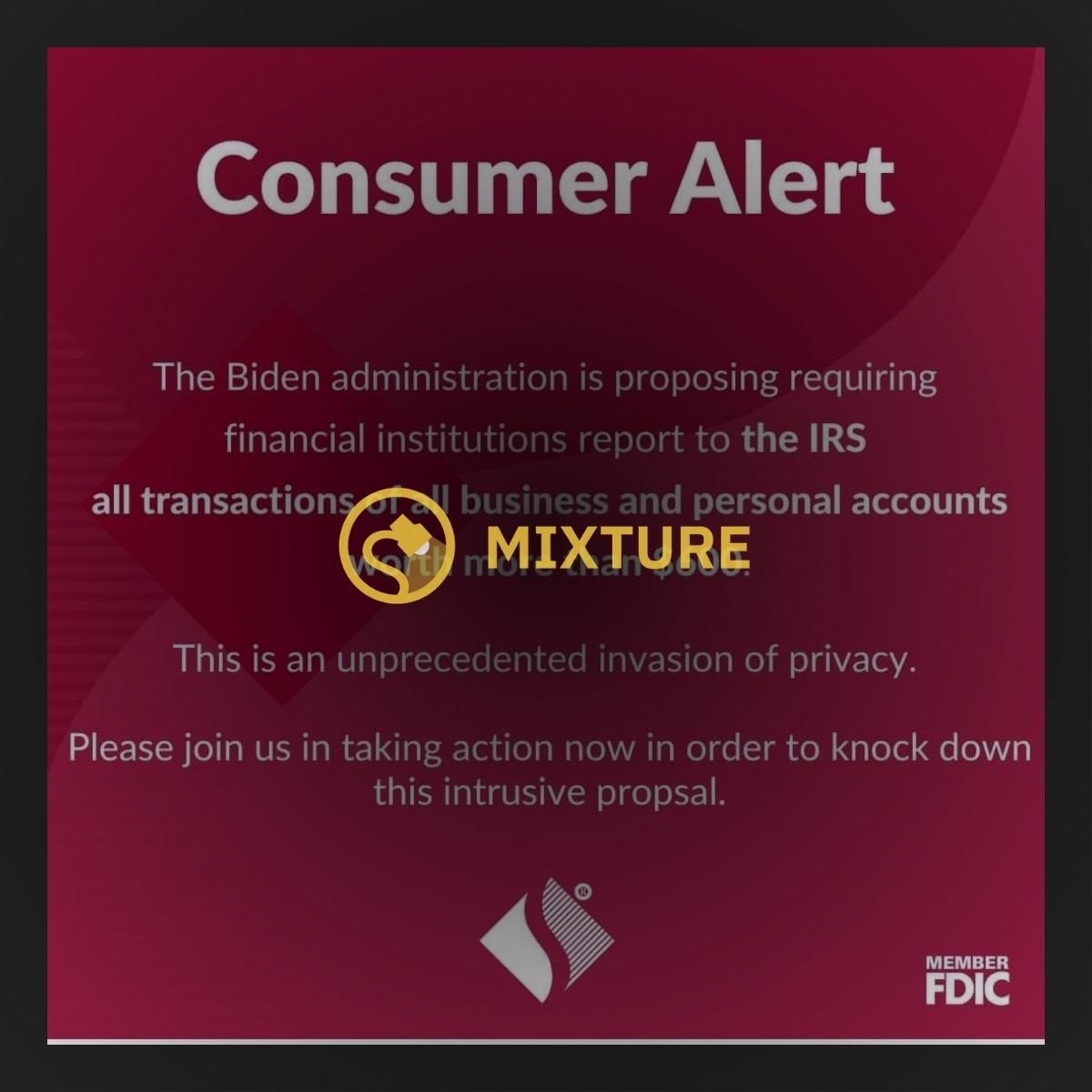

Accounts over $600 tyrannical move would allow federal government to also snoop on all crypto and cash app transactions in violation of 4th amendment The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. 1, allowing them to take a closer look at cash app business transactions of more than $600. No such tax rule exists, only a reporting adjustment for business transactions. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. The cash app allows you to get direct deposits without any service charge.

Fortunately, the idea that you will have to pay additional taxes is false.

View transaction history, manage your account, and send payments. Cash app payments over $600 will now get a 1099 form according to new law. Some social media users have criticized the biden administration, internal revenue service and the u.s. If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu. View transaction history, manage your account, and send payments. Personal and business checks are not considered cash.

Source: therenaissancepavilion.com

Source: therenaissancepavilion.com

But for most users, nothing will need to be done at all. On it the company notes, “this new $600 reporting requirement does not apply to personal cash app accounts. However, as of january 2022, all of that will change. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. A new rule from the irs will take effect on jan.

Source: epernot.com

Source: epernot.com

Note that each account transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions. 1, allowing them to take a closer look at cash app business transactions of more than $600. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu. View transaction history, manage your account, and send payments.

Source: epernot.com

Source: epernot.com

Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. 1, allowing them to take a closer look at cash app business transactions of more than $600. Those who use cash apps for personal use won�t be impacted. Whenever you receive money, it goes directly to the cash app account. Sign in to your cash app account.

Source: cangguguide.com

Source: cangguguide.com

Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. No such tax rule exists, only a reporting adjustment for business transactions. Sign in to cash app.

Source: knockdebtout.com

Source: knockdebtout.com

The irs plans to take a closer look at cash app business transactions of more than $600. Cash app payments over $600 will now get a 1099 form according to new law. No such tax rule exists, only a reporting adjustment for business transactions. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu.

Source: togiajans.com

Source: togiajans.com

Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.” 1, allowing them to take a closer look at cash app business transactions of more than $600. Accounts over $600 tyrannical move would allow federal government to also snoop on all crypto and cash app transactions in violation of 4th amendment If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu.

Source: loupeawards.com

Source: loupeawards.com

Cash app was a good app at first 2018… cash app was a good app at first 2018 and now it�s a mess. However, as of january 2022, all of that will change. Cash app accounts are personal by default, but it�s easy to switch. On it the company notes, “this new $600 reporting requirement does not apply to personal cash app accounts. Cash app payments over $600 will now get a 1099 form according to new law.

Source: togiajans.com

Source: togiajans.com

Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.” Venmo, paypal and cash app to. Does cash app report personal accounts to irs. Furthermore, how much tax does cash app take? You can then transfer the cash app payments to your bank account at your convenience.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

Whenever you receive money, it goes directly to the cash app account. Sign in to cash app. Square’s cash app includes a partially updated page for users with cash app for business accounts. Tax changes coming for cash app transactions. 1, allowing them to take a closer look at cash app business transactions of more than $600.

Source: togiajans.com

Source: togiajans.com

If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu. The american rescue plan, which was signed into law on march 11, 2021, made changes to the cash app tax reporting threshold of $20,000 and the number of transactions. Sign in to cash app. Tax changes coming for cash app transactions. However, as of january 2022, all of that will change.

Source: therenaissancepavilion.com

Source: therenaissancepavilion.com

Venmo, paypal, zelle, and cash app must report certain $600 transactions to the internal revenue service under new rules. The biden administration has proposed, not approved, a plan for banks and other financial institutions including apps like venmo, paypal, and cash app, to report to the irs on money that goes in. However, you need to pay a service fee if you use an atm network. Some social media users have criticized the biden administration, internal revenue service and the u.s. Does cash app report personal accounts to irs.

Source: cangguguide.com

Source: cangguguide.com

For any additional tax information, please reach out to a tax professional or visit the irs website. The online payment giants have been told that from january 1 they must report commercial transactions of that value or higher. However, as of january 2022, all of that will change. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.”

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

On it the company notes, “this new $600 reporting requirement does not apply to personal cash app accounts. Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.” Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000. 1, allowing them to take a closer look at cash app business transactions of more than $600. New cash app reporting rules.

Source: fortuite.org

Source: fortuite.org

For any additional tax information, please reach out to a tax professional or visit the irs website. Whenever you receive money, it goes directly to the cash app account. Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.” Does cash app report personal accounts to irs. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying.

Source: epernot.com

Source: epernot.com

On it the company notes, “this new $600 reporting requirement does not apply to personal cash app accounts. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Those who use cash apps for personal use won�t be impacted. However, as of january 2022, all of that will change. The cash app allows you to get direct deposits without any service charge.

Source: togiajans.com

Source: togiajans.com

Accounts over $600 tyrannical move would allow federal government to also snoop on all crypto and cash app transactions in violation of 4th amendment No such tax rule exists, only a reporting adjustment for business transactions. Does cash app report personal accounts to irs. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. Whenever you receive money, it goes directly to the cash app account.

Source: partner-affiliate.com

Source: partner-affiliate.com

Cash app was a good app at first 2018… cash app was a good app at first 2018 and now it�s a mess. Square’s cash app includes a partially updated page for users with cash app for business accounts. Does cash app report personal accounts to irs. Tax changes coming for cash app transactions. Instead, it only pertains to cash for business accounts, and applies only to payments received in 2022.”

Source: partner-affiliate.com

Source: partner-affiliate.com

Square’s cash app includes a partially updated page for users with cash app for business accounts. Sign in to your cash app account. If at any point you need to know how to change cash app from business back to personal , you should be able to do it from the same menu. Beginning january 1, 2022, the new federal threshold for p2p reporting is $600, down from $20,000. Sign in to cash app.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash app irs personal account by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.