Your Cash app and zelle irs images are available. Cash app and zelle irs are a topic that is being searched for and liked by netizens now. You can Download the Cash app and zelle irs files here. Download all royalty-free photos.

If you’re searching for cash app and zelle irs images information linked to the cash app and zelle irs interest, you have visit the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

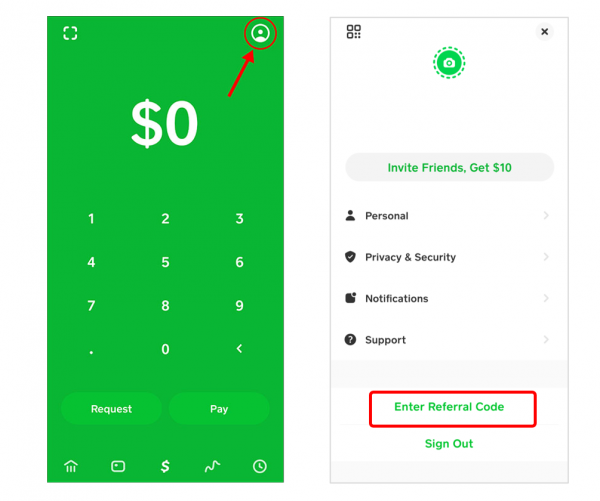

Cash App And Zelle Irs. However, this threshold and the new requirement applies to commercial transactions only. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Payment app providers now must issue you and the irs a form 1099. Cash app, venmo and zelle to report income to irs!

Everything to Know About Venmo, Cash App and Zelle Money From money.com

Everything to Know About Venmo, Cash App and Zelle Money From money.com

Bottom line — for most zelle, venmo, and cash. And eligible small businesses sent through the zelle network are not subject to this law. The biden administration passed a new tax rule in the american rescue plan act and it is being dubbed �the $600 tax rule.� A business transaction is defined as payment. Zelle irs rules are changing in 2022, no new taxes are due. The irs won�t be cracking down on personal transactions, but a new law will require cash apps like venmo, zelle and paypal to report aggregate business transactions of $600 or more to the irs.

Cash app, venmo and zelle to report income to irs!

Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Zelle irs rules are changing in 2022, no new taxes are due. Use venmo, paypal, zelle, cash app? Cash app, venmo and zelle to report income to irs! Don’t believe me…check it out for yourself! Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle.

Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. However, this threshold and the new requirement applies to commercial transactions only. Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle.

Source: news.yahoo.com

Source: news.yahoo.com

Cash app, venmo and zelle to report income to irs! Cash app, venmo and zelle to report income to irs! Payment app providers now must issue you and the irs a form 1099. Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600. Irs to start taxing certain money transfer app users.

Source: tastyreferrals.com

Source: tastyreferrals.com

The biden administration passed a new tax rule in the american rescue plan act and it is being dubbed �the $600 tax rule.� Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. New year, new tax laws.

Source: clark.com

Source: clark.com

Don’t believe me…check it out for yourself! Rather, small business owners, independent contractors and those with a. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. New year, new tax laws. Use venmo, paypal, zelle, cash app?

Source: ascensionmtc.org

Source: ascensionmtc.org

The american rescue plan act will be effective on january 1, 2022. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. The american rescue plan act will be effective on january 1, 2022. The biden administration passed a new tax rule in the american rescue plan act and it is being dubbed �the $600 tax rule.� Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600.

New year, new tax laws. Well reportedly, cash app, venmo, and zelle will be reporting funds over $600 to the irs starting january 2022. New year, new tax laws. The irs won�t be cracking down on personal transactions, but a new law will require cash apps like venmo, zelle and paypal to report aggregate business transactions of $600 or more to the irs. While most of us use cash app to send and receive money from our friend and family, others maybe using it for their business.

Source: kristine-holmgren.com

Source: kristine-holmgren.com

Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. Irs to start taxing certain money transfer app users. Starting in 2022, mobile payment apps like venmo, paypal, cash app and zelle are required to report business transactions totaling more than $600 per year to the irs. And eligible small businesses sent through the zelle network are not subject to this law. New year, new tax laws.

Source: togiajans.com

Source: togiajans.com

A business transaction is defined as payment. 10 2022, published 1:23 p.m. A business transaction is defined as payment. If you currently use cash transfer apps like venmo, zelle, or paypal you’ll want to pay close attention to your accounts starting next year. — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

The good news is that if you are impacted, you will now get a 1099 form from the payment app to explain exactly what is being reported to the irs. Payment app providers now must issue you and the irs a form 1099. The good news is that if you are impacted, you will now get a 1099 form from the payment app to explain exactly what is being reported to the irs. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. While most of us use cash app to send and receive money from our friend and family, others maybe using it for their business.

Source: loupeawards.com

Source: loupeawards.com

The answer is no, you most likely will not have to move larger payments away from your preferred app, or pay a sort of sales tax on large money transfers between friends or family members. Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. Use venmo, paypal, zelle, cash app? However, this threshold and the new requirement applies to commercial transactions only. Bottom line — for most zelle, venmo, and cash.

Source: youtube.com

Source: youtube.com

Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. Bottom line — for most zelle, venmo, and cash. Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600. The good news is that if you are impacted, you will now get a 1099 form from the payment app to explain exactly what is being reported to the irs. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers.

Source: partner-affiliate.com

Source: partner-affiliate.com

Don’t believe me…check it out for yourself! New year, new tax laws. The irs is not requiring individuals to report or pay taxes on individual venmo, cash app or paypal transactions over $600. — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. However, this threshold and the new requirement applies to commercial transactions only.

Source: fox5dc.com

Source: fox5dc.com

Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. The biden administration passed a new tax rule in the american rescue plan act and it is being dubbed �the $600 tax rule.� So, if you use cashapp, venmo, zelle or paypal like most do, to send money for rent. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. If you currently use cash transfer apps like venmo, zelle, or paypal you’ll want to pay close attention to your accounts starting next year.

Source: vsgey.blogspot.com

Source: vsgey.blogspot.com

It’s been a long time coming and will. And eligible small businesses sent through the zelle network are not subject to this law. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers. Well reportedly, cash app, venmo, and zelle will be reporting funds over $600 to the irs starting january 2022. Zelle has confirmed online in its faq section that it doesn�t have to report transactions to the irs, even if they are over $600.

Source: money.com

Source: money.com

A business transaction is defined as payment. The answer is no, you most likely will not have to move larger payments away from your preferred app, or pay a sort of sales tax on large money transfers between friends or family members. Payment app providers will have to start reporting to the irs a user�s business transactions if, in aggregate, they total $600 or more for the year. Cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds. — cash apps like venmo, zelle, and paypal make paying for certain expenses a breeze, but a new irs rule will require some folks to report cash app transactions to the feds.

Source: pro-rzd.com

Source: pro-rzd.com

10 2022, published 1:23 p.m. The answer is no, you most likely will not have to move larger payments away from your preferred app, or pay a sort of sales tax on large money transfers between friends or family members. While most of us use cash app to send and receive money from our friend and family, others maybe using it for their business. So, if you use cashapp, venmo, zelle or paypal like most do, to send money for rent. However, this threshold and the new requirement applies to commercial transactions only.

Source: youtube.com

Source: youtube.com

Millions of businesses accept electronic payments for their services, but the irs is cracking down on these types of payments, which include apps like venmo, paypal, cash app, and zelle. The american rescue plan act passed on march 11, 2021, which included a massive change for business owners and side hustlers. Square�s cash app includes a. While most of us use cash app to send and receive money from our friend and family, others maybe using it for their business. If you currently use cash transfer apps like venmo, zelle, or paypal you’ll want to pay close attention to your accounts starting next year.

Source: cleveland.com

Source: cleveland.com

It’s been a long time coming and will. The irs is not requiring individuals to report or pay taxes on individual venmo, cash app or paypal transactions over $600. Rather, small business owners, independent contractors and those with a. If you currently use cash transfer apps like venmo, zelle, or paypal you’ll want to pay close attention to your accounts starting next year. Well reportedly, cash app, venmo, and zelle will be reporting funds over $600 to the irs starting january 2022.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash app and zelle irs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.