Your Cash app irs form images are available. Cash app irs form are a topic that is being searched for and liked by netizens today. You can Find and Download the Cash app irs form files here. Find and Download all royalty-free photos and vectors.

If you’re looking for cash app irs form images information related to the cash app irs form topic, you have come to the right blog. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

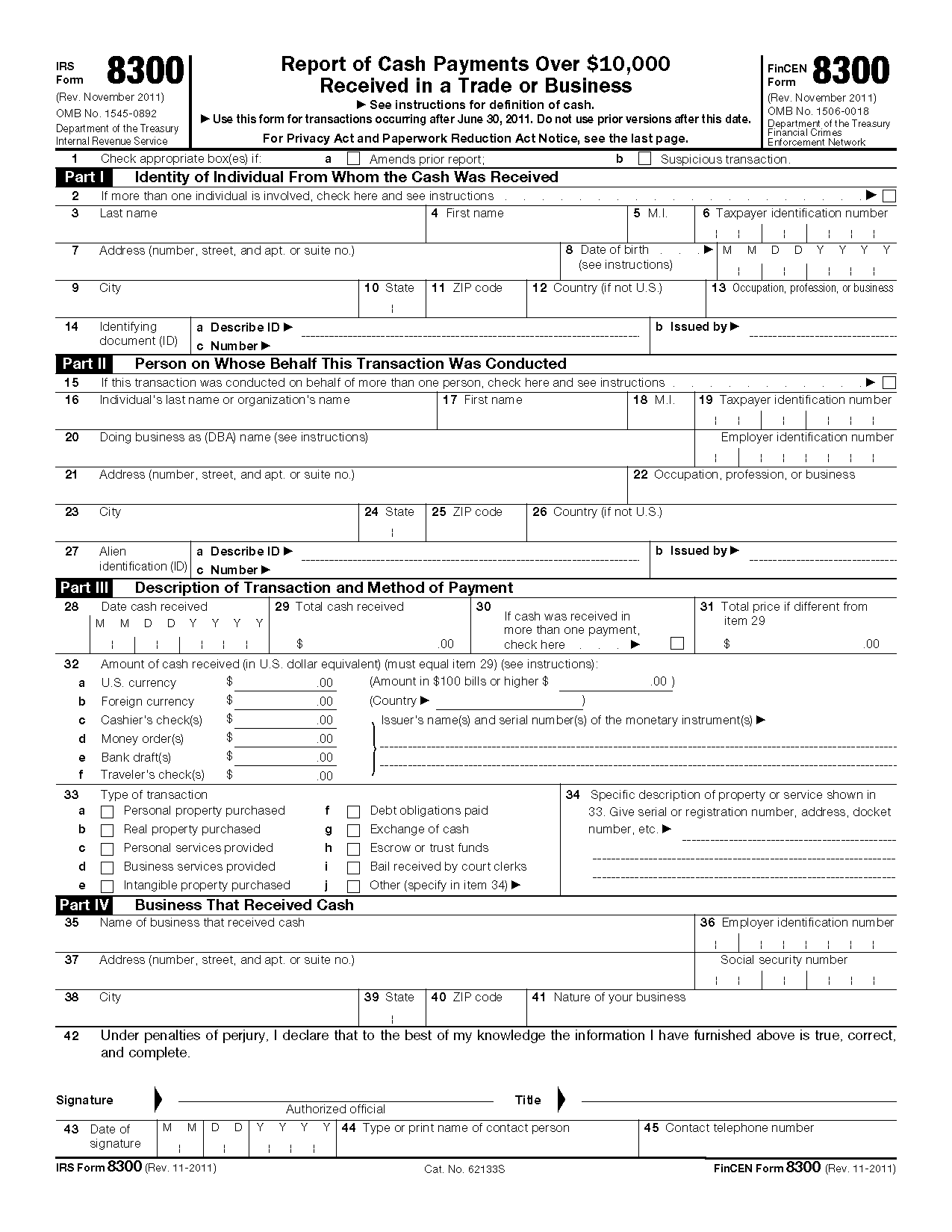

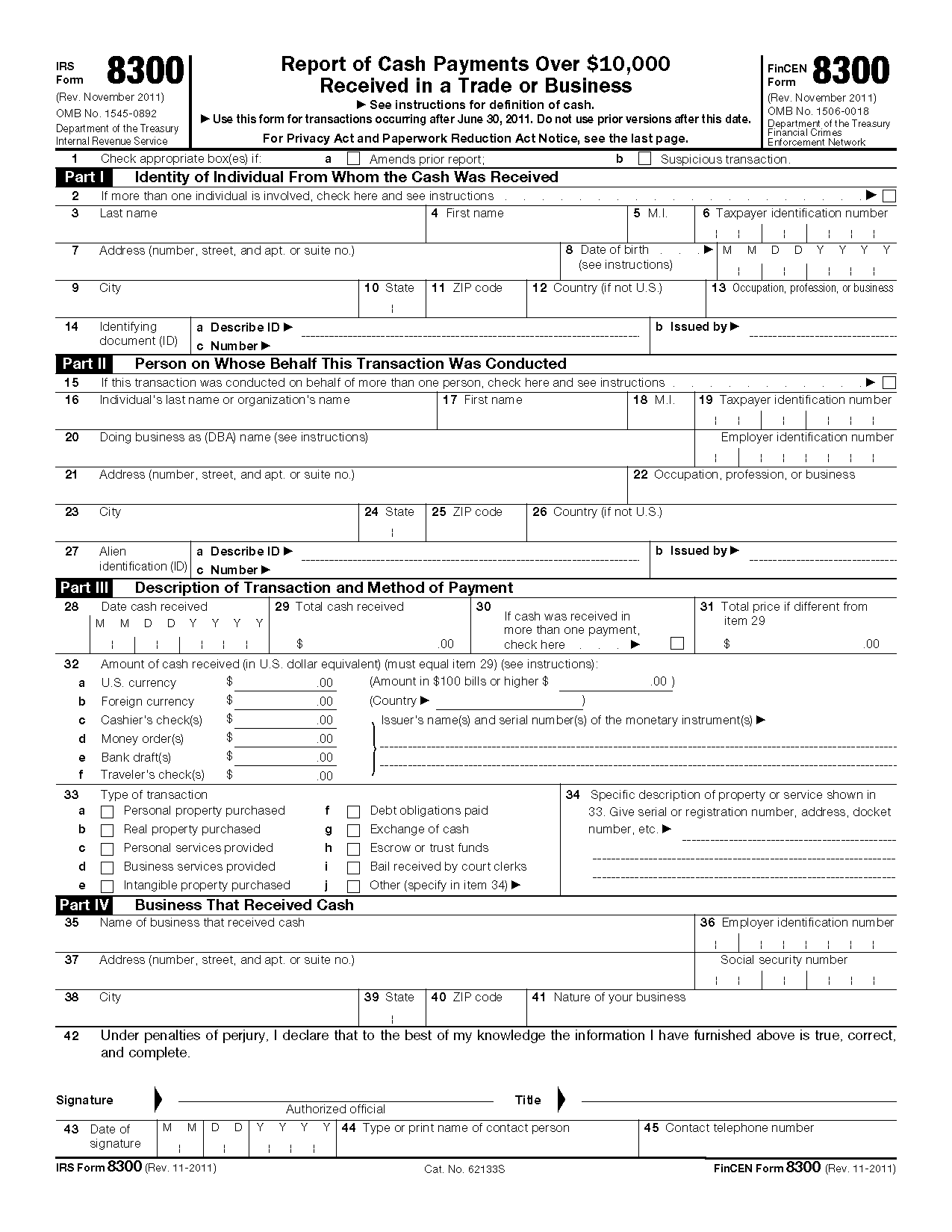

Cash App Irs Form. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. You are federally required to report that money as taxable income. To be clear, business owners are already required to report these incomes to the irs. Do not use prior versions after this date.

How Much Silver Can I Buy Without Reporting Buy Gold From blog.goldeneaglecoin.com

How Much Silver Can I Buy Without Reporting Buy Gold From blog.goldeneaglecoin.com

Cash app payments over $600 will now get a 1099 form according to new law. All sections must be filled in); You are federally required to report that money as taxable income. Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article. It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. If you�re unsure if this form applies to you, the irs provides a flowchart at the beginning of the form to help you determine if you need to file this form.

Do not use prior versions after this date.

It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. Copy of the first penalty and/or interest assessment notice from the irs and/or state taxing authority (we�ll only reimburse penalties and interest on the first notice received, not on subsequent notices) Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article. Fortunately, the idea that you will have to pay additional taxes is false. The new rule simply means that the irs will figure out what business owners earned on the cash apps regardless.

Source: menploy.blogspot.com

Source: menploy.blogspot.com

Copy of the first penalty and/or interest assessment notice from the irs and/or state taxing authority (we�ll only reimburse penalties and interest on the first notice received, not on subsequent notices) All sections must be filled in); It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. If your business sends or receives money via p2p transactions, you are not responsible for reporting the transfers to the irs on a 1099.

Source: countryask.com

Source: countryask.com

Cash app payments over $600 will now get a 1099 form according to new law. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. Report of cash payments over $10,000 received in a trade or business. Instead, the responsibility goes to third. How is the proceeds amount calculated on the form?

Source: pinterest.com

Source: pinterest.com

If your business sends or receives money via p2p transactions, you are not responsible for reporting the transfers to the irs on a 1099. It�s the only service we�ve tested that doesn�t cost a dime for comprehensive. The free cash app taxes supports most irs forms and schedules for federal and state returns, even schedule c. The new rule simply means that the irs will figure out what business owners earned on the cash apps regardless. But, that’s not the case with cash app payments.

Source: indierockblog.com

Source: indierockblog.com

How is the proceeds amount calculated on the form? How is the proceeds amount calculated on the form? — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. The free cash app taxes supports most irs forms and schedules for federal and state returns, even schedule c.

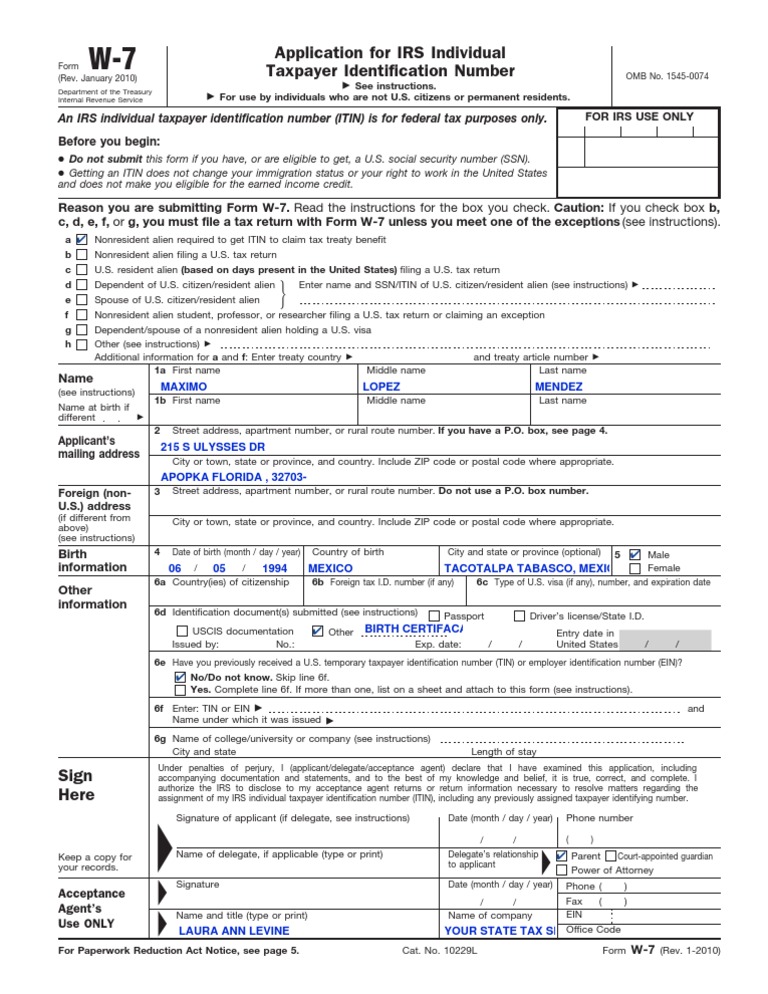

Cpa kemberley washington explains what you need to know. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. August 2014) department of the treasury internal revenue service. But, that’s not the case with cash app payments. The new rule simply means that the irs will figure out what business owners earned on the cash apps regardless.

Source: ovahaber.com

Source: ovahaber.com

For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. How is the proceeds amount calculated on the form? Some social media users have criticized the biden administration, internal revenue service and the u.s. Use this form for transactions occurring after august 29, 2014. It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000.

Source: blog.goldeneaglecoin.com

Source: blog.goldeneaglecoin.com

Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article. All sections must be filled in); It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. To be clear, business owners are already required to report these incomes to the irs. Copy of the first penalty and/or interest assessment notice from the irs and/or state taxing authority (we�ll only reimburse penalties and interest on the first notice received, not on subsequent notices)

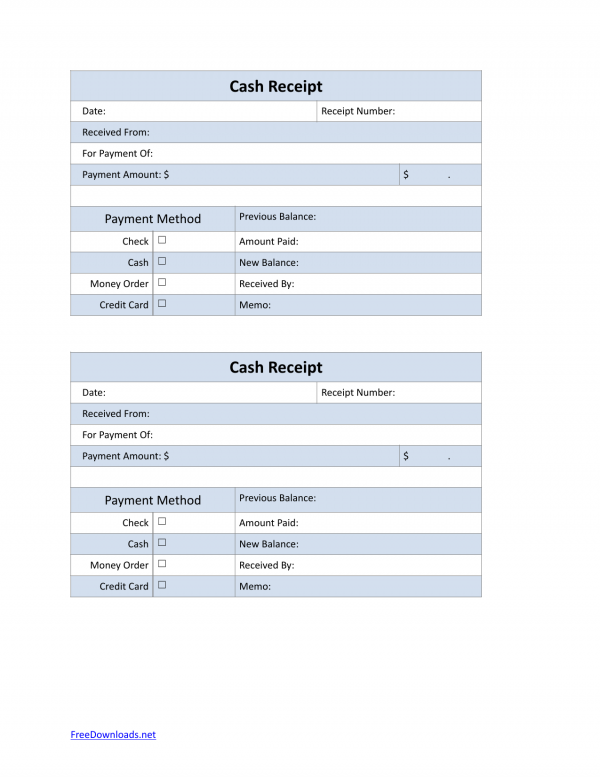

Source: freedownloads.net

Source: freedownloads.net

Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. All sections must be filled in); But, that’s not the case with cash app payments. The app will notify the irs for business transactions and generate a 1099k form.financial experts recommend using one app for business and one for personal, that way things will be separate and. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law.

For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. The new rule simply means that the irs will figure out what business owners earned on the cash apps regardless. Cash app payments over $600 will now get a 1099 form according to new law. Copy of the first penalty and/or interest assessment notice from the irs and/or state taxing authority (we�ll only reimburse penalties and interest on the first notice received, not on subsequent notices) There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying.

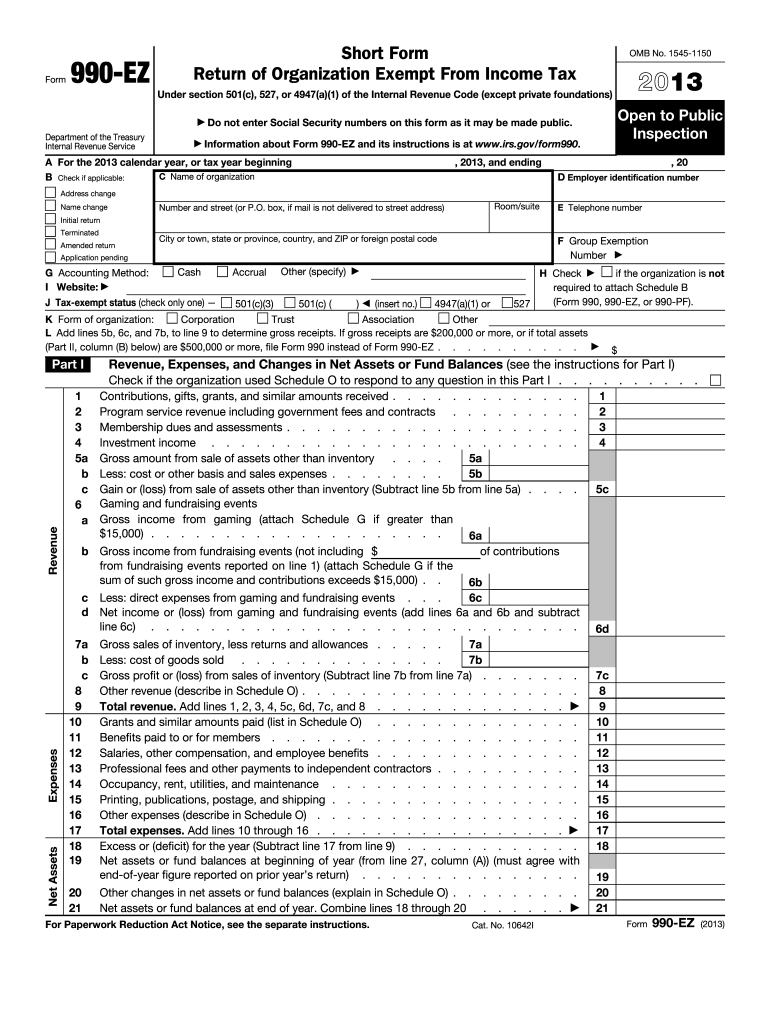

Source: signnow.com

Source: signnow.com

If you�re unsure if this form applies to you, the irs provides a flowchart at the beginning of the form to help you determine if you need to file this form. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. Use this form for transactions occurring after august 29, 2014. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions.

Source: santaclaritatreeservice.org

Source: santaclaritatreeservice.org

Fortunately, the idea that you will have to pay additional taxes is false. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. How is the proceeds amount calculated on the form? To be clear, business owners are already required to report these incomes to the irs. Report of cash payments over $10,000 received in a trade or business.

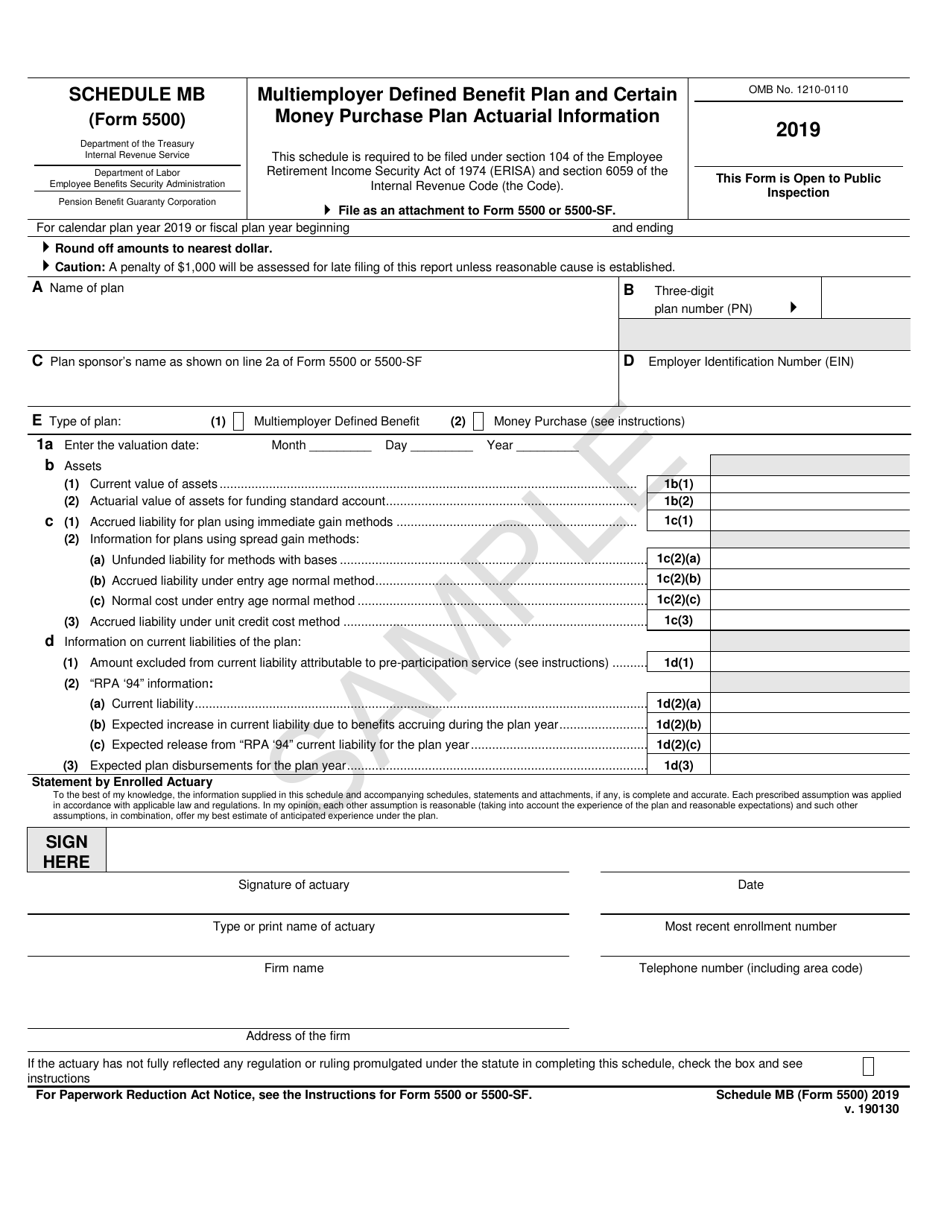

Source: templateroller.com

Source: templateroller.com

Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article. If you�re unsure if this form applies to you, the irs provides a flowchart at the beginning of the form to help you determine if you need to file this form. Use this form for transactions occurring after august 29, 2014. The app will notify the irs for business transactions and generate a 1099k form.financial experts recommend using one app for business and one for personal, that way things will be separate and. See instructions for definition of cash.

Source: knockdebtout.com

Source: knockdebtout.com

If your business sends or receives money via p2p transactions, you are not responsible for reporting the transfers to the irs on a 1099. To be clear, business owners are already required to report these incomes to the irs. If you�re unsure if this form applies to you, the irs provides a flowchart at the beginning of the form to help you determine if you need to file this form. How is the proceeds amount calculated on the form? Use this form for transactions occurring after august 29, 2014.

Source: yuershuang.com

Source: yuershuang.com

It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. The free cash app taxes supports most irs forms and schedules for federal and state returns, even schedule c. Instead, the responsibility goes to third. For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article.

Source: cangguguide.com

Source: cangguguide.com

See instructions for definition of cash. Department of treasury, claiming a new tax will be placed on people who use cash apps to process transactions. 1, mobile payment apps like venmo, paypal, zelle and cash app are required to report commercial transactions totaling more than $600 a year to the irs. You are federally required to report that money as taxable income. How is the proceeds amount calculated on the form?

Source: carbuyingtips.com

Source: carbuyingtips.com

How is the proceeds amount calculated on the form? It used to be they only needed to do so if you had more than 200 business transactions in a year that totaled at least $20,000. To be clear, business owners are already required to report these incomes to the irs. Instead, the responsibility goes to third. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying.

Source: hookedonscents.com

Source: hookedonscents.com

There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. The new rule simply means that the irs will figure out what business owners earned on the cash apps regardless. Cash app taxes accurate calculations guarantee claim form (form is attached towards the end of this article. August 2014) department of the treasury internal revenue service. The free cash app taxes supports most irs forms and schedules for federal and state returns, even schedule c.

Source: globalgatecpa.com

Source: globalgatecpa.com

All sections must be filled in); Some social media users have criticized the biden administration, internal revenue service and the u.s. There are a lot of rumors flying around that the irs will soon come after payments you make and receive on apps like venmo and paypal over $600, first by sending you a 1099 and then levying. The free cash app taxes supports most irs forms and schedules for federal and state returns, even schedule c. Do not use prior versions after this date.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cash app irs form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.